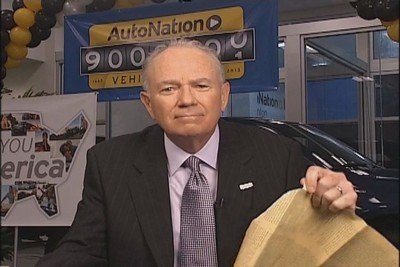

AutoNation CEO Concerned About Inventories but Sees 3-5% Growth in '14

Mike Jackson, the CEO of AutoNation, the largest retail dealer group in the United States, told CNBC that the domestic automakers are carrying inordinately large amounts of inventory. Telling Just-Auto that U.S. automakers have a “pretty bizarre” way of calculating inventories that end up justifying high inventory levels, Jackson said, “But if you cut through the bogus calculations and look at dealer inventory for the Detroit Three, it’s over a 100-day supply. And it simply doesn’t need to be there.”

Jackson called 2013 “the perfect year,” for AutoNation with a better than expected profit report and despite his concerns about the bloated inventories he remains positive about 2014. “I’m optimistic about 2014. Industry sales will continue to grow 3% to 5%. We’ll break through 16m units this year.

“The powerful drivers are the same in that there’s genuine replacement need [because of the] age of the vehicles on the road; great financing is available; and we have the best product offering from the manufacturers ever,” he added.

Jackson said he saw “very strong profitability from the suppliers, to the manufacturers, right through to retailers”.

More by TTAC Staff

Comments

Join the conversation

when he first was hired by Auto Nation, I felt Mr. Jackson was a good fit. now I am sure. this guy gets it.

Mike Jackson always sees growth, no matter what -he even saw a high, sustained rate of growth back in 2007, and wasn't shy about loudly & frequently broadcasting this forecast in all the usual financial outlets. He became oddly silent, for whatever reason, in the two years to follow.

I think the lease thing is interesting. Perhaps some member of the B&B or TTAC Staff could find a source for "MOST LEASED" vehicles of the past 2 or 3 years, the ones that will be coming back on lease return and hurting the resale values of that model. That would be helpful for those of us "cheapskate" used car buyers who plan on buying during the 2014 calendar year.

I can think of no worse place to buy a car than an Auto Nation dealership. Even when they belong to the True Car pricing arrangement, getting a bottom line price out of them is reminiscent of the old days, of dealing with dealers who will waste your time all day. I find that in almost any market I have purchased a car, Auto Nation dealers are the highest priced, and offered the least service. I have no idea on Mike Jackson's expertise as a CEO, or how well he is positioned to make an impartial projection of vehicle sales for the year. I do know than any CEO that admits to a flat, or shrinking year, usually uses that as a resignation letter. So Jackson's opinion means as much to me as anyone else's.