General Motors Death Watch 96: Half Empty

Yesterday, a Yahoo news bulletin popped up: “GM’s losses narrow.” If that’s the way you see it, please don’t tarry here. You know GM CEO Rabid Rick Wagoner’s turnaround plan is “gaining traction.” You know GM’s too big to fail, that the supertanker will change course and avoid the jagged rocks of bankruptcy. The fact that GM’s fundamentals are still broken— too many brands, models and dealers; excessive bureaucracy and crushing union obligations— is not your concern. For those of you willing to stare into the abyss, let’s take a closer look at those third quarter results.

First, GM’s cash flow is still negative. GM NA dropped $367m for the quarter. That might not seem like much compared to last year’s $1.67b hit, but it’s not chicken feed— especially considering its origins. As the official press release joyfully proclaims “This significant progress largely reflects improvements in structural costs, as the company executes the pension, health care and manufacturing cost reduction initiatives related to its North American turnaround plan.” In other words, GM has reduced its costs and it’s still taking in less money than it spends. Even worse, there ain’t much more GM can cut.

No wonder Rabid Rick Wagoner was talking up the chances of the new Chevrolet Silverado/GMC Sierra pickups and the Saturn Outlook/GMC Acadia crossovers. While these vehicles offer the prospect of higher profits, their market segments are heating up, driving margins down. And they only represent a fraction of GM’s lineup across its eight US brands. The fact that GM’s margins are being squeezed across the board is a far more important financial factor than the Silverado/Outlook’s potential success. With over a million unsold units on the ground, the pressure to slash prices will grow, reducing margins yet further, and continuing GM’s reputation as the K-Mart of cars.

And there's your fundamental problem: GM is not a price leader. It’s still a high cost producer selling products at a discount. Public demand for its retail products just isn’t strong enough for it to charge prices equal to Honda/Toyota/Nissan. Bottom line: GM makes little to no margin overall on its North American auto business. Not to put too fine a point on it, it’s unclear whether GM can ever make a profit in North America again.

As always, market share is key, and the signs are on the disastrous side of bad. Despite public pledges to reduce bulk sales, nearly 25% of GM's sales still go to fleets. Pull those sales out of the equation and GM's market share at the retail level is only about 19%, spread over eight brands. Take out employee/vendor pricing deals, and the true retail demand for GM products is less than Toyota’s.

Now consider this: GM's third-quarter North American market share slipped a percentage point compared to a year earlier. In light of Ford and DCX' falling market shares, GM’s highly-trumpeted “market share stabilization” actually means it’s losing ground to the so-called imports. That ain’t good. Conquesting sales from Ford and Chrysler is hard enough. Taking on the non-union guys over at Honda, Nissan and Toyota will be just about as hard as it sounds— if not harder.

GM’s balance sheet may not show this sort of mission critical information, but there’s plenty else to set off warning bells (for those who aren’t deaf to the dangers). What are we to make of the fact that GM drew on its secured line of credit in Q3, and then repaid the money? We’ve been saying for quite some time that GM’s wandering on the edges of a liquidity crisis. The sale of half of the GMAC finance unit grows more important by the day— especially considering the rapidly deteriorating asset quality of their mortgage/auto receivables. Are the loan loss reserves adequate? If not, bad things are bound to happen.

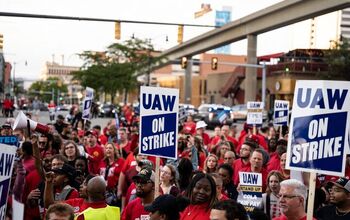

There are other "hidden" shoals, such as the psychological impact of federal changes in the rules regarding corporate accounting for pensions and other post-employment benefits. When they kick-in in ‘07, GM will have no stockholder equity. None. While the development won’t have any cash impact, the the development will bring to light the magnitude of the liabilities facing Generous Motors. It’s a huge negative, despite being downplayed by GM’s management. And if that isn't enough to convince GM execs to break out the Prozac, UAW negotiations are set to begin…

In short, GM’s future is far from secure. Wagoner’s highly touted “turnaround” is based on the idea that GM can return to profit without changing its business basics (downsizing does not equal change). It won’t because it can’t. It no longer has the time or the money to do so. But more than that, its management doesn’t have the will. The man who does— investor Kirk Kerkorian— knows that he’d have to destroy GM to save it. If he lives long enough, one way or another, it will come to pass.

More by Robert Farago

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Ajla But no ES500h at this time? 🤔 I'd be a little surprised if they bothered to make a trim with the 2.4T or any other ICE-only version. I'm thinking a 250hp AWD hybrid will be the "ES350h". Then whatever these "e" versions are and then maybe something with the Hybridmax.

- Jeff Not so much of a Malibu fan but this is a missed opportunity by GM to make the Malibu a hybrid only and sell it at a more competitive price. This would make a perfect fleet rental car with a hybrid and priced right it would be popular with many buyers who don't want a truck, suv, or crossover but want an American made car. The tooling and dies have long been paid off just offer the hybrid and make the interior a little nicer.

- SCE to AUX This makes the Pontiac Aztek look beautiful.

- Jeff If we are worried about the Chinese spying on us and gathering information then we need to make certain specifications on vehicles imported from China that would lessen any concerns about this. I don't see how we could eliminate all information gathering especially if that vehicle has connectivity to your phone.

- ToolGuy Oh look what's this?

Comments

Join the conversation

Tragically and sadly, the legacy liabilities are crushing Detroit. It's simply unavoidable to have to deal with those one way or another. If GM goes Chapter 11, those liabilities will end up in the government's lap anyway. So why not negotiate some sort of solution between the government, GM, UAW and the retirees?

There is this vacant dealership in town. Now there are about 50-75 '07 model GM trucks in there. You know those stories of how in certain areas, the manufactures store large amounts of their vehicles? Why don't they instead of making the dealerships pay up front, give them all the vehicles they want on consignment? That way they won't have to store them. "Hey, you want 300 vehicles?"