And Now, The Killer Yen

Once Japanese automakers have dug out from under the rubble, cleared the ports and start shipping again, they will face a possibly bigger problem: A killer yen that has accumulated strength in an absolutely abnormal fashion over the last few days.

It stands to reason that the currency of a country grappling with damages of around $200 billion would suffer along. However, this is not how it works here. Japan is not a debtor country. With nearly $900 billion in dollar reserves, Japan is one of the world’s largest creditors. Japan doesn’t need to print or borrow money. They simply make a withdrawal. As predicted last weekend, some of their money is coming home. And when large amounts of dollars are converted into yen, the yen goes up, the dollar goes down. Supply and demand.

Says The Nikkei [sub]: “Japanese investors held around $2 trillion in foreign assets, net of reserves, at the end of 2010. Speculators are betting a chunk of this will flow home as Japan begins to re-build and repair damage from the quake and ensuing tsunami, and insurance companies begin to pay out claims on life and property and casualty policies.”

“The yen bolted to all-time highs on speculation that Japanese insurers would be forced to bring money back home to settle huge quake-related damage claims,” writes Reuters. Before the disaster, a dollar bought around 82 yen, which already was seen as way too high. Now, a dollar buys only 78 yen, and we have seen spikes to 76.

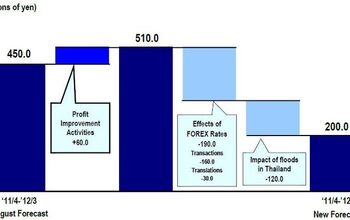

The Japanese car industry is considered as not competitive if the dollar falls below the 85 yen mark. Moving production abroad helps to some degree. It shelters from the currency swings. Except when the books are closed. When overseas profits are counted, it makes a difference if a dollar converts to 76 yen instead of 86.

Maybe the Japanese central bank should seek the counsel of all the people who claimed that the yen had been manipulated and was artificially low. I bet tips on how to lower the price of the Japanese currency would be highly welcome.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- ToolGuy Please allow me to listen to the podcast before commenting. (This is the way my mind works, please forgive me.)

- ToolGuy My ancient sedan (19 years lol) matches the turbo Mazda 0-60 (on paper) while delivering better highway fuel economy, so let's just say I don't see a compelling reason to 'upgrade' and by the way HOW HAVE ICE POWERTRAIN ENGINEERS BEEN SPENDING THEIR TIME never mind I think I know. 😉

- FreedMike This was the Official Affluent-Mom Character Mobile in just about every TV show and movie in the Aughts.

- Offbeat Oddity The RAV4, and I say this as someone who currently owns a 2014 CR-V. My aunt has a 2018 CR-V that has had a lot of electrical issues, and I don't trust the turbo and CVT to last as long as Toyota's NA engine and 8-speed automatic. Plus, the RAV4 looks sportier and doesn't have the huge front overhang.

- Offbeat Oddity I'd go with Mazda, especially now that there's no more cylinder deactivation on the 2024 NA motor. It's around $4-5k less than the Toyota with similar equipment, and I think reliability is probably very close between them.Regarding reliability, hasn't this generation of RAV4 taken a hit? I know it's not rated as highly in Consumer Reports, and there were teething issues during the first few years. I'm surprised it's not mentioned in more reviews- even Jack Baruth's. I'm sure the bugs have been worked out by now, though.

Comments

Join the conversation

Until this situation with the nuclear reactor isn't resolved we should see more volatility. I think I've said before in the other article, but this spike in yen is short-term. Primarily due to the uncertainty associated with the fluid situation after the disaster. Obviously there is some repatriation of yen as Japanese companies seek liquidity to pay for damages. The sudden spike however, is more due to speculation by carry-traders. Which borrow money in yen (due to low-interest rates and strong yen) and invest money in assets denominated in foreign currency. However, we should see a weakening of the yen once the rebuilding effort starts, there will be a massive expansion of the JPY money supply as Japanese government injects the economy with rebuilding money. Which should be in the scale of the hundreds of billions of dollars. BoJ has already injected the banking system with 6 trillion yen today. What is a question however is if the BoJ will intervene directly in the fx markets. The conversation that Yosano had with Obama this morning may indicate that. But its a double edged sword, a high yen keeps rebuilding costs low for the Japanese government, a weak yen helps Japanese companies that have been hit with the disaster.

My decrepit feeble age-impaired memory informs me that in 1975 forking over one USA greenback resulted in 220 Yen tossed back. My astonishingly vile inability to conceive "mathematically" has always bothered/impaired me. Perhaps the time when I was playing with the car door handle while Mom was driving and was around 2 years old or so(she related in later life she was going around 35mph) and I fell out, landing upon my rather misshapen head...........and no medical care sought (a different era back then) perhaps the portion of the brain involved with "math" thinking was affected? Where's " Fantastic Voyage" when needed? Anyway............ the Old Disgruntled One does appreciate topics, comments, etc involving ,monetary topics and much but not ALL can be assimilated. Not expecting the Herd to explain but feel free to maximize examples and/or use anecdotes, whatever but in no way do I want to impair the free-flow of writing or conversations. Muchas gracias!!!!!!!!!!