Japan Blatantly Copies America, Europe, Imports Cheap Parts From China

The Japanese car industry found a way to soften the impact of the crushingly high yen on its books. It does what U.S. and European automakers have practiced for a long time: Import low-cost parts from abroad. It is a stop-gap measure while large parts of the Japanese car industry is packing.

After studying recent trade statistics, The Nikkei [sub] learned that Japanese “parts imports rose to approximately 324,000 tons in the first six months of the current calendar year, the highest level recorded since 1998.”

The abnormally strong yen quickly turns the export of cars from Japan into a loss-making endeavor. By the same token, it makes imports from softer currency markets cheaper. Not surprisingly, parts imports from China to Japan rose 40 percent in the first six months, The Nikkei says.

Nissan is leading this drive, the Nikkei says:

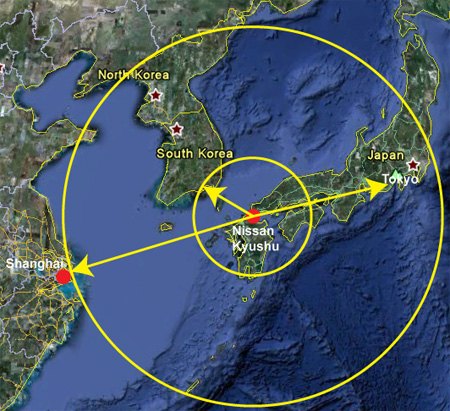

“A number of Nissan Motor Co. factories throughout Kyushu now buy more parts from South Korea and China than they did in the past. About 40 percent of the parts for Nissan Shatai Kyushu Co.’s new NV350 Caravan, launched in June, were procured from overseas markets, for example.”

Map, drawn last year in September

Well, if The Nikkei would have paid attention last September at the trip to that same Nissan plant in Kyushu, this development could have been anticipated, now it needs to be ex post facto reported.

There, Nissan CEO Carlos Ghosn announced that “as a first step to ward off high yen denominated costs, Nissan will increasingly import parts and components from South Korea and China.” Ghosn also gently put his finger on a possible pitfall of the operation:

“Importing from China does not automatically mean that we stop buying from our Japanese suppliers. Many Japanese companies have plants in China. What is better than Japanese supplier? It is Japanese suppliers with the benefit of competitive production.”

In this case, the domestic supplier probably would like to pocket the new exchange rate windfall, if he not already has outsourced most of the work to a subsidiary in China. Interesting discussions with purchasing will ensue. Also, let’s not forget that the big automakers have their own or affiliated parts makers in low cost countries.

However, widgets are only a, well, part of the total cost, and that still is in the grossly overvalued yen. Let’s recall what Ghosn said last September:

“Given the choice, we stay in Japan, This is our home, this is our base. If we go, then because we are forced out. If in six months down the road we are still in this situation, then this will provoke a rethinking of our industrial strategy. Personally, I don’t think this will be the case – but I may be wrong.”

He was wrong, and he knew it. On September 20, 2011, a dollar bought 76 yen. Six months late, a greenback bought 83 of the Japanese currency. Now, nearly a year later, a dollar buys only 78 yen.

Ghosn does not make idle threats. On Saturday, Derek reported that “Nissan is leading the exodus from Japan.” Ghosn is not leaving by himself. Toyota opens factories everywhere, except in Japan. A few days ago, we reported that even the Japanese government is helping its hard hit companies with the moving abroad expenses.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Turbo Is Black Magic My wife had one of these back in 06, did a ton of work to it… supercharger, full exhaust, full suspension.. it was a blast to drive even though it was still hilariously slow. Great for drive in nights, open the hatch fold the seats flat and just relax.Also this thing is a great example of how far we have come in crash safety even since just 2005… go look at these old crash tests now and I cringe at what a modern electric tank would do to this thing.

- MaintenanceCosts Whenever the topic of the xB comes up…Me: "The style is fun. The combination of the box shape and the aggressive detailing is very JDM."Wife: "Those are ghetto."Me: "They're smaller than a Corolla outside and have the space of a RAV4 inside."Wife: "Those are ghetto."Me: "They're kind of fun to drive with a stick."Wife: "Those are ghetto."It's one of a few cars (including its fellow box, the Ford Flex) on which we will just never see eye to eye.

- Oberkanone The alternative is a more expensive SUV. Yes, it will be missed.

- Ajla I did like this one.

- Zerofoo No, I won't miss this Chevrolet Malibu. It's a completely forgettable car. Who in their right mind would choose this over a V8 powered charger at the rental counter? Even the V6 charger is a far better drive.

Comments

Join the conversation

I generally understand references to exchange rates. But I keep seeing these stories about Japanese auto manufacturing and they keep not making sense to me. The yen is low compared to the yuan and the dollar. By what logic is that "crushingly high"? Relative to where it used to be? It remains low compared to other currencies, isn't that the primary measure? Can someone explain it like I'm a 4 year old?

The Japanese used up all of thier QE options in the 90's, we just started using ours (it won't end well either) in 2008, Japan has no ability to manipulate the Yen anymore. As the Yes decrease in value to $, that means every $ earned in US converts into less Yes in Japan (its the opposite that the Japanese companies want) Worse we used QE to keep the financial institutions alive, Japan used it to keep everything alive (sometimes referred to as the land of zombies, companies that have been bankrupt for years, but the banks just lend more money to pay the princple and interest). We let the Steel industry die, Japan wasn't willing to let anything die, there's a price to pay and they're paying it now, they have no control of currency valuation to make thier goods artificially more competitive (same as Euro countries, they can't print to depredciate currency). The G8 (+) Switzerland and Norway need to come up with a number and apply a encompassing tariff on China to make it currency value what it should be. That would begin to correct alot of problems.