Will Toyota Beat The Rare-Earth Material Bottleneck?

Bloomberg reports that Toyota’s engineers have reached an “advanced stage” of research on a new “induction”-type electric motor which holds the promise of freeing the Japanese automaker from dependence on so-called rare-earth materials. These elements, including neodymium and dysprosium, are used to strengthen the magnets used in traditional electric motors and generators, and are crucial to the production of everything from electric and hybrid cars to wind turbines and guided missiles. China currently controls over 90 percent of the world’s supply of rare-earth materials, and has recently cut exports quotas, raising tensions between China and Japan.

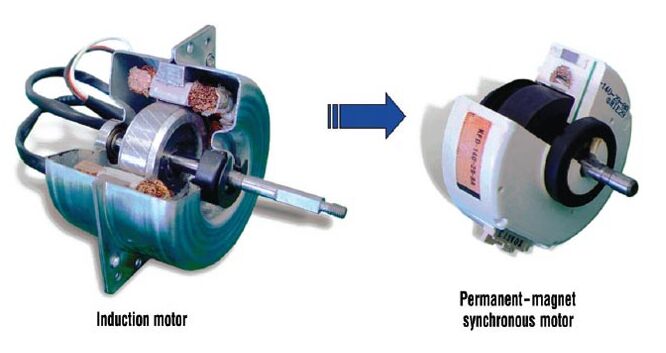

Modern hybrids use “fixed-magnet”-type (or “synchronous”) electrical motors as they are more compact and, according to Eric Rasak of the Argonne National Lab, offer superior “torque density” across a number of driving conditions. The trade-off is that they use fixed magnets in the rotor and, because they are subjected to high stress as both motors and generators, must be strengthened using rare earth compounds. Pure EVs, which lack the added bulk of an internal combustion engine, often use induction engines. Toyota’s breakthrough in induction motor research, according to the company, could create motors that are both more efficient and more compact than the current fixed-magnet motors. But, as with all technological breakthroughs, costs could be higher. Never a company to take too much risk, Toyota is keeping its fixed-magnet motor options open by exploring rare-earth exploitation in India. Just in case.

More by Edward Niedermeyer

Comments

Join the conversation

If many electric motors are of the induction type I don't see why they used the permanent magnet route. I remember books explaining how the shape of the wire influences the features of the motor, torque curves mostly, so Honda's "breakthrough" is hardly that, based on the few information given here, that PR is no different from Ahmadinejad or Chavez PR.

One issue with the RE "scarcity". It isn't. And China doesn't have a monopoly, just the best cost commercial operations. If the price rises too much it becomes economically viable to develop other -- and yes, more local -- operations. It's similar to the Canadian oil sands project.

American mining companies got significant tax breaks for selling their rare earth mining rights to the Chinese. Our Government, under the Cheney/Bush Administration, gave the Chinese this monopoly on a silver platter.

Toyota (and others) should invest in Australia. Lynas, Alkane Resources, and others are reliable producers of rare earth metals. The problem I see happening in a few years time however is the price of these metals collapsing, as everyone's getting on the bandwagon now. So many new mines opening today means a glut tomorrow.