The Big 2.5's Fleet Sales Fiasco

In 1996, the Toyota Camry was about to become America’s best-selling car. To protect the Taurus’ five year reign, Ford ramped up sales to Hertz Rental Car. The strategy worked– for a year. Despite the catastrophic effect on the Taurus’ resale value and image, despite selling off Hertz, Ford still relies on fleets to maintain economies of scale. As do the rest of The Big 2.5, who use fleet sales to mop up extra production, earn new money for old rope and blow out their sales stats. While Detroit knows fleet sales are slow motion suicide, their moves to curtail the practice are not as convincing as they could– or should– be.

That’s because the fleet market’s a double-edged sword. Again, fleet sales keep factories humming– plants whose restrictive union contracts make running them less expensive than not running them. Fleet sales also enhance cash flow and prop up quarterly numbers. On the other hand, selling hundreds of thousands of cars at or below cost throws retail residuals off a cliff, destroys the perceived value of a product and gives a false impression of how well both car and company are doing.

Over the last few years, The Big 2.5 have all admitted the truth of that equation. They’ve publicly declared their intention to wean themselves off the “easy money.” GM claims they’ve trimmed their fleets sales over the last two years, walking it down by 11.2 percent. Although Ford and DaimlerChrysler have also promised to follow the same path, they haven’t. In that same two-year window, Ford’s rental sales have increased 12.3 percent. DCX’ fleet sales have climbed by a staggering 35.3 percent. And it’s getting worse.

From September 2006 to February 2007, Chrysler (division) offloaded 48.5 percent of its total sales to the fleets, while 32.1 percent of The Dodge Boys’ sales went to the same market. And even though GM overall has cut back on fleet sales, 44.9 percent of Pontiac’s and 29.6 percent of Chevrolet’s total sales ended up in fleets. Ford (the division) off-loaded fully one-third of their total sales to the fleets, with half of that number going to rental companies.

If you deduct fleet sales, Chrysler (division) sold just 147K vehicles over the last six months– which ain’t great but sure beats Pontiac’s 96K retail units. Subtracting fleet action, Chevy’s sales drop to 742K. The math also reveals that Ford (division) placed just 676K vehicles into retail customers’ hands. With this many vehicles still flowing into the fleet market, destined to reemerge at auctions, Chrysler, Pontiac, Chevrolet and Ford will have a tough time convincing retail customers to pay full whack for vehicles facing epic depreciation.

Detroit “gets it” but can’t quite “kick it.” For example, the Pontiac G6 (GM’s fourth best selling car) is now flooding the fleet market. According to Jim Hall, AutoPacific’s VP for industry analysis, GM is trying to replace the Chevrolet Malibu’s fleet sales with the G6. The goal: resuscitate the Malibu’s residual values ahead of the refreshed model’s launch. “You don’t want a brand new model to lose money in resale."

At the same time, Chrysler’s used the fleet market to divest itself of an embarrassment of 2007 Town & Country minivans and Sebrings, and disappear that pesky sales bank that attracted so much media and stockholder attention. But the mid- to long-term effect of Chrysler’s used car tsunami cannot be avoided, either by current Chrysler owners or the corporation itself.

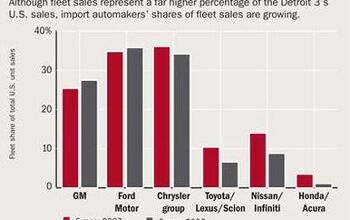

All that said, The Big 2.5 ARE, however haltingly, cutting back on fleet sales. And the imported and transplanted automakers are taking up the slack. Kia’s fleet sales are up 60 percent over last year (the Optima is proving especially popular with rental agencies). Nissan reports a 45 percent increase in its fleet sales, while Toyota’s contribution to airport rental lots and other fleet repositories is up by 30 percent.

In case you’re thinking the newbies are headed for a fleet enema to rival The Big 2.5’s, Kia promises to restrict fleets sales to 12 to 15 percent of total ‘07 sales. Nissan won’t allot more than eight percent of its overall sales to fleets, with a maximum of 10 percent of any given model’s sales destined for that end. Toyota says they’ve never sold more than nine percent of total U.S. sales to fleets, and never will.

Flexible factories are the best way to solve The Big 2.5’s production vs. demand dilemma without the cost of shutting down hugely expensive assembly lines. Yet Detroit’s maddening bureaucracy, older plants and less-than-flexible workforce make implementing that approach… problematic. This leaves The Big 2.5 in a bad place: they’re damned if they do, and damned if they don’t. To paraphrase Oscar Wilde, when it comes to fleet sales, Detroit can resist anything except temptation.

More by Frank Williams

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- MaintenanceCosts "And with ANY car, always budget for maintenance."The question is whether you have to budget a thousand bucks (or euro) a year, or a quarter of your income.

- FreedMike The NASCAR race was a dandy. That finish…

- EBFlex It’s ironic that the typical low IQ big government simps are all over this yet we’re completely silent when oil companies took massive losses during Covid. Funny how that’s fine but profits aren’t. These people have no idea how business works.

- Ajla Goldman Sachs 🥂

- Rna65689660 DVR and watch all that are aired. Has been this way for 40 years.

Comments

Join the conversation

Lokkii: Pontiac could still be the performance division yet still sell something like the G6. They just actually have to MAKE it worthy of being in the performance division. Look at Mazda. They are Ford's Free Engineering Department for almost everything worthwhile (the Fusion, Edge, Volvo S40/V50, Euro Focus, etc have massive amounts of Mazda DNA), profit center ($80M+/year consistent), and "Zoom Zoom" car division, and they have a very competitive Camcordima competitor with the Mazda6. Mazda has a compact (Mazda3), a micro minivan (Mazda5), a couple of SUVs (CX-7, CX-9) and a family car (Mazda6), yet all but bad badge-engineered Ford products (Tribute, B-series) have the Mazda ZoomZoom brand DNA. Pontiac could easily be GM's equivelent to Ford's profitable Mazda. But this would require cohesive engineering.

SuperAROD, It's interesting that you haven't checked all the facts. As Frank said, Toyota has set a hard limit on the percentage of sales that will be fleet. Toyota's fleet sales in the US will never exceed 10%. You should be more specific, as should media outlets, when mentioning exactly who is picking up the fleet sales slack. In particular, Kia and Hyundai are picking up a lot of the slack.