Payback's a Bitch: New GM Stock Must Hit $68 Billion

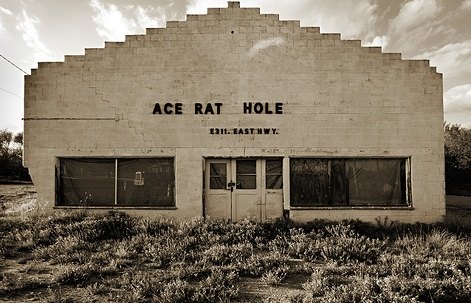

The Washington Post reminds us that Uncle Sam’s chance of recouping taxpayers’ $50 billion “investment” in New GM shares are somewhere between slim and none. To recover the money poured down the GM rathole so far, not including “extraneous” bailouts to lender cum banks, suppliers, dealers and car buyers, the automaker’s stock must rise to the point where it’s worth $68 billion. And remain at the level as the feds attempt to off-load their/our 60 percent share. As we like to say in these parts, good luck with that. Or, as the WaPo puts it, “Even at its recent 2000 peak, GM’s stock was worth only $56 billion.”

Forgetting to add “if ever,” analyst Maryann “Where’s the sense of urgency” Keller puts that into perspective: “I don’t see GM hitting those benchmarks in a very long time.” And here’s the really galling thing: as, previously stated, one the main guys behind/within the Presidential Task Force on Automobiles isn’t mad as hell and will take it some more. On your behalf.

“We have certainly looked at scenarios where, over time, a very substantial portion and potentially all of the taxpayer investment in General Motors will be returned,” Ron Bloom, a senior adviser to the administration’s auto task force, told a Senate committee earlier this month. “But I certainly by no means would say that I am highly confident that that will occur.”

Is Ron trying to say that he’s somewhat confident GM won’t pay back a “substantial portion” of US tax dollars? Normally, when I invest $50 billion in something, I want to know when I might see my money again. You know: plans, timelines, benchmarks, deadlines. Just sayin’.

Anyway, if you’re looking for an analyst sufficiently delusional to believe that New GM’s stock price will soar to previously unattainable heights, triggering a happily-ever-after come-to-Jesus-type moment, look no further than the company’s CEO. Of course.

“Can a company with $100 [billion] to $140 billion of revenue have $70 billion of market cap?” Henderson said in an interview last week at the company’s headquarters. “Yeah.”

Yeah? Well, there’s only possible justification for this bridge loan into bailout into equity mishegos, as performed by rapper 2Big2Fail: the cost of letting GM go under would have been greater than $50 billion (and the rest). As the feds march down the road of nationalization, it’s about time someone other than the ridiculously biased CAR statisticians actually MADE that calculation.

More by Robert Farago

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Lou_BC Well, I'd be impressed if this was in a ZR2. LOL

- Lou_BC This is my shocked face 😲 Hope formatting doesn't fook this up LOL

- Lou_BC Junior? Would that be a Beta Romeo?

- Lou_BC Gotta fix that formatting problem. What a pile of bullsh!t. Are longer posts costing TTAC money? FOOK

- Lou_BC 1.Honda: 6,334,825 vehicles potentially affected2.Ford: 6,152,6143.Kia America: 3,110,4474.Chrysler: 2,732,3985.General Motors: 2,021,0336.Nissan North America: 1,804,4437.Mercedes-Benz USA: 478,1738.Volkswagen Group of America: 453,7639.BMW of North America: 340,24910.Daimler Trucks North America: 261,959

Comments

Join the conversation