#CentralPlanning

Cleveland City Planners Change Policies to Create 15-Minute City

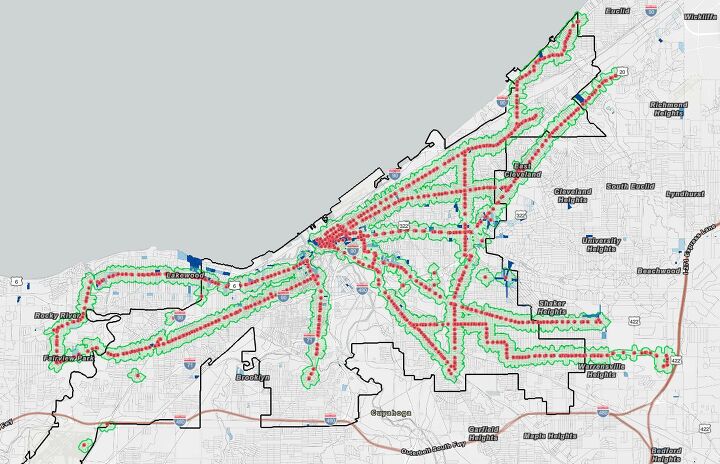

Cleveland, Ohio, has approved new zoning and transportation policies that are angling to transform it into the next “fifteen-minute city,” The City Planning Commission voted to move forward with changes to building codes in several pilot neighborhoods it wants to make more pedestrian friendly. However, such policies have become contentious with European examples further down the path of progress seeing relatively consistent opposition due to the fact that the ultimate goal is to eliminate the automobile.

Senate Finance Committee Approves $12,500 EV Tax Credit Bill

On Wednesday, the Senate Finance Committee advanced the Clean Energy for America Act making a few tweaks from earlier proposals. Changes include raising the federal EV tax rebate ceiling to $12,500 and opening the door for automakers who already exhausted their production quotas.

It’s good news for General Motors, which recently begged the government for just such a handout. But any manufacturer participating in the sale of electric vehicles will find themselves similarly blessed by the updated rules — assuming they make it through the halls of Capitol Hill with the necessary support.

Let’s take a peek behind the curtain to see what the updated proposal entails.

European Automakers Think Fuel Taxes Will Increase EV Sales

Undoubtedly eager to improve the take rate of electric vehicles, automakers have a myriad of solutions at their disposal. But the majority have something to do with getting the government involved to futz around with taxes.

Normally, this has to do with making special exceptions for EVs or subsidizing them via rebate programs. But governments seem happy to do this, as increasingly more legislation is advanced that would place restrictions on when and where people will be able to drive internal combustion vehicles, and automakers appear to be getting with the program. We’ve already seen manufacturers choosing sides in America’s gas war and now the Europeans are getting in on the action by demanding higher taxes be imposed on vehicles reliant on gasoline or diesel.

Recent Comments