Europe February Sales: The Good, The Bad, And The Basket Cases

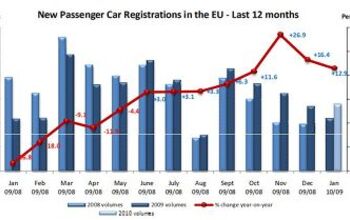

The European Automobile Manufacturers’ Association (ACEA) has released their February numbers, Reuters reports. European new car registrations fell 18.3 percent in February, says the ACEA. That’s much better than the 41.3 percent decline the USA suffered in the same month. But it could have been worse had it not been for Germany. Here, registrations soared 21.5 percent in February. The only other market in Western Europe to show growth was tiny Luxembourg—up a tiny 0.3 percent

The German market boosted Western Europe’s tally, with “strong demand in certain market segments following the recent motor vehicle tax reform and scrapping bonus introduced by the German government.” France, which also gives cash for clunkers, but only €1K (as opposed to €2.5K in Deutschland) saw a rather benign drop of 13 percent.

Western European car registrations fell 17.3 percent, while new member states saw a 30.3 percent drop.

Iceland put auto purchases on ice, with a drop of 91.2 percent. Crisis-hit Spain was down 48.8 percent, while Italian registrations dropped 24.4 percent and the UK posted a 21.9 percent decrease.

New member states were a mixed bag: Poland registered a 7.3 percent increase on February last year, with 30,194 new cars registered, while Hungary’s registrations dropped 46.4 percent and Romania plunged 66.5 percent.

Across Europe in February, Europe’s largest carmaker, Volkswagen, posted a 10.2 percent drop in new passenger car registrations for the group, while its Spanish Seat brand saw a 31.2 percent fall, and the Volkswagen brand declined by 6.2 percent.

Within Daimler, the Mercedes premium brand posted a 34.2 percent plunge, while Smart car registrations edged up 0.6 percent compared with February 2008 leaving the group as a whole down 29.8 percent.

The PSA Peugeot Citroen group saw new registrations fall by 25.3 percent, while fellow French manufacturer Renault was down 23.1 percent.

Italy’s Fiat posted a 16.5 percent group-wide decline.

GM, whose European brands including Sweden’s Saab and Germany’s Opel are fighting for survival, posted a 21.9 percent drop in February registrations.

For the raw data per brand, click here and ye shall receive.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Theflyersfan I know their quality score hovers in the Tata range, but of all of the Land Rovers out there, this is the one I'd buy in a nanosecond, if I was in the market for an $80,000 SUV. The looks grew on me when I saw them in person, and maybe it's like the Bronco where the image it presents is of the "you're on safari banging around the bush" look. Granted, 99% of these will never go on anything tougher than a gravel parking lot, but if you wanted to beat one up, it'll take it. Until the first warning light.

- Theflyersfan $125,000 for a special M4. Convinced this car exists solely for press fleets. Bound to be one of those cars that gets every YouTube reviewer, remaining car magazine writer, and car site frothing about it for 2-3 weeks, and then it fades into nothingness. But hopefully they make that color widespread, except on the 7-series. The 7-series doesn't deserve nice things until it looks better.

- Master Baiter I thought we wanted high oil prices to reduce consumption, to save the planet from climate change. Make up your minds, Democrats.

- Teddyc73 Oh look dull grey with black wheels. How original.

- Teddyc73 "Matte paint looks good on this car." No it doesn't. It doesn't look good on any car. From the Nissan Versa I rented all the up to this monstrosity. This paint trend needs to die before out roads are awash with grey vehicles with black wheels. Why are people such lemmings lacking in individuality? Come on people, embrace color.

Comments

Join the conversation

Thanks Mr. Schmitt! And good for Ford and Alfa ... and Hyundai (yikes!)

How much of Germany's strategy is really just accelerating next year's purchases into this year though? At some point most people will have new-ish cars and the resulting sales slowdown will be worse than now for longer than it would have been. The car companies did this in America with rebates and incentives for years--didn't need the gov't to throw in another paltry $2500. They pulled sales forward and hollowed out future demand (like now) for current demand (2007/2008). Oh well...