#AutoFinancingSubprimeLoans

Canadian Borrowers Seeing More Loan Debt While U.S. Sees Subprime Loans Rise

Car buyers who borrowed money to finance their purchase are seeing higher loan debt per borrower rates, along with higher delinquency rates. And it’s happening on both sides of the border.

Let’s start with Canada. Automotive News picked up a report from TransUnion showing that average auto-loan debt per borrower has gone up in the second quarter, and so too have delinquency rates. This is happening as vehicle prices have also risen during the same time period. Consumers are also rolling in other debt and parts of the country are still in recovery mode from the recent economic crisis.

The Industry Might Be Facing Disaster, But at Least Used Car Prices Are Down

The auto industry has really turned a corner over the last decade, but this year has been underlined by an unsettling lack of interest in new vehicles — potentially hinting at the return of a industry-wide crisis. The good news is that abnormally high used car prices are sinking like a stone. The flip-side of that coin, however, means that we could be approaching darker days as more consumers shy away from the new vehicle market.

Most carmakers spent last year enjoying record sales but seemed keenly aware that the market was about to plateau. However, 2017 sales have stagnated more than predicted, with rising interest rates and deflated prices seen on second-hand automobiles. It all looks very pre-recessionish and some analysts are beginning to make fearful noises.

FTC Hunting for Abuse in Auto Lenders' Implementation of Kill Switches

Finance companies have begun using ignition kill switches and tracking devices, which allow them to disable and then easily locate vehicles for repossession. Some of the devices even remind borrowers when they’ve missed a payment. According to PassTime, a company that sells such devices, somewhere between 35 and 70 percent of cars financed on subprime loans have some variant of the hardware installed.

Now the the Federal Trade Commission is looking into whether these automotive finance companies are illegally harassing consumers with poor credit by imposing the hardware onto their vehicles — potentially violating their privacy while also garnering unnecessary intimidation from banks.

The New York Times Shines A Light On Subprime

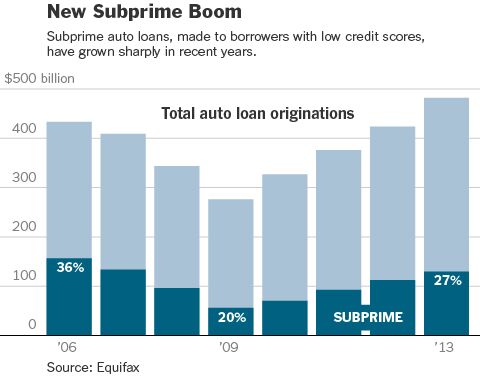

The issue of subprime car loans, specifically loans with exorbitant interest rates for used cars, has filtered into the New York Times, with the paper’s Dealbook section running an investigation into the practice.

Recent Comments