#CaptiveFinance

Right On the Money: Stellantis Acquires Auto Finance Company

A captive lending arm can be a major source of profit for automakers. After all, keeping that paper in-house instead of farming it out to a third party permits some of that sweet interest-driven revenue rolling on a monthly recurring basis. Why else did most of us, for many years during GMAC’s heyday, refer to General Motors as a finance company which just happened to sell cars?

Following several years of shacking up with Santander in order to offer financing for their customers, Stellantis has bought F1 Holdings Corp., an outfit that is the parent of Texas-based First Investors Financial Services Group. Now they’ve spent $285 million in this all-cash transaction, Stellantis is no longer the only major automaker in America without a captive finance arm.

Used Car Prices Take a Dive, Spelling More Worry for Anxious OEMs

At this point, only two things in our present reality bear any similarity to what took place in the Great Before: average new car transaction prices are shooting for the Van Allen Belt, and pickups sell like hotcakes. The relationship between 1 and 2 can’t be downplayed.

Everything else has been turned upside down by the coronavirus pandemic and the resulting plunge in sales spurred by both fear and state lockdown measures. Domestic market share is up, zero-interest loans are proliferating, and used vehicle prices are falling through the floor.

That latter issue could spell big losses for manufacturers whose main business is selling new vehicles.

QOTD: What Was The Worst Beating You Ever Took?

Yesterday I talked about the worst kind of subprime lenders and how they misused the courts to collect their profits. There was a broad spectrum of reader response, including a few people who felt compelled to discuss the fact that Hillary Clinton won the popular vote and therefore won the presidency. (To which I can only respond: that’s like awarding the Super Bowl win to the team with the most rushing yards.)

Here’s what we didn’t discuss: our own experiences with subprime loans and/or bad car deals. I suspect that there are some members of the B&B who have never so much as walked by a subprime lender; I also suspect that there are plenty of readers who are currently in a subprime situation right now but don’t want to admit it.

So for today, let’s consider two topics: a) What’s the worst car deal you ever made? and b) did you ever use a subprime source? I’ll start, of course.

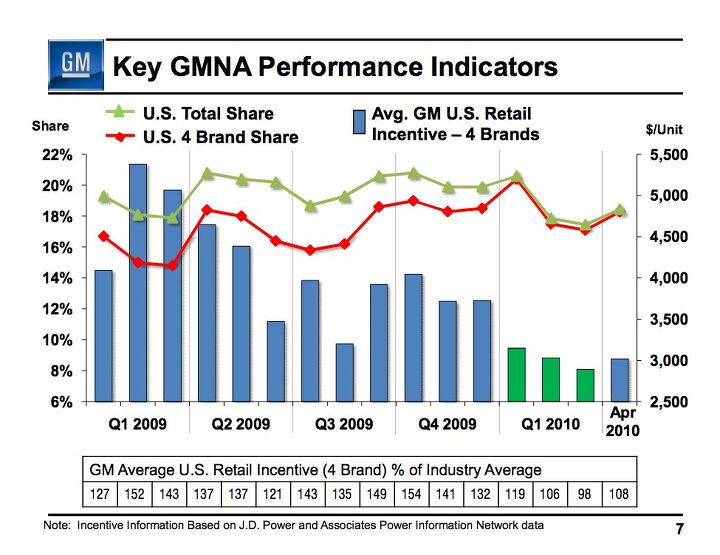

What's Wrong With This Picture: Follow The Incentives Edition

Sadly, my internet came crashing around my ears just as GM’s Q1 results conference call was getting interesting. Typical Monday. I’ll rock myself to sleep tonight with a recording of the call and report back tomorrow, but at this point the big news is plainly visible on this single slide. Yes, GM finally got control of its incentives and wrestled them below the industry average… for a month. That month (March) also just happened to be the worst month this year for GM market-share wise. The next month (April), the incentives went back over the industry average, and market share increased once again. The lesson seems obvious: GM won’t gain market share on promises of high-quality cars and taxpayer payback alone.

GM And Chrysler Racing Towards Captive Finance?

News that GM is considering a number of options for a return to captive finance, has lit a fire under Chrysler CEO Sergio Marchionne, who tells the Detroit News that

One of the things that we do not wish under any circumstance is to have an uncompetitive relationship vis-À-vis GM

That would certainly be the case if GM bought up its recently-bailed-out former captive finance arm, GMAC (now known as Ally Financial). Chrysler relies on GMAC for leasing and loans just as much as GM does at the moment, so an Ally buyout would create major long-term problems. But even if GM created a new finance arm, Chrysler doesn’t seem to think that it will be able to survive without forming its own in-house finance department. Which would then compete with GM and Ally, to say nothing of the industry’s other finance competitors. But is the rush to captive finance going to be good for anyone?

Recent Comments