#CoxAutomotive

Um, What? Survey Claims People Happier With Modern Car Buying Experience

A new survey from Cox Automotive is suggesting that people are relatively pleased with their trips to the dealership these days — at least compared to the last few years. According to the team that’s been crunching the numbers over at Automotive News, “Buyer satisfaction with the shopping experience from the research stage through delivery dipped to 66 percent in 2021.” Back in 2020, respondents claimed they were happy 72 percent of the time. But in 2019 Cox was only getting 60 percent of shoppers to say they had an okay time buying a vehicle.

The uptick in 2020 is obvious. Showrooms were devoid of customers, production shortfalls hadn’t yet become the norm, and dealers were selling just about everything at a discount — keeping prices low until 2021 sent them into the stratosphere. However, the outlet still framed it as a win against 2019, suggesting that consumers are more satisfied with their shopping experience than before the pandemic. It also claimed that people who purchased vehicles online, the no-haggle alternative to going to a dealership to argue in a small room, tended to be happier overall.

Study Shows Auto Dealer Sentiment Still Ridiculously Positive

Car dealers have been polled for the fourth-quarter Cox Automotive Dealer Sentiment Index (CADSI) and they’re still incredibly optimistic, despite losing some of their earlier confidence that new-vehicle sales would be relatively healthy.

The dealer optimism – especially among franchised entities – seems to be wholly tied to profitability here. New vehicle sales dropped in 2019 and absolutely cratered in 2020 due to the nation’s response to the pandemic. In spite of there being plenty of talking heads in the news media telling you not to stress about the economy, inflation has created pricing increases across the board and automobiles are at the tippy top of that list. With inventories remaining relatively lean due to production slowdowns, staggering dealer markups have become the norm. Basically, stores just seem happy that they can charge more per car while they’re in short supply. But they’re also starting to have concerns about the long-term viability of the market and are are feeling the pinch of rising operating costs.

Used Vehicle Pricing Sets Another Record High

Used-vehicle prices set another record last month thanks to elevated demand and suppressed production of new cars. Depending on who you ask, the typical transaction fee for a secondhand automobile rose nearly 50 percent in November vs the same period in 2020. While the pandemic had meaningfully suppressed demand during that time, that’s still a staggering increase over any 12-month period.

Sharing Cox Automotive’s Manheim Used Vehicle Value Index, Automotive News nailed down the annual difference to a 44-percent increase. This also represents the November pricing index swelling by 3.9 percent against October, which is noteworthy in itself. But what does that look like in dollars?

Penske & Cox Premiere AI Based Auto Sales Platform With Confusing Name

Years ago, waiting for a haircut, dental appointment, or psychological evaluation meant thumbing through a paperback filled with local listings of automobiles you had convinced yourself you might be in the market for. While primarily an exercise for wasting one’s time, there was always a chance you’d run to a payphone or whip our your Nextel to contact the seller so you could begin the delicate dance of commerce.

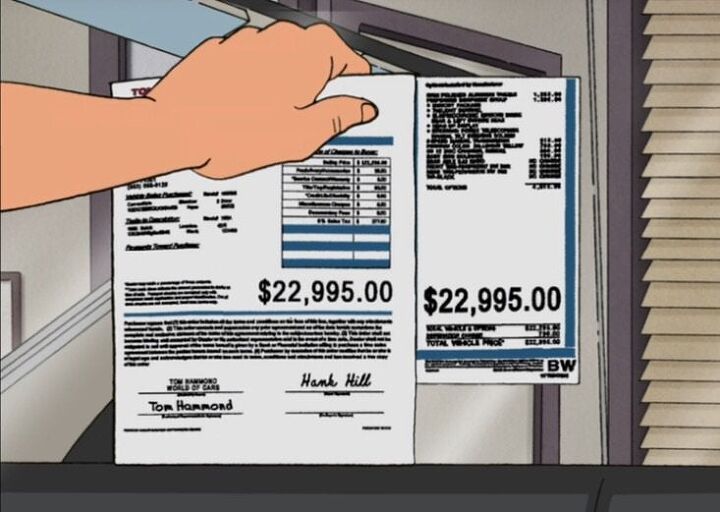

Report: People Willing to Pay Stupid Prices for New Cars

While we’d like to get away from stories about everything becoming more expensive, everything actually is becoming more expensive and it looks like a healthy slice of the population is allegedly willing to go along with it. According to the latest data coming from Cox Automotive, roughly 40 percent of the U.S. population would purchase a vehicle at 12 percent above sticker. There’s always been a subset of shoppers who don’t know when they’re being taken but this represents a healthy share of the country.

It makes one wonder where these surveys were being conducted until Cox summarized the situation as the direct result of a populace beaten down by their environment. Apparently, people no longer expect to find good deals and have not yet reached the point where they’ll feel comfortable driving around in the same busted crate that’s seen them through the last decade as a way to save money.

Cox Automotive Cuts Staff, Focuses on 'Digital Services'

Cox Automotive eliminated around 1,600 jobs this month as it prepared to better embrace online commerce (and nobody having any money). The company axed nearly 300 employees in June after having furloughed over 12,000 people in response to the coronavirus pandemic this spring. A large number of those positions were related to its Manheim auction arm, which suffered the hardest due to stringent lockdown protocols that prohibited public gatherings.

Now it’s talking about improving some of the digital features it added to Autotrader this year and embracing the virtual landscape to future-proof itself while forecasting a 25-percent cut in annual profits, and letting people go — with the majority of the layoffs coming to furloughed Manheim employees.

Bark's Bites: Cox Automotive's Investment In Rivian Speaks Volumes About The Future

Full disclosure time: For those who are new around here, I worked at Cox Automotive for a little over four years as a sales trainer in the Media Sales division. In that role, I was (very) peripherally aware of some of the company’s strategic decisions, as the Sales Strategy team was also part of my larger department, but I didn’t have any influence or advance knowledge of them. (This is a boilerplate statement for when my old friends at Cox decide I’m in violation of my employment termination agreement by writing this.)

When I first started at Cox (before they even called it “Cox Automotive,” it was just Autotrader.com then), the company was a fat cat, to say the least. I remember when one of our leadership team members declared that we had sold $1.2 billion of revenue in a year, and that over $700 million of it was pure profit. I remember when we drastically overpaid for Dealer.com and Dealertrack at a whopping $4 billion dollar pricetag, just because we had the cash laying around and we were going to get heavily taxed on it if we didn’t spend it on something.

Of course, everything has an expiration date, and the third-party automotive classified business was no exception. Around 2016 or so, consumers started using this new thing called “Google” to search for cars on the internet, dealers stopped writing five-figure checks for classified ads every month without even asking why, and sales reps learned that they aren’t actually worth $250,000 a year for just “checking in” on dealers. Their strategy of diversification, with the purchases of companies like Kelley Blue Book, vAuto, and VinSolutions turned out to have been a smart move, as some of their competitors like Cars.com were stuck holding the note on a company that literally nobody wants. Ouch.

So when I read that Cox Automotive had invested $350 million into Rivian last week, my initial thoughts were, “Oh, there goes Cox burning some more cash,” and I mostly went about my day. However, a week later, I’m beginning to see that there are more wheels in motion than anybody on the outside realizes — and they will have a significant impact on the automotive marketplace in the years to come.

How Would Dealers Rate Their Brand? Scorecard Ranks Winners and Losers

Cox Automotive, in conjunction with Automotive News, just released its Retail Brand Scorecards Study for 2018. The survey is interesting in that it ranks the perceived value of automakers by assessing how desirable they are to dealerships via an A-through-F grading system. Though, as engaging as it might be to look at these traits from a highly specific viewpoint (how dealerships see you in relation to specific manufacturers), we’re not sure how useful the average consumer will find them. Dealers and industry geeks, however, may want to take notice.

“This study represents a comprehensive review of brands from a unique perspective — how well they support the success of dealers,” said Cox Automotive Chief Economist Jonathan Smoke. “As we assembled the data and began to see how the brands performed differently, we started looking at the results as grades in high school, where the most well-rounded and high-achieving students are those who perform well across a wide range of disciplines. With that scorecard framework, we found a clear set of brands that are honor-roll worthy, as they are in essence the hardest-working, most successful students.”

Recent Comments