Suppliers Rule! The PACE of Automotive Innovation

Suppliers are integral to new technology in the auto industry to an extent not true since the early years of the 20th century, when ventures such as Ford began as mere assemblers, not manufacturers. That will be highlighted on Monday at the 21st PACE “academy awards” for supplier innovation. (For those not in the know, Monday’s the opening night of the SAE [Society of Automotive Engineers] in Detroit.)

General Motors began as a conglomeration of existing firms, both suppliers and assemblers. As it grew – and as Ford stumbled – it added more suppliers while dropping brands. By the 1960s it was highly integrated, with suppliers relegated to trying to make parts to GM’s blueprints. Now that strategy had unintended consequences, as the route to the top became finance, with other functions such as making and selling cars treated as an afterthought. Be that as it may, come the 1970s, first emissions controls, then fuel efficiency mandates, and finally safety regulations forced car firms to engage with non-traditional, outside suppliers. Meanwhile, new entries meant the comfortable Big Three oligopoly could no longer ignore the challenge of actually making and selling cars. One response was to spin off internal parts operations, and with it the ability to do the relevant component-specific R&D. Finally, alongside this demand-side story were two technology revolutions, those of materials science and of electronics and sensors, enabling these suppliers to turn to innovation as a way to build their businesses and preserve margins. The bottom line: suppliers became central to automotive innovation.

This supplier-centric industry has lots of implications. For one, it may facilitate new entry; Aptera, Fisker, BYD, Chery, Geely, Great Wall, Tesla, Bright Automotive, Edison2 and others could buy drivetrains, transmissions, sensors and controls from existing, auto-tech-savvy suppliers. Not all have survived, due to a combination of undercapitalization, poor product strategy and bad luck. However, none could have started had suppliers not controlled – and built their businesses around selling – core technologies. Exploring such implications, including for investors, is a topic for subsequent posts.

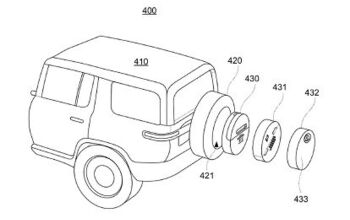

Here let me briefly note the role of suppliers, using engines are an example. (My apologies to Europeans for focusing on gasoline rather than diesel engines.) Drawing from among PACE award winners, we see the following areas dominated by suppliers: fuel tanks, fuel pumps, fuel vapor recovery, injectors, injector electronics, spark plugs, valves, camshafts, pistons, piston rings, bearings, seals, sensors of many types, turbochargers and turbocharger escape valve technologies. There are other areas (engine block castings, machining) where car companies continue to dominate, but even there suppliers provide the machine tools that are critical to these operations. In short, while car companies may work on the configuration of the engine and the integration of these various components, the advances come from supplier technology. [The photo is Federal-Mogul’s IROX engine bearing designed to withstand start-stop systems.]

It’s not just engines. A wide array of vehicle systems are dominated entirely by suppliers, such as clutch components, transmissions, differentials and driveshafts, HVAC systems, lighting, ESC systems, tires, tire sensors, suspensions, ECUs and most other sensors and vehicle electronics, airbags, seatbelts, hot stamping, hydroforming, paints, structural adhesives, sound-proofing materials, water pumps, radiators, headliners, instrument panel surfaces and underfoams, starter/alternator systems, belt and pulley systems, timing chains, windshields and glass, wiper motors, wiper blades, radar, lidar and ultrasound sensors, cameras and image recognition systems, infotainments systems, and on and on. More important for Monday, you can find examples among the two decades of PACE finalists and award winners.

I’ve been privileged to judge this competition since its inception, thanks to the entre provided by my own research (my PhD dissertation was on automotive suppliers in Japan). As a result I’ve been able to visit 2-4 suppliers a year for in-depth presentations on technologies and their business case, and to sit with the judging panel to hear summaries of their visits to another 30 or so suppliers. Along the way I’ve earned my PE degree as well. [P.E = pretend engineer] Now the entire process is under NDLs (non-disclosure agreements) so I have to be careful, but I have tried my hand (with co-author Peter Warrian) at analyzing the finalists using publicly available information for lessons on technology. Here’s our initial Warrian-Smitka paper and a more recent analysis (incorporating 2015 finalists), my presentation at James Madison University.

Watch Monday night for the stream of press releases from the winners, and the Automotive News coverage of the entire award ceremony. I’ll be there, in my tuxedo, enjoying the food and drink, and the celebration of innovation. It’s a fun and thought-provoking event!

Mike Smitka is an economist at Washington and Lee University in Lexington, Virginia. He's been a judge of the Automotive News PACE supplier innovation awards since they began in 1994. His household's vehicles are a 2014 Chevy Cruze, a 2013 Honda CR-V and a 1988 Chevy pickup. Find his auto industry course at <a href="http://econ244.academic.wlu.edu/">Econ 244</a>; he also blogs with David Ruggles at <a href="http://autosandeconomics.blogspot.com">Autos and Economics</a>.

More by Mike Smitka

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Bd2 Would be sweet on a Telluride.

- Luke42 When will they release a Gladiator 4xe?I don’t care what color it is, but I do care about being able to plug it in.

- Bd2 As I have posited here numerous times; the Hyundai Pony Coupe of 1974 was the most influential sports and, later on, supercar template. This Toyota is a prime example of Hyundai's primal influence upon the design industry. Just look at the years, 1976 > 1974, so the numbers bear Hyundai out and this Toyota is the copy.

- MaintenanceCosts Two of my four cars currently have tires that have remaining tread life but 2017 date codes. Time for a tire-stravaganza pretty soon.

- Lorenzo I'd actually buy another Ford, if they'd bring back the butternut-squash color. Well, they actually called it sea foam green, but some cars had more green than others, and my 1968 Mercury Montego MX was one of the more-yellow, less-green models. The police always wrote 'yellow' on the ticket.

Comments

Join the conversation

Mike, why is Honda, generally speaking, capable of designing and manufacturing more durable/reliable engines, even those targeting an aggressive cost-of-production price point, than so many other automotive companies? I've asked this question of at least a half dozen automotive engineers over a stout or ale and have gotten a variety of responses over the years.

In the days of yore suppliers did dominate many systems. Bendix, Motorola, Kelsy-Hayes, Borg Warner, Prestolite, TRW, Dana-Spicer, Holley, Carter are just a few of the names of brands that dominated a particular segment back in the day. GM also dominated the supplier market for many decades. Saginaw, Delco-Remy, Guide, Rochester Products, Harrison and Packard Electric items showed up on many brands of non GM automobiles. In the 70's every US mfg and many foreign mfgs used at least some parts from at least one GM division. Ford used the lowest number of GM division parts, while IH used more parts supplied by GM than ones they built themselves.