#DealerFinance

Obama: Dealer Finance Must Be Regulated

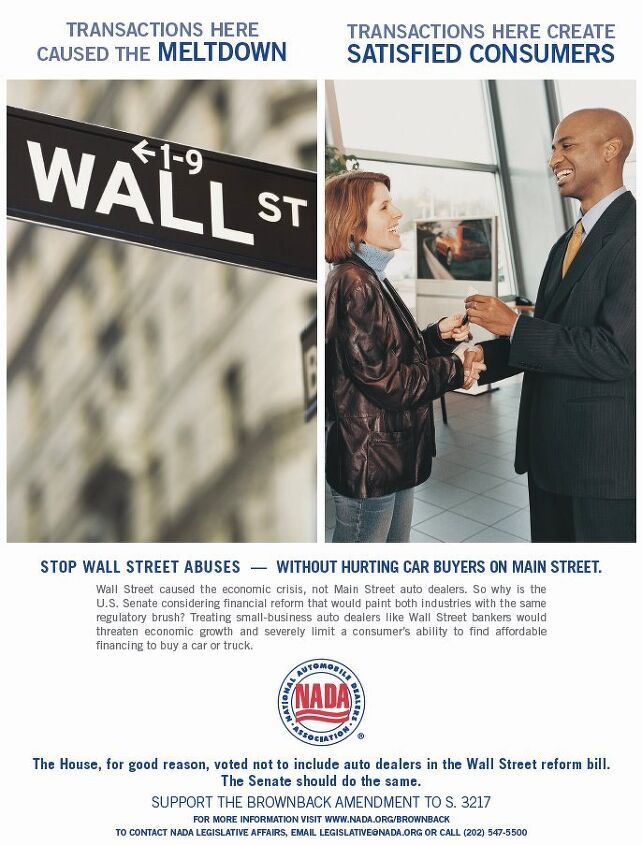

President Obama has weighed in on a crucial matter facing legislators attempting to overhaul America’s financial system: whether or not auto dealer finance should be subject to regulation by the new Consumer Protection Agency. Unsurprisingly, he has come down on the side of regulation, specifically echoing concerns voiced earlier by the Pentagon. The National Automobile Dealers Association has vowed to fight attempts to regulate dealer finance.

Statement by President Obama on Financial Reform

Throughout the debate on Wall Street reform, I have urged members of the Senate to fight the efforts of special interests and their lobbyists to weaken consumer protections. An amendment that the Senate will soon consider would do exactly that, undermining strong consumer protections with a special loophole for auto dealer-lenders. This amendment would carve out a special exemption for these lenders that would allow them to inflate rates, insert hidden fees into the fine print of paperwork, and include expensive add-ons that catch purchasers by surprise. This amendment guts provisions that empower consumers with clear information that allows them to make the financial decisions that work best for them and simply encourages misleading sales tactics that hurt American consumers. Unfortunately, countless families – particularly military families – have been the target of these deceptive practices.

Pentagon Backs Dealer Finance Regulation,

Funny or Die’s Presidential Reunion from Will Ferrell

Remember when we reported that the cash cow known as in-house dealer finance wouldn’t be covered by the Consumer Financial Protection Act, currently making its way through congressional committees? That version of the bill passed the House Financial Services Committee (with some questionable support), but now Automotive News [sub] reports that the Senate Banking Committee has passed its own version which does make dealer finance subject to regulation by the Consumer Financial Protection Bureau. The Senate version would also make the CFPB an office of the Federal Reserve, rather than a stand-alone agency. So, should an agency set up to prevent another financial crisis extend regulation to dealer finance operations? Dealers aren’t happy about the idea, but traditional consumer advocates aren’t the only ones saying yes…

Recent Comments