Chrysler Suicide Watch 10: Mopar Melodrama

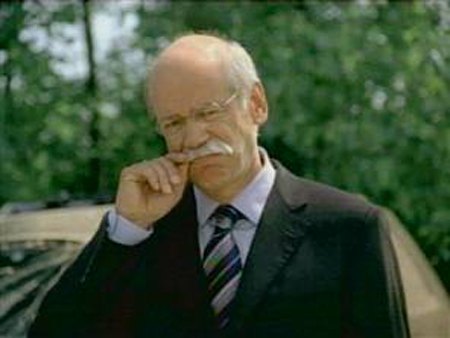

[Cue organ music] Welcome to this week’s installment of “That’s the Way the Daimler Benz!” When we last we left our hapless heroine, little Chrissie Chrysler, the not-so-sprightly maiden was tied to the railroad tracks. The fiendish Dr Z stood nearby, twirling his mustache, laughing maniacally as he mentally explored the options for disposing of Chrissie’s family farm. Will this be the end of our plucky paladin? Or will a courageous cowboy arrive to save Chrissie in the nick of time? Join us as we anxiously await little Chrissie’s final fate. [Fade organ music]

The latest episode of the Chrysler “restructuring” melodrama brings us news that Canada’s Magna Corporation and “a private equity partner” have made a $4.6b offer to buy Chrysler from DaimlerChrysler. Magna’s equity partner remains under wraps, but every indication (i.e. common sense) points to The Blackstone Group LP.

On Thursday, this enormous private equity firm announced an IPO aimed at raising up to $4b. Blackstone is one of three major equity firms (including Cerberus Capital Management and Centerbridge Partners) that’s expressed interest in buying the Chrysler Group from its German owners.

The “who” of this first offer may remain [slightly] mysterious, but the timing of the play wasn’t. Earlier this week Chrysler General Manager Tom LaSorda told a gathering of Chrysler dealers that an announcement about his employer’s future would be made “soon.” At the same time, Tommy Boy sent an email to every Chrysler employee urging them to “focus on the urgent job at hand–to develop, build and sell great products and establish the foundation for a long and prosperous future.”

Industry analysts and traders knew something was afoot. DCX stock had risen as much as six percent on speculation that a deal is pending. As Howard Wheeldon, the automaker specialist at BCG Partners in London stated, "I would suggest there is some form of approach that has been made for Chrysler that is springing the shares to life." Well duh.

Ah, but will DaimlerChrysler go through with a sale? Some analysts have suggested the DCX is dangling Chrysler like so much bait to drive their stock up and bully the United Auto Workers into some major concessions. Others just want them to hurry up and get on with it.

Argus Research Corp. auto analyst Kevin Tynan states "I don't think Daimler-Benz is looking to dump Chrysler on the first company that waves a buck at them. But I think it would be in their best interest to let it go."

According to Citigroup analyst Jon Rogers, a private equity company is the most logical buyer. But Rogers isn’t ready to rule out General Motors. Like former GM board member Jerry York, Rogers thinks the UAW is the linchpin. The union would be more open to offering concessions to GM than a financial buyer flush with cash.

Even though GM has publicly stated they’re not interested in owning Chrysler, Rogers reports GM could easily borrow up to $18b toward restructuring Chrysler. A zero equity transfer to GM would create $9 billion in value– and the mother of all Detroit Death Watches.

Whoever ends up with Chrysler faces not one but two 900 pound gorillas in the proverbial room: the UAW and legacy costs. Back to former Chrysler CFO and ex-GM’er Jerry York: “I wouldn't even think about [buying Chrysler] unless I could form a true partnering relationship with the UAW.”

Partner schmartner. UAW President Ron Gettelfinger has stated his union’s first priority in all of this Chrysler kerfuffle: stopping any sale. Although Big Ron says priorities two and three are encouraging a sale to an existing automaker or an equity firm, Chrysler’s new owner or owners will have to deal with the aftermath of what the unions would view as a hostile takeover.

Without concessions, the new boss’ revitalization plans would be stymied by Chrysler’s staggering pensions and healthcare costs. Goldman Sachs estimates that Chrysler’s next gen masters would inherit $16.5b in pension and healthcare liabilities.

In fact, DCX may not be looking to benefit from the sale of Chrysler– other than divesting themselves of these obligations. University of Maryland business professor Peter Morici can’t see anyone paying much for Chrysler. "The reality is that unless there are structural changes in the labor agreement, Chrysler Corp. is worth less than zero."

[Cue organ music] What does all this mean for our luckless lass, little Chrissie Chrysler? Sadly, she remains lashed to the railroad tracks, contemplating her fate. It seems that the rescuing cowboys are busy drawing straws, trying to decide who should have the honor of rescuing her from the evil Dr. Z., or whether if it’s even worth the effort. Join us again next week and watch one of her well-heeled saviors swing into action– or not! [Swell organ music then fade]

More by Frank Williams

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Kwik_Shift_Pro4X No thanks. You'll never convince me that anybody needs this.

- Kwik_Shift_Pro4X I'd rather do the driving.

- SCE to AUX EVs are a financial gamble for any mfr, but half-hearted commitment will guarantee losses.BTW, if there were actual, imminent government EV mandates, no mfr could make a statement about "listening to their customers".

- Zachary How much is the 1984 oldmobile (281)8613817

- Yuda Very dystopian. Not good.

Comments

Join the conversation

"big bad corps.crushing little people is where unions got thier start. If and thats a big if,the 2.5 fall apart the unions will be there to help pick up the pieces." Really Mikey? Is that what happened in the steel industry and airline industry?

In a risk adverse environment, it's impossible for these executives to conceive of every variable and make a wise decision. It's likely that the risks involved in the transfer of ownership of Chrysler Corp are so high, that it's just as well to stick it out. The Brand story is the variable here that is unpredictable. It’s safe to say that the value of Chrysler is it’s Brands. Chrysler Group makes money two ways: Trucks and Minivans. Understanding that makes the Brand choice clear. I predict that the key brand Jeep will be parceled away to GM, or Ford while Daimler keeps Dodge for their trucks and phases out Chrysler Brand in a buyout. If the UAW concedes to the 16.9b pension and medical defecit then it’s possible to imagine even Dodge would be put on the chopping block. But Dodge/Mopar, and it's history in Nascar makes a case for keeping it. Why not Pepsi or Philip Morris? What marketing executive wouldn't give his eye teeth to have a product base which sole purpose was for marketing and advertising their other products? There’s money to be made here Pepsi and Nike…think big picture. Jeep's brand identity recognition is second only to Mercedes, but not much marketing potential there. Jeep is what Jeep is, and always will be. GM may offer to buy Jeep, but only to strengthen Hummer. Jeep is actually a very good option for a Chinese or Asian market, simply because of the emerging Chinese FME thing. Several knock-offs already sell mass quantities of fake Wranglers, who’s to say what the potential for Jeep Brand is in the 3rd world… And Chrysler Brand profits (or seemingly lack therof) are essentially the result of two vehicles, the 300 and the Minivan. GM or Ford would pay top dollar to eliminate the competition in those markets. The 300 is a clever interpretation of the Mercedes E-Class for Americana. But the RWD luxury sedan market is quickly being saturated with top contenders. How long before 300 gets swallowed up by foreign brands that offer more for less? Also Chrysler "invented the minivan" but Honda perfected it. If Chrysler minivans went extinct, Honda would take that market over in minutes. In summary, there is amazing Brand strength in the Chrysler portfolio. It’s worth a lot of money to the right buyer. Leaving the UAW debacle out of the scenario, strong cases can be made for parceling the group away.