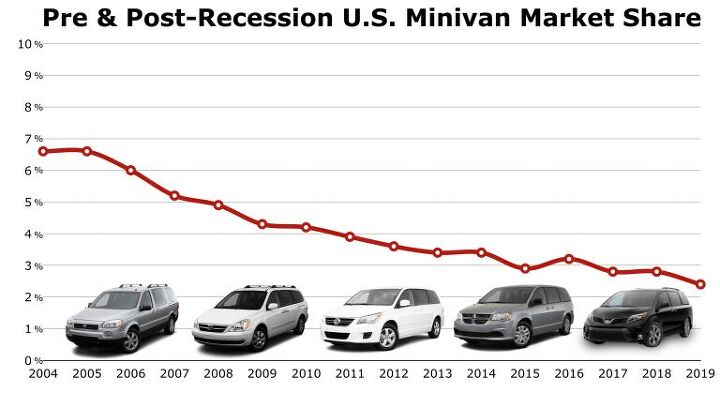

Minivan Market Share Is Now at 2 Percent In America, and It's Rapidly Getting Worse

Sales of minivans in the United States in 2019 plunged below Great Recession levels as every member of the existing quintet reported sharp year-over-year declines.

The 408,982 sales produced by the Dodge Grand Caravan, Chrysler Pacifica, Honda Odyssey, Kia Sedona, and Toyota Sienna in calendar year 2019 were a far cry from the 1.1 million sales produced by the sector in 2005, or even the 553,506 sold three years ago. But after hovering just below or above 3 percent of the market for half a dozen years, and after overall volume showed signs of recuperation through the middle half of the last decade, the segment’s 2019 collapse suggests we haven’t reached bottom yet.

At the current rate of decline, America won’t even acquire 300,000 minivans next year.

It’s a shame.

Granted, the author’s bias was not checked at the door. The modern minivan’s practical prowess (the ancient minivan’s practical prowess, for that matter) is indisputable, a fact our family encounters every day with three children, a large dog, an ATV trailer, assorted bikes, and sleds galore. Not unlike its rivals, our 2018 Honda Odyssey combines high levels of power, fuel efficiency, space efficiency, affordability, and unique packaging that popular three-row crossovers can’t muster. We’ve owned one before acquiring the current van, and despite the allure of pickup trucks, Tellurides, and hot hatches, we’re likely to own another.

Yet if a minivan purchase was typical in 2005, it was unexpected by 2013, unusual in 2019, and is likely to be downright odd by 2022.

How bad is it? And how bad is it going to be?

First, take it a model at a time. It won’t take long: hardly any contenders remain.

For the top-selling Dodge Grand Caravan, 2019’s 122,648 sales marked a four-year low. Grand Caravan sales fell 19 percent, year-over-year, in 2019. After enduring a hazy outlook for the last number of years, the Grand Caravan now appears to be approaching the end of its life cycle thanks to the dawn of a downmarket Chrysler Pacifica addition, the Voyager. Caravan sales peaked in the mid ’90s, with back-to-back 300k annual results in 1996 and 1997, and last topped the 200k mark in 2006.

The Grand Caravan’s Pacifica cousin worked with the Dodge to garner 54 percent of the American minivan market in 2019. Yet Pacifica sales, not unlike the Dodge, were down 17 percent, year-over-year. For the Pacifica, 2019 was the lowest-volume full year since its 2016 launch. At 97,705 sales, 2019 was just the third year since the recession that the Chrysler brand failed to sell more than 100,000 minivans.

It wasn’t even three years ago that Honda believed the U.S. minivan market was “stable at around half a million,” and that the company’s share of that market “is pretty well spoken for” at 125,000 units. The 25-percent market share figure is not outlandish – the Odyssey’s 99,113 sales in 2019 translated to 24 percent of the segment. But Honda’s belief in the size and stability of the minivan segment in 2017 now proves to be unrealistic. 2019 was the lowest-volume year for the Odyssey since 1999, the year Honda released its first proper sliding-doors people carrier.

In the Kia Sedona’s world, little has changed. The Sedona was an afterthought when it arrived in 2001 and has maintained that status. Gone, however, are the days when existing as an afterthought in America’s minivan category translated to 50k+ sales per year, which is what the Sedona managed consecutively from 2003 through 2006. Kia reported only 15,931 Sedona sales in 2019, down 64 percent since 2016.

Unlike the Sedona, the Toyota Sienna has typically been a powerhouse player in America’s minivan market. As recently as 2015, Sienna sales spiked to an eight-year high. In 2019, the tide had turned for a van that’s remained visually and architecturally similar for nine model years. Only 73,585 Siennas were sold last year, the worst full year in the nameplate’s history. Sienna sales are down 55 percent from the 2006 peak.

The picture isn’t pretty for any of America’s five MPV candidates. And based on the downward trend we’ve seen over the last 15 years and ignoring any other market force (EVs, fuel prices, a sudden acceptance of truly mini vans), minivan sales will number fewer than 300,000 by 2021, and fewer than 200,000 by 2024.

[Images: Fiat Chrysler, Honda, Kia, Toyota]

Timothy Cain is a contributing analyst at The Truth About Cars and Driving.ca and the founder and former editor of GoodCarBadCar.net. Follow on Twitter @timcaincars and Instagram.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Spectator This was an amazing vehicle. Back then Acura knew how to make a plush and comfy seat!

- Syke F1 fan and normally watch every race, although most of them are DVR'd. I've got my Xfinity box set up to record everything automatically. This past Sunday I watched the race live for a change.

- Jalop1991 There is no inflation. Everything is cheaper than it was 5 years ago. SHRIMP AND GRITS!

- ChristianWimmer Exterior and interior look pretty flawless for such a high mileage car. To me this is an indication that it was well-maintained and driven responsibly. It’s not my cup of tea but it’s bound to find an enthusiastic owner out there.And with ANY car, always budget for maintenance.

- Fred I'm a fan and watch every race. I've missed a few of the live races, but ESPN repeats them during more reasonable hours.

Comments

Join the conversation

If people bought vehicles based on needs, value and fun, Toyota wouldn't be able to keep up with Camry TRD demand, Honda with the Accord Sport and Acura with the RDX. Instead, we live in a world where Explorers and larger rule the roost. The level of overbuying or misunderstanding of one's own need is the norm. Or is it? Status vehicles are tall vehicles. That's where we are today, and status is more important than needs, value and fun. We kinda suck.

Increasing requirements for economy and safety will likely evolve the CUV into revolutionary forms: hatchbacks and wagons! Be patient, and wait for something that's more to your liking. Or buy something old, and learn how to wrench.