Bark's Bites: Orlando Kia West Is a Stunning Example of Why People Still Hate Car Dealers

On May 4th, my friend “Jenny” (whose name is changed for the sake of her privacy) could not contain her excitement. She posted the photo seen above to Facebook, sharing with her friends that she had just bought what she believed to be a brand-new 2014 Kia Soul from Orlando Kia West. She got what she also believed to be a rip-roaring deal, too, paying $4,000 under sticker.

Although the car was a 2014 model with 530 miles on the clock, Jenny said the dealer claimed it had never been sold to a private customer, but Orlando Kia West had to list it as a used car because it had purchased it from another dealer.

The minute I saw that, I immediately knew something was up. I contacted Jenny and asked her some questions about her experience. Fifteen minutes later, we were both furious.

Although I had no desire to rain on Jenny’s parade, everything about the deal smelled fishy to me. This was Jenny’s first time ever buying a car from a dealership, and it took advantage of her in several ways, most of which were completely unethical.

First of all, if the vehicle had simply been acquired as a dealer trade, it would still be sold as a new car, not as a used car, and there’s no way the dealership would have made that mistake.

I asked TTAC contributor Bozi Tatarevic to search the VIN on Autocheck. Sure enough, he discovered the vehicle was previously sold to a private owner in Florida on August 29th, 2015. That’s lie number one, and it’s a pretty big one. Furthermore, it’s a stupid lie. Why not just say the car was sold to somebody who couldn’t afford it and sold it back to the dealer?

I asked Jenny a bit more about the transaction, and uncovered some more issues. The purchase price on the car was $14,000 (plus the dealer’s outrageous $199 document fee and $699 “dealer fee,” whatever that is), and she had $5,000 to put down. After the dealer ran her credit application, it told her that she would need a cosigner as she had never had any credit in her name. She asked her stepfather to co-sign on the loan for her, which he was reluctant to do. Jenny’s stepfather asked for 24 hours to go home and think about it.

At this point, the sales manager at the dealership pressured him into signing that day, claiming Jenny would never get approved on her own anywhere else and that she’d never find another deal this good on a Kia Soul. Jenny’s stepfather agreed, and the best the F&I manager claimed he could do on the loan was 6.9% over 72 months even with his 700+ beacon score.

But, the F&I manager said, if Jenny and her stepfather were willing to buy a gap insurance policy, he’d be able to get the loan down to 5.13% over that same 72 months.

Jenny said that the F&I manager made it sound as though she desperately needed gap insurance, despite the fact that she was only doing a $9,000 loan on a car that they were selling her for $14,000. He said that her regular insurance wouldn’t cover the value of the loan if she were to get in an accident. The gap insurance was “only” $15 a month — or a whopping $1,080 over the course of the loan. For those of you playing along at home, that’s over ten percent of the loan value.

Since Jenny had never taken out a car loan before, she trusted the advice of the F&I manager and signed up for gap insurance and the 5.13% loan rate over 72 months. Yet, somehow, her payment ended up being $232/month. I did the math. Based on a reverse loan calculation, that’s a loan for $14,351.73, which is nowhere near the $9,000 Jenny thought she was paying for her car.

After I advised Jenny that her car was not actually new, and that she’d been completely swindled on the gap insurance and loan, she was rightly furious — so much so that she couldn’t even bring herself to call the dealership for two weeks. When she finally called back yesterday, the sales manager wouldn’t admit to lying to her about the history of her car, but he wouldn’t say that it was really a “new” car again. The finance manager refused to take any blame for selling her gap insurance, only saying “I didn’t pressure you into it.” Well, how else did she end up with it, then? Furthermore, the sales manager couldn’t explain how her payment got up to $232/month, nor tell her the actual purchase price.

Jenny asked for an incredibly realistic resolution to her issue: she wanted a set of floormats, because her Soul didn’t come with any, and she wanted an apology. That’s it. Neither the sales manager nor the finance manager would even offer her that resolution, which would cost the dealer less than a hundred dollars — approximately one-tenth of the pure-profit gap insurance that they sold her. She hung up even more frustrated than she was to start.

So after talking with Jenny yesterday, I started looking into Orlando Kia West a bit more. The dealer’s Google Reviews are good, with an average score of 4.4. In fact, they’re a little too good.

Every single positive review is written in pure Search Engine Optimization style, with the salesperson’s full name mentioned at least once, and often multiple times. Even more curious is that the salesperson most often mentioned appears to occasionally switch genders depending on the review. It’s obvious that the dealer is paying an agency to “manage” its online reviews.

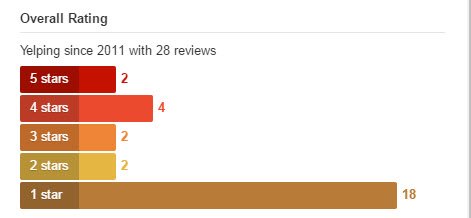

Now, let’s look at its Yelp reviews, which most dealers forget to, ahem, manage as effectively.

Ooooh, not as good. In fact, it’s got a two-star rating on Yelp, with most ratings scoring a single star. High-pressure tactics, misinformation, and downright shady business practices are the most common complaints.

I called and emailed the dealership yesterday, asking for its side of the story. The dealer didn’t reply to requests for comment. Jenny and her stepfather are now looking to refinance their purchase through a local bank.

It’s a shame, because even after all of this, Jenny still loves her little Soul, which she has nicknamed “Vader.” Business practices like this are what have given the Kia brand a black eye since Day One. It’s easy to say that she should have been more knowledgeable and cautious about her purchase — but this is what these dealers do. They prey upon the uninformed, the under-banked.

While the Optima and Soul are wonderful cars that I’ve personally enjoyed driving, you’ll never see me recommend one of its cars to anybody until Kia dealers can stop acting like Kia dealers.

More by Mark "Bark M." Baruth

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Buickman forget 5G, WiFi, microwaves, smart meters, and Bluetooth. (fluoride, chemtrails, clot shots)what does riding on a giant battery with ultra magnetic frequency do to your innards?oh, so an EV works for you not venturing far? YOU'RE NOT USING GAS!THERE'S NO FOOD IN THE DESERT!

- Buickman Who Killed the Electric Car?the buying public, that's who.

- MaintenanceCosts This is refreshing. Excess car storage which brainless local zoning rules forced the builders of this mall to include, but which normally sits empty, is actually being used for car storage!

- MaintenanceCosts Nice car if you can get it properly sorted, but the level of safety tech doesn't seem quite enough for a young driver on today's brodozer-infested highways.

- VoGhost OK. But if Subaru really wants this to sell, they'd make it as a PHEV with enough American content to get buyers $7,500 back on their federal taxes. Otherwise, this really doesn't stand out in a world of RAV4s and CR-Vs.

Comments

Join the conversation

We shouldn't be too hard on the poor F&I guy who was just doing his job - Always Be Closing. After all, he didn't get any good leads in his previous job selling lots at Glenn Gary Glenn Ross. Signed. Alec Baldwin

I know this is a bit old, but one of the reasons you'll find that they're rating is was as high as it was back when you wrote this is that they were using their own employees to post positive reviews. City Kia used to be a "better" alternative, but they've reached their own level of shady themselves. In fact, I noticed they replaced their embedded XTime service system with one from CDK Global, and it's even worse than before. The prices are significantly higher for the same service that you would find through the Kia corporate XTime portal. What's worse, even with the VIN entered, they can't even tell any specific information about your vehicle, whether it's 2wd or awd, or whether it even came with an engine or just a hamster wheel. Plus they have the same $2100 markup stickers on everything, which on some vehicles lists things the vehicle does not even have or comes standard with in the first place. For instance, the list includes pin striping, but not all the cars have it. Other things include door pockets, something that comes standard rather than something they added.