You Are Looking At The U.S. Car Market

What is the difference between the November U.S. car market and my wife? The answer is: None. Edmunds says the U.S. annual sales rate for new vehicles in November will be essentially flat from the prior month.

This reiterates equally flat predictions Wardsauto and J.D.Power had made a few days ago. Edmunds analyst Jessica Calwell paints a pretty face on the prediction: “We’re seeing some stability and consistency in the marketplace for the first time since the economic downturn. The auto makers have realized that they can achieve profitability at this level of sales, and they seem to be settling into that reality.”

Edmunds sees November SAAR to stay at 12.2 million, just like October. Compared to the horrendous November of 2009, sales are expected to be up 17 percent, so there will be something to celebrate.

Edmunds already has forecasts for the largest automakers. As per their crystal ball, it will look as follows:

Change from November 2009Change from October 2010Chrysler22.4%-15.4%Ford25.6%-2.0%GM11.5%-8.5%Honda16.2%-13.3%Nissan10.0%-12.4%Toyota-1.8%-9.8%Industry total17.0%-8.1%(Unadjusted for selling days)

Two other closely followed metrics will be up. Average auto incentives in the U.S. are expected to be $2,490 per vehicle sold in November, up 2.1 percent from the prior month, but down 8.6 percent from the desperate month of the prior year. Buy (North) American proponents will be pleased to hear that the combined U.S. monthly market share for Chrysler, Ford and GM is expected to be 45.5 percent in November, up from 44.8 percent a year ago and up from 45.2 percent in October. If you look at it this way, the market appears much better proportioned.

But with one month to go, it’s time to settle into the reality of an 11.5m car market. Compared to the 10.4 million units in 2009, we’ll call that an A-cup.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

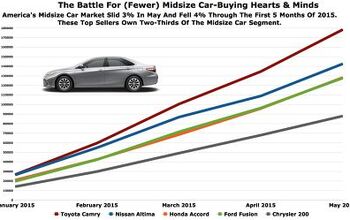

- Flashindapan Will I miss the Malibu, no. Will I miss one less midsize sedan that’s comfortable, reliable and reasonably priced, yes.

- Theflyersfan I used to love the 7-series. One of those aspirational luxury cars. And then I parked right next to one of the new ones just over the weekend. And that love went away. Honestly, if this is what the Chinese market thinks is luxury, let them have it. Because, and I'll be reserved here, this is one butt-ugly, mutha f'n, unholy trainwreck of a design. There has to be an excellent car under all of the grotesque and overdone bodywork. What were they thinking? Luxury is a feeling. It's the soft leather seats. It's the solid door thunk. It's groundbreaking engineering (that hopefully holds up.) It's a presence that oozes "I have arrived," not screaming "LOOK AT ME EVERYONE!!!" The latter is the yahoo who just won $1,000,000 off of a scratch-off and blows it on extra chrome and a dozen light bars on a new F150. It isn't six feet of screens, a dozen suspension settings that don't feel right, and no steering feel. It also isn't a design that is going to be so dated looking in five years that no one is going to want to touch it. Didn't BMW learn anything from the Bangle-butt backlash of 2002?

- Theflyersfan Honda, Toyota, Nissan, Hyundai, and Kia still don't seem to have a problem moving sedans off of the lot. I also see more than a few new 3-series, C-classes and A4s as well showing the Germans can sell the expensive ones. Sales might be down compared to 10-15 years ago, but hundreds of thousands of sales in the US alone isn't anything to sneeze at. What we've had is the thinning of the herd. The crap sedans have exited stage left. And GM has let the Malibu sit and rot on the vine for so long that this was bound to happen. And it bears repeating - auto trends go in cycles. Many times the cars purchased by the next generation aren't the ones their parents and grandparents bought. Who's to say that in 10 years, CUVs are going to be seen at that generation's minivans and no one wants to touch them? The Japanese and Koreans will welcome those buyers back to their full lineups while GM, Ford, and whatever remains of what was Chrysler/Dodge will be back in front of Congress pleading poverty.

- Corey Lewis It's not competitive against others in the class, as my review discussed. https://www.thetruthaboutcars.com/cars/chevrolet/rental-review-the-2023-chevrolet-malibu-last-domestic-midsize-standing-44502760

- Turbo Is Black Magic My wife had one of these back in 06, did a ton of work to it… supercharger, full exhaust, full suspension.. it was a blast to drive even though it was still hilariously slow. Great for drive in nights, open the hatch fold the seats flat and just relax.Also this thing is a great example of how far we have come in crash safety even since just 2005… go look at these old crash tests now and I cringe at what a modern electric tank would do to this thing.

Comments

Join the conversation

This is the new normal. The industry won't be getting anywhere near the credit bubble 16-17m per year rate any time soon. Bad economy, high costs of ownership, high initial purchase costs are all driving people out of cars. The US auto fleet will probably keep shrinking over the next decade as people give up cars.

You are a brave man, Bertel. My wife is also Japanese, but I would never have the courage to remark about the size of her chest. Ever. No matter where or how private.