General Motors Death Watch 142: Chapter 11: A Capital Idea?

By their own admission, General Motors' North American operations are currently doing business with negative working capital (NWC). At About.com, an unnamed investment adviser has some advice on that subject. "Negative working capital is a sign of managerial efficiency in a business with low inventory and accounts receivable. In any other situation, it is a sign a company may be facing bankruptcy or serious financial trouble." Any guess which one of those descriptions applies to GM?

GM has been staving-off the whole "NWC leads to bankruptcy" paradigm by hocking the family jewels. The $5.4b recently added to GM's accounts by the sale of their highly profitable Allison Transmissions unit is only GM's last (and I do mean last) significant sell-off. In the preceding two years [alone], GM CEO Rick Wagoner jettisoned some $21.4b worth of corporate assets. During those same two years, the company signing his paycheck lost $12.4b.

While the charges for losses in these years were mostly non-cash items (worker buyouts, plant closings, etc.), the piper must be paid. The charges will eventually morph into cash demands. Without positive earnings (i.e. profitable vehicles), the situation is destined to deteriorate.

Selling assets to cover the shortfall wasn't an inherently bad idea– if GM had used the proceeds to reinvigorate their brands and products. No such luck. GM was forced to use the money to pay for the aforementioned worker buyouts, plant closures and other downsizing costs. The automaker did so in the hopes that production would eventually equal demand, while cost reductions would lead to more profitable products.

As the last two month's of lowered sales and diminished market share have shown, as GM's accounts reveal, that strategy is dead in the water.

In terms of the downturn's effects on GM's life-sustaining margins, much has been made of GM's increased incentives. Fair enough; every discount dollar bestowed upon GM's customers is one dollar less profit. But it should also be noted that the company's been heavily discounting its products beneath the media radar for quite some time.

According to GMAC's recent 10K filing, at least 90 percent of the lender's 2006 GM vehicle financing involved rate buy-downs and lease subventions. That's up some 22 percent since 2005. Figure the same amount for '07, estimate the cash value at around $2k per vehicle, consider the fact that 48 percent of ALL GM's U.S. retail sales are financed by GMAC, and you can see that the automaker has been burning big bucks to maintain market share.

Scanning the large number of pickup truck and SUV sales involved, it's impossible not feel a frisson of fear. Pickups (many sold to construction companies and contractors) and large SUVs (sold to God-knows-whom) still generate the lion's share of General Motors' operating capital. The current sub-prime meltdown is hurting housing starts and refurbs AND causing a general economic slowdown. GM's cash cow is being slaughtered.

No wonder CFO Fritz Henderson declared that The General will defend its pickup truck market share "at all costs." Which is exactly the kind of statement you don't want to hear from a company with NWC.

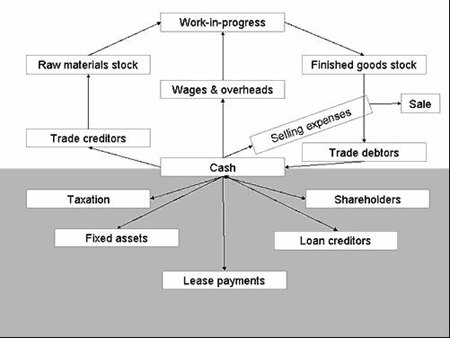

There's another, hidden danger. The NWC situation has reached the stage where GM increasingly depends on suppliers' payment terms to keep the wheels turning. Should GM's suppliers decide not to extend the corporate mothership credit, the gig is up. GM would be forced to file. But even with their suppliers' support, GM is now sailing into hurricane force headwinds.

The way out of this mess hasn't changed since Rick Wagoner first outlined his turnaround strategy and began jettisoning assets to pay for it: trim production until it matches demand. Only GM can no longer afford large production cuts. Lost in NWC world, they need all the capital (i.e. money) they can get. If GM stops making so many vehicles, the gap between income and outgo earthquakes open and they'll fall into Chapter 11.

To eliminate the NWC crisis, GM needs significant earnings from profitable vehicles and/or massive new borrowings. But the recent withdrawal of the Allison junk bond sale and Cerberus' escalated borrowing costs betray the new reality: the price of money has skyrocketed. So GM must sink or swim on the back of their products.

Clearly, the company's paddling like crazy. Truth is, Toyota could drown GM in debt simply by lowering their prices. GM couldn't afford to follow suit. At the same time, they couldn't afford NOT to follow suit.

Mind you, that's Toyota's nightmare scenario. Toyota's American profits depend on GM and Ford remaining high cost producers, setting a floor for U.S. market pricing. If GM files Chapter 11, eviscerates its bloated dealer network, consolidates its brands, builds some shit hot products and undercuts Toyota's prices, ToMoCo would have a real fight on its hands.

Sounds like a plan to me.

More by Robert Farago

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Tane94 I'd be curious to know whether 87 octane is no longer the most popular grade of gasoline by sales volume. My Costco often runs out of Premium grade and I suspect 93 octane might now be the most popular grade of gas. Paying 40-50 cents more per gallon 87 vs 93 octane because of turbo engines is the real story

- Redapple2 125 large? You re getting into 911 territory.

- Redapple2 Industry worst quality prevents any serious consideration. I ll take an Evil gm Vampire Denali first.

- MaintenanceCosts Thing mentioned in the article: 77 pounds lighter than the standard version!Thing not mentioned in the article: The "lighter" curb weight is 3902 pounds. That is a few pounds heavier than my 2011 335i *convertible*.

- Carson D Printing a trillion dollars every hundred days was not the cause of inflation.

Comments

Join the conversation

virgule wrote: "The board of directors declare bankruptcy when there is no value left to salvage for the shareholders after the creditors get their due." So why do they bother? They have a _fiduciary_ responsibility to shareholders. They are required to put the interests of shareholders above all else. *Bankruptcy Law* places shareholders below creditors, as others have noted, but this is only relevant *once bankruptcy is filed*. In other words, once they've screwed up the business so badly that they file Chapter 11, then why not simply file Chapter 7 and let the judge decide otherwise? That's not the order in which things happen, but why? As far as the fiduciary interests of the board is concerned, once the shareholders are screwed there's nothing left. Yet boards don't behave that way...consider Delphi. Should Steve Miller be sued because of his choice to file? If not, then what exactly, *other than bankruptcy law itself*, compelled him to file? After all, he publicly claimed "October" as a deadline when "October" was nothing more than the effective date of a law which made filing bankruptcy more difficult. But on either side of that deadline, shareholders were equally screwed. Tom.

"Martin Albright: August 20th, 2007 at 3:22 pm Steve Biro: Thanks for the clarification. I’m curious about what happened to owners of warranted AMC cars? of course, back in the 80’s, IIRC, most warranties were still 12 months, 12k miles, correct? So maybe it wasn’t much of an issue. Presumably those people who had bought Hornets or Javelins in 79 or 81 saw the writing on the wall." Sorry it's taken me so long to respond. You're right.. warrantys were only 12 months/12,00 miles in those days, so it wasn't a big issue. However, customers who bought AMC vehicles in the last year of the old AMC were covered by Chrysler because Chrysler assumed all of AMC's obligations.