#StateFarm

Your Quick Lube Place Is Probably Snitching on You to Your Insurance Company

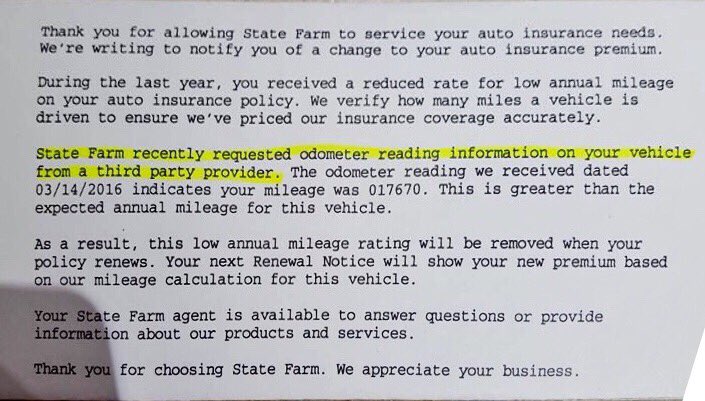

Ever wonder exactly how the various “quick-lube” places in your city made a profit?

The price of motor oil rises and falls — mostly rises — but the pricing stays at $19.95 or $24.95 or whatever your local market will bear. As fate would have it, most of my vehicles aren’t compatible with the quick-lube business model of having some sweaty dude waving your air filter in your face and telling you that it has the Zika virus while an actual rhesus monkey cross-threads your drain plug using an impact gun. My 993, as an example, has two oil filters, while my Boxster requires a 32-step process to get to the air filters. Nor would I trust my mighty Accord V6 to somebody whose path in life hasn’t qualified them to work above ground.

Not all of us have the luxury of doing our own oil changes at home, however. You might not have the space, the tools, the ability, or the time that’s required to do it correctly yourself. That last factor is perhaps the biggest. If you’re working two McJobs to make ends meet, the Valvoline Oil Change down the street might be your only practical choice. The good news: it’s cheap. The bad news: some of that cost savings comes from another way the shop makes money on you, without you even knowing.

Want Cheaper Car Insurance? Pay Your Electric Bill on Time

Automotive insurers use more than just your driving history to set your rates, the New York Times is reporting.

Factors such as your credit score, address and marital status can increasingly affect premiums more than driving history, the story explains.

A survey of the nation’s largest insurers — Geico, State Farm, Nationwide, Liberty Mutual and Farmers — found that a hypothetical woman in her 30s paid more if she was widowed, instead of married, at four of the five firms. The premium increases ranged from 3 percent to 29 percent. Only State Farm charged the woman the same, regardless of marital status.

Just Like A Good Neighbor: State Farm Joins Toyota Shake-Down

More and more Americans have recently detected that they have a rich uncle in Japan. The uncle’s name is Toyota. From LaHood to a bevy of lawyers, all have a yen for Toyota’s money. Latest (but surely not last) to join the fray: State Farm. You know, that same insurance company that had disclosed all those claims to NHTSA and never received an answer. They went public with the story a few days before the congressional hearings. Now we know why: Like a good neighbor, State Farms wants its money back.

“Armed with reports of accidents for which they’ve already paid claims, State Farm insurance has asked Toyota to repay them for any crashes related to unintended acceleration by its vehicles,” reports USA Today. The request for a little Farm Aid is just the beginning.

Other insurance companies are expected to – make that will follow and ask for money. In the trade, this is called “subrogation.” No, it’s not a kinky sex practice.

Toyota: New State Farm Disclosures Trigger Accusations Of Lackadaisical NHTSA

Akio Toyoda is spending the weekend in Japan, being prepped for his appearance in front of the modern day version of the tribunal of the Spanish Inquisition, better known as a Congressional Hearing.

According to Reuters, and as suggested by TTAC, Toyoda “is likely to undergo intense preparation. Toyota may hire lawyers to drill him with mock questions, one consultant said. A company source said it had not yet been decided whether Toyoda would speak in Japanese or English, but the company has already contacted some translation companies.”

The weekend drill was interrupted by the news that State Farm had informed the NHTSA as early as February 27, 2004, that the insurance company had five claims of unwanted acceleration in the 2002 Lexus ES 300 during the previous 12 months. Reuters broke the story, writing “the insurer said earlier this month it had contacted the National Highway Traffic Safety Administration in late 2007. However, prompted by the public interest in Toyota, the insurer reviewed its records again and has now found that it contacted safety regulators initially in 2004.” All hell broke loose …

Recent Comments