Pay Czar Outs Cereberus' Plans to Kill Chrysler Financial

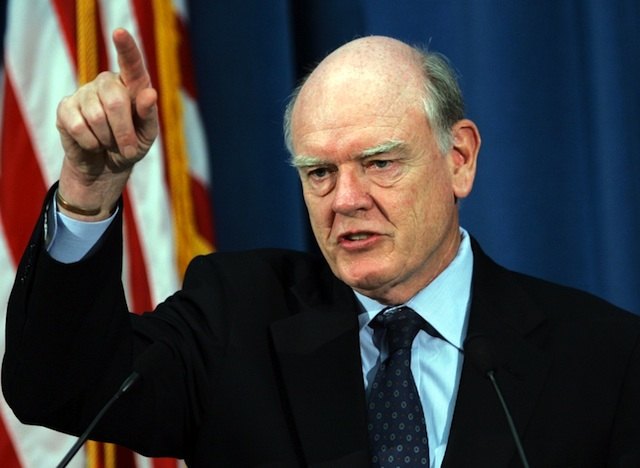

When the history of the 2008/2009 federal bailouts is finally written, the chapters on Cerberus’ federal teat suckage will contain some of the best/worst examples of insider sweetheart deals between failed financiers and Uncle Sam. Deals that protected their protagonists from genuine accountability for their actions, and inaction. Case in point: Cerberus-owned GMAC’s eleventh-hour, Christmas Eve exemption from FDIC banking laws. GMAC’s Board Member, former U.S. Treasury Secretary John Snow, brokered the get-out-of-C11-free card and subsequent $6 billion bailout. Dirty? How about the fact that GMAC’s then-Chairman’s J. Ezra Merkin’s was up to his eyeballs in Bernie Madoff’s Ponzi scheme. OK, so, here we are. When federal Pay Czar Kenneth J. Feinberg announced that executives at ChryCo Financial wouldn’t get as close a haircut as their colleagues everywhere else, his explanation let the C11 cat out of the bag.

Feinberg said that Chrysler Financial ‘contends that the risk of employee departures must be minimized because Chrysler Financial has stated it intends to wind down its operations and will have difficulty attracting new employees.’

Feinberg said Chrysler Financial’s cash compensation will decrease 30 percent over 2008 levels for the top 25 executives — compared with 50 percent at most other firms. Overall compensation will fall 56 percent at Chrysler Financial — compared to 90 percent on average.

Chrysler Financial will pay its top executive $1.5 million and $1.35 million for a second executive. Two others will receive $800,000 and $600,000. The remaining top 21 will make no more than $500,000.

This report from the The Detroit News is, in a word, revolting. By what twisted logic is it OK to pay a company’s executives MORE when they’re heading for dissolution rather than recovery? And not just because Chrysler Financial has been quietly screwing Chrysler, Dodge and Jeep dealers to facilitate its exit strategy.

Dealers for months have been of the opinion that Chrysler Financial was trying to collect on all its outstanding loans in preparation for liquidation of its $26 billion portfolio, down from $60 billion at the start of the year.

The finance company’s global work force has shrunk from 4,000 in January to less than 2,700.

So much for saving American jobs. For those of you who say that the bailouts were necessary to keep America’s economy from tanking, remember that not all bailouts are alike. Or, put another way, some are worse than others.

More by Robert Farago

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Dartman https://apnews.com/article/artificial-intelligence-fighter-jets-air-force-6a1100c96a73ca9b7f41cbd6a2753fdaAutonomous/Ai is here now. The question is implementation and acceptance.

- FreedMike If Dodge were smart - and I don't think they are - they'd spend their money refreshing and reworking the Durango (which I think is entering model year 3,221), versus going down the same "stuff 'em full of motor and give 'em cool new paint options" path. That's the approach they used with the Charger and Challenger, and both those models are dead. The Durango is still a strong product in a strong market; why not keep it fresher?

- Bill Wade I was driving a new Subaru a few weeks ago on I-10 near Tucson and it suddenly decided to slam on the brakes from a tumbleweed blowing across the highway. I just about had a heart attack while it nearly threw my mom through the windshield and dumped our grocery bags all over the place. It seems like a bad idea to me, the tech isn't ready.

- FreedMike I don't get the business case for these plug-in hybrid Jeep off roaders. They're a LOT more expensive (almost fourteen grand for the four-door Wrangler) and still get lousy MPG. They're certainly quick, but the last thing the Wrangler - one of the most obtuse-handling vehicles you can buy - needs is MOOOAAAARRRR POWER. In my neck of the woods, where off-road vehicles are big, the only 4Xe models I see of the wrangler wear fleet (rental) plates. What's the point? Wrangler sales have taken a massive plunge the last few years - why doesn't Jeep focus on affordability and value versus tech that only a very small part of its' buyer base would appreciate?

- Bill Wade I think about my dealer who was clueless about uConnect updates and still can't fix station presets disappearing and the manufacturers want me to trust them and their dealers to address any self driving concerns when they can't fix a simple radio?Right.

Comments

Join the conversation

I thought TTAC had predicted that Cerberus wanted to keep Chrysler Financial so they could merge it with GMAC. What happened to that? And if they repaid the Tarp money, do they have to liste to Feinberg or any of Obama's minions about how much they pay their employees?

Current lawsuits against Chrysler Financial may impact Cerberus in finding a money trail for settlements. For more information go to lawsuitsagainstchryslerfinancial.com