Ask Bark: To Lease or Not Lease a CPO Dealer Demo?

Sam writes:

Hi Bark,

I have a multi-part question and I’m interested to get your insight.

Part one: To CPO or not. After decades of driving Fords, I’ve decided to treat myself with a sporty German car. A BMW 328i seems like just the ticket. I’m looking at a 2015 model year dealer loaner with 4,000 miles, and it’s available with $8,000 off the $53,000 sticker price. The warranty has been reset, so it’s effectively a full, new-car warranty. With no major changes between 2015 and 2016, this seems like a no-brainer.

Part two: To lease or not. A BMW with a turbo and automatic transmission gives me the willies. I like the idea of turning it back in after three years and washing my hands of any long-term maintenance issues (or having to unload it myself). BMW’s lease interest rate is 4.375 percent, which seems high. The residual factor is 59 percent of MSRP.

Part three: To pay up-front or not. I hate paying monthly for stuff. I’m inclined to just pay the entirety of the lease payments up front. BMW will cut the rate by a little in this case, to 4.125-percent on the residual amount. It still seems high relative to the 0-percent offers on domestic vehicles. Are there any gotchas to paying up front?

I’ve never leased before. I’ve always been a “pay cash” kind of guy. But the lease on the low-mileage CPO with no major changes seems like a slam-dunk over a new car similarly equipped. Am I missing something?

Thanks!

Hoo boy. Get ready for a barn burner.

Leasing is one of those subjects that very, very few people truly understand, and that virtually everybody thinks they understand. So, be prepared for a whole bunch of numbers and facts and data that will make the average person’s head spin right round like a record, baby.

I’m going to answer each question individually, and then try to address your situation as a whole. I’m also going to try very hard not to be effing astonished and disgusted that a BMW 328i can be optioned up to $53,000!!!

Part One: The decision as to whether or not you should buy certified pre-owned (CPO) is entirely separate from whether or not you should buy a dealer loaner. The fact that they’re selling it as a CPO and not just a new car “demo special” indicates that you must live in one of the states where dealers are required to actually buy and title their loaners (that varies by state). Most dealer employees will tell you, even off the record, that the typical loaners are meticulously maintained by the service departments — far better than any consumer would maintain his car. Also, the majority of customers who get service loaners treat them better than they treat their own cars, lest they get hit with some repair bills for a car they don’t own.

However, I’m sure that every single current/former dealer employee here has a “loaner story.” I’ve heard several myself over the years: the car was returned with 2,000 more miles than it left with, we had to clean puke out of it, the used car manager used to take it to pick up prostitutes, etc. Some dealers use their loaner cars in absence of a real demo program for employees, too. $8,000 off sticker isn’t that huge of a demo discount (I saw a Lexus dealer demo with over 20 percent of the MSRP deducted from sticker, for example), but it’s enough that you definitely want to get as much information as possible about the history of the car before thinking about signing on the dotted line. Most dealers deduct about $0.20 to $0.30 per mile off of the invoice price; your discount is obviously significantly higher than that. That could mean that it’s an awesome deal, but it could also mean that a lot boy ran it through the garage door.

You won’t have any problems with the BMW CPO warranty, so don’t stress that part of it. Just be as sure as you possibly can that there aren’t any niggling issues with the car. Sure, they’d likely be covered under the warranty, but your time is worth something, too. See if they’re open to a pre-purchase inspection from an independent shop. If they aren’t: Danger, Will Robinson.

Part Two: That’s a high lease rate/money factor. Super high. Again, most people don’t really understand how the lease rates are calculated, so I’m going to try to explain it in the simplest possible terms. Deep breath … and here we go:

When you lease, you’re paying interest on the average of the net capitalized cost — in other words, the actual cost of the car after dealer contribution — of the car (in your case, around $45,000) and the residual (in your case, about $31,270). To get the amount of interest that you’re paying, you add those two numbers together and multiply them by the money factor.

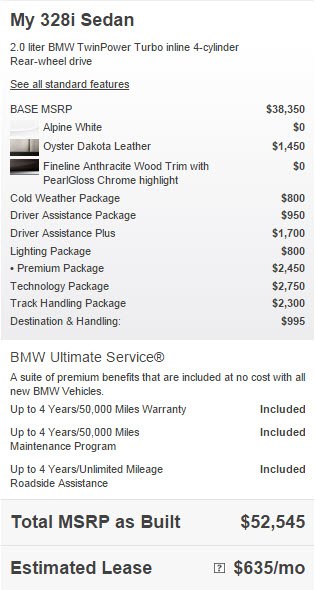

In case you’re not aware, the “money factor” is the way that interest rates are expressed on leases. It’s often not disclosed on lease paperwork, so most people have no idea what the actual money factor is on their leases. It can be determined by dividing the interest rate by 2,400. You don’t have to divide the sum of the net capitalized cost and the residual by 2 to get the average. That division is already accounted for in your money factor calculation. I did the math on your lease and, before local sales tax is added, I came up with a payment of approximately $520 per month over 36 months, which includes about $140 of interest every month (assuming no down payment at all). I went to BMW’s website and optioned up a 328i to around $53,000 (which required me to check nearly every effing box) and here’s what I got for a lease payment:

WHAT IN THE? That $635/month lease payment assumes a $2,500 down payment and a $925 acquisition fee, too. Who’s paying that for a turbo-four 328i? I just … I can’t.

So, in comparison to what you’d pay to lease a brand new car, your payment seems pretty, pretty good. But man, there are so many other cars you could lease for similar cash … erm, wait, I’m sorry. I started to superimpose my values on you. You like the 328i. Good for you. Moving on.

I’d have to think that if you have decent credit, you’d be able to qualify for a lower interest rate on a buy — but your payment would be higher. A 2.9 percent, 60-month loan for that same $45,000 is going to be about $810/month. Saving $300 a month and being able to walk away from the car at the end if you so choose isn’t a bad deal.

Part three: No, you should not pay for the whole lease up front. There are several reasons why this is a bad idea. First of all, you’re still paying to borrow money that you’re not actually borrowing. You’re paying the interest on the depreciation of the vehicle over the time that you’re leasing it. That’s kinda effed up, man. Secondly, if you total the car when you drive it off the lot, that money might end up being entirely lost. Lastly, even if you put that money in a savings account at 0.5-percent per year and auto-drafted your payment right from that account, you’d come out ahead due to inflation over three years. The actual difference in money you’d save, by my calculations, is right around $300 — or less than ten bucks a month. Not worth it.

Also, there are so many jaw-dropping good lease deals available right now on new cars that, even though you’re getting a substantial deal on the price of this car, you’re really overpaying for the lease in comparison what else is being offered on the market. I recommend that anybody who wants to lease a car right now should just call up dealers in Detroit and see what they’re willing to offer you. The domestic OEMs are putting out leases that are just mind boggling (try a Cruze for $69 a month!) and the import dealers are freaked out. It couldn’t hurt to ring up a few dealers and see what you can shake out of the tree.

Do you need your 328i to have every option under the sun? If not, you can probably work a much better payment on a brand new car with fewer options. BMW is advertising $349/month over 36 months with $3,000 down on a no-option 328i. Even with zero down, that still puts you at around $450/month.

But if you’ve fallen in love with this particular car, then you need to see if your dealer can work a better money factor for you, and be prepared to walk away if they can’t. Bottom line, you’re paying too much money to borrow this car for three years.

[Image: © 2012 Alex L. Dykes/The Truth About Cars]

More by Mark "Bark M." Baruth

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Dick Mottram What happens when you are on slippery pavement and AEB slams on the brakes. I see it causing many accidents in the winter!

- FreedMike Bummer for the folks who work there.

- FreedMike Sounds like Apple wants to recoup some of the bucks it spent on the car project.

- EBFlex Insatiable demand for EVs yet this happens. And a lot more layoffs at Tesla.

- SCE to AUX Maybe some Apple tech would be helpful, but please no self-driving stuff.

Comments

Join the conversation

The beauty of this lease is lessee doesn't have to worry about lemon/mechanical breakdown. According to provided 59% residual, Sam is looking at 12,000 miles/ year over 36 months . His BMW will be adequately covered . Also, he will have access to loaner shall the car is in shop for repair.

Personally, I love BMW leases. 4 banger or not, they drive still drive better than most other cars out there. But I don't have the appetite to pay more than around 400 with 0 down for one. Luckily, that's almost always possible even on a well optioned BMW. Right now I'm driving a $57k 528i for a little over 400. You should be able to snag that 328 loaner for under 400. Go for it, but don't pay anywhere close to 600.