#SAIC

SAIC Goes Hybrid

Chinese automaker SAIC has concluded its deal to assume control over its joint venture with GM [via the WSJ [sub]], and to keep its momentum going, it will be releasing its first hybrid vehicle this year. Reuters reports that the Roewe 750 Hybrid will be released this year, making SAIC the second Chinese firm to offer a hybrid drivetrain after BYD. SAIC may even deliver …

China's Booming Car Market Takes Its Toll: SAIC Profits Up 900%

When you are a Chinese car company, especially one that is mostly government owned, reporting profits is not one of your prime objectives. As long as you don’t lose money hand over fist, as long as you provide jobs for many people, as long as you grow in market share and influence, having money left over is sometimes just a (taxable) nuisance. But in times like these, it’s unavoidable. And it doesn’t hurt your stock when you are a publicly traded company. Shanghai Automotive Industry Corporation, better known as SAIC, has announced that their net profit for 2009 jumped 900 percent from the previous year, reaching a record of nearly $1b ($966m, to be exact.)

What's Wrong With This Picture: Speaking Of Downsizing… Edition

Japan’s Mag-X [via Autoten] brings us this rendering of a Toyota low-cost car, said to be planned for a 2012 launch in India’s hot-hot entry-level car market. Expected to weigh about 1,322 lbs, Toyota’s Tata Nano-fighter is said to have an 800cc two-cylinder engine mounted out back (alá Nano).

As Google Evacuates China, SAIC Launches Google Android Powered Car

GM Officially Out Of Control In China

Everybody who’s ever worked in China knows that some things take some time. Nothing that is announced today, happens tomorrow. There are applications to be made, documents to be “chopped.” Sometimes, this process takes forever, as it seems to be the case with Hummer. Sometimes, things move a bit faster. Last December, we reported that GM would sell a crucial one percent of the 50:50 holdings of GM China to their joint venture partner SAIC to bring the shareholdings to 51 percent SAIC, 49 percent GM.

As China’s new year (that of the tiger) came around, China’s biggest automaker SAIC Motor Corp has won regulatory approval to acquire the crucial 1 percent stake in Shanghai GM, Shanghai Daily reports today via Gasgoo. The matter has been officially filed to the Shanghai Stock Exchange yesterday. It’s official now. General Motors officially has been relegated to minority shareholder in its key venture in the world’s largest auto market. SAIC is now calling the shots.

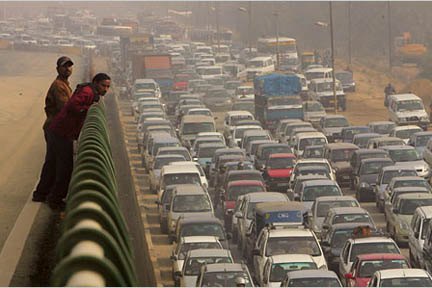

In The Midst Of An Auto Goldrush, Is India Headed For Overcapacity?

Optimism is a rare commodity in the auto industry these days, and nearly all of it comes from the so-called BRIC nations of Brazil, India, China and (to a lesser extent) Russia. India in particular is being targeted as one of the few growth opportunities for the industry’s global players. Nissan/Renault, Volkswagen, Honda, Ford and GM have all recently announced major initiatives to target growth in India’s entry-level market, and GM even gave up control of its Chinese operations in order to beef up its Indian presence. But, as the Hindu Business Line reports, India could be staring down the kind of overcapacity that is causing so many headaches for automakers in mature markets.

Saab's Crown Jewels To Be Carted Off To China

Bloomberg read it in Sweden’s Dagens Industri that General Motors will send the tools for Saab’s new 9-5 model to China. Mind you, these are not the old 9-5 tools sold to BAIC. These are the tools for the new Epsilon 2 based 9-5, or what Dagens Industri calls “the crown jewels of Saab.”

Another Chinese Rumor: Tengzhong And SAIC (Won't) Cooperate On Hummer

And the Hummer mess is marching on: Both Tengzhong and SAIC deny reports in the Chinese press that they are planning to cooperate in the production of the Hummer SUV in China. A lot of sense it would make:

GM's Sell-Out To China Continues

When news came out that GM would sell a critical 1 percent of their Chinese joint venture to SAIC (now owner of a 51 percent majority,) and that GM would sell half of their Indian operation to SAIC, rumors swirled that GM would sell-out their future in the world’s only remaining growth markets to raise cash for Opel. It doesn’t seem that way. GM is mortgaging their future at the pawn shop for pocket change. A whacko report even claims that GM is already under Chinese control …

Shunned Volt Battery Maker Joins Forces With China

After a two year neck-and-neck race between battery makers LG Chem and A123, GM awarded its Volt contract to Lucky Goldstar – make that LG Chem, or rather their subsidiary Compact Power: Now the Lucky Guys are waiting for the thing to hit the road in large quantities. A123 was widely regarded as the far better technology, the Koreans most likely were cheaper – we’ll most likely never know.

Now, A123 cut a possibly much bigger and more lucrative deal. A123 is forming a joint venture with China’s top carmaker SAIC to build and sell battery systems for electric vehicles in the world’s largest auto market, and possibly beyond.

Whitacre: GM-SAIC Deal Was Henderson's Idea

Yet Another NanoSwatter. By GM And SAIC

Let’s get small: The new 50:50 joint venture between China’s SAIC and GM may plan to launch an entry-level low-cost car for the Indian market, say’s India’s Wheels Unplugged.

Maruti Suzuki Gears Up For Indian Turf Battle

In my editorial on GM’s plant to take on the Indian market in partnership with SAIC, I wrote that Maruti Suzuki’s monstrous market share indicated the possibilities for GM. Well, the Indian market leader isn’t going to just sit on that lead. In 2007, Osamu Suzuki said that his firm’s Indian passenger car market share would never drop below 50 percent, an assertion that took two years to prove untrue. The WSJ reports that although the overall Indian market will probably grow 16 percent this year, Maruti’s share of that market has fallen over the last year from 45 percent to about 40 percent (with passenger car share down from 55 percent to 48 percent).

GM Zombie Watch 22: International House Of Panic

News that GM is selling a control-shifting single share in GM Shanghai to its Chinese partner SAIC was the toads-from-heaven flourish at the end of an epic week for the RenCen. The day after the last of GM’s lifer CEOs left the building, Opel’s CFO followed suit. One management re-organization and a rough LA Auto Show later, came this symbolic surrender of GM’s largest market for a measly $85m. Accompanied by news that The General would buy out Suzuki’s stake in CAMI for an estimated $46.5m, no less. Oh yeah, and something about India. Freshly-minted CEO and notorious rattlesnake killer Ed Whitacre isn’t about be accused of not trying to shake things up. The only question is where will everything land?

One Percent Of GM China Worth $85m

Fresh details on GM’s Asian wranglings are coming in, and it seems that SAIC paid The General a mere $85m for the one percent needed to control the joint venture. GM’s Nick Reilly tells the New York Times:

the 51 percent stake would give S.A.I.C. the right to approve the venture’s budget, future plans and senior management. But the venture has a cooperative spirit in which S.A.I.C. has already been able to do so… S.A.I.C. wanted to have a majority stake to consolidate the venture in its financial reporting

Which is about as credible as the conclusion that the Shanghai and India deals are going to provide GM International with a meaningful amount of cash with which to rescue its European and Korean divisions. As it turns out, the Indian deal isn’t going to translate into free cash for GM. GM and SAIC will set up a joint Hong Kong-based investment company, which GM will give its Indian operations and SAIC will fund with $300-$530m, bringing its overall value to $650m.

Recent Comments