#lenders

Ford Repurchasing $5 Billion in Debt, Tapping Into ESG & Green Bonds

Ford Motor Co. has announced a cash tender offer to repurchase up to $5 billion of the company’s high-yield debt in the hopes of rebalancing its budget after needing to borrow so much during the back-to-back-to-back production shutdowns incurred since the start of 2020. The automaker is retiring as much of the $8 billion in bonds the company issued at the start the coronavirus pandemic as it can and will be doing the same for some older bonds issued at similarly high rates (over 8 percent annually).

However this will be used to make room for environmental, social and corporate governance (ESG) initiatives and establish a “sustainable financing framework” the automaker said would be a first for North America. Ford clearly believes social governance investments will become increasingly routine and is attempting to showcase itself as one of the kinder, more forward thinking, and environmentally responsible multinational industrial concerns. Sort of like a fully armed M1 Abrams tank painted with peace symbols and hippie daises.

Bark's Bites: Regulators, Mount Up!

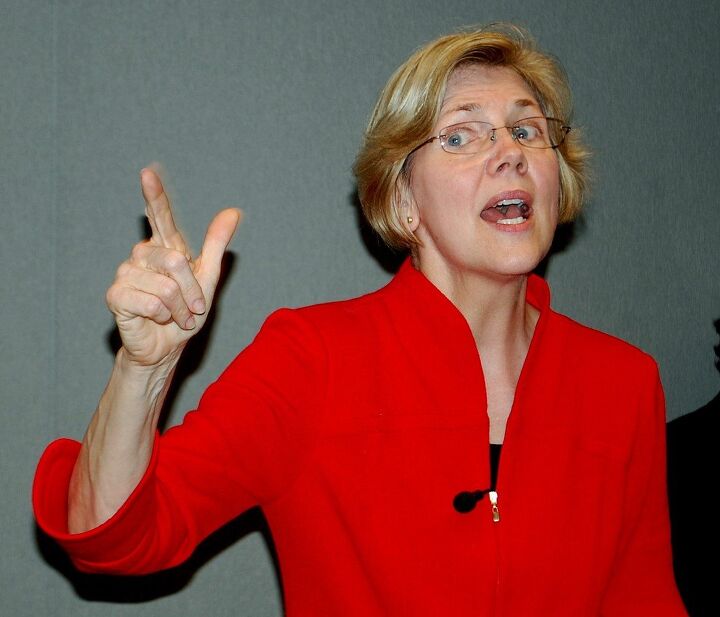

It pains me greatly, dear readers, to say what I’m about to say. Those of you who regularly follow my writing know how I lean when it comes to politics. However, given the current state of the auto dealership world, I have no choice. I gotta admit it — I agree with Elizabeth Warren on something.

Good ol’ P…er, Senator Warren and I both agree that there needs to be more oversight of the automotive lending business. Part of my day job is to educate new automotive advertising sales representatives about the car sales industry, and when I get to the part of the day where I tell them about how the Finance and Insurance office works, I always give them the following warning:

“Guys, if you don’t know about how car loans work, you’re about to get very, very angry.”

So I’ll give you the same warning, friends. I’m going to share about the predatory lending practices that go on behind the scenes, and I’ll tell you what I think should be done to stop it.

The Industry Might Be Facing Disaster, But at Least Used Car Prices Are Down

The auto industry has really turned a corner over the last decade, but this year has been underlined by an unsettling lack of interest in new vehicles — potentially hinting at the return of a industry-wide crisis. The good news is that abnormally high used car prices are sinking like a stone. The flip-side of that coin, however, means that we could be approaching darker days as more consumers shy away from the new vehicle market.

Most carmakers spent last year enjoying record sales but seemed keenly aware that the market was about to plateau. However, 2017 sales have stagnated more than predicted, with rising interest rates and deflated prices seen on second-hand automobiles. It all looks very pre-recessionish and some analysts are beginning to make fearful noises.

Recent Comments