Gas Tax Hike Could Kill New Jersey's Famously Low Pump Prices

A looming bump in New Jersey’s gas tax would mean fewer drivers from neighboring states crossing the Hudson and Delaware Rivers to take advantage of the state’s famously low pump prices.

The state’s transportation fund is almost empty, roads and bridges need repairs, and Democrat lawmakers and select Republicans are putting pressure on Governor Chris Christie to send the gas tax skyward, according to the New York Times.

How much higher? Try 23 cents/gallon more.

New Jersey residents now enjoy the second-lowest gas tax in the nation, at 14.5 cents/gallon. (That includes a 10.4-cent motor fuels tax and a 4-cent petroleum products tax.)

State Democrats want to raise the tax to 37.5 cents per gallon, citing a $46 million budget shortfall at New Jersey Transit and the poor condition of the state’s infrastructure. The American Society of Civil Engineers gave New Jersey’s transportation infrastructure a D-minus grade in its 2016 report.

A gas tax hike would allow the state to raise $20 billion in funds over the next decade. Christie kiboshed past attempts to raise the tax, but cracks are forming in the Governor’s resolve. The Democrats propose to repeal the state’s estate tax as a way of luring the other side into agreement.

“There is a lot of work that needs to be done,” Mr. Christie said in the Times. “There is a lot of show-me that has to be done. But as you know, at the end of any session, miracles happen.”

According to GasBuddy.com, New Jersey’s lowest pump price this morning was $1.87/gallon, found at several North Brunswick Township stations. The state average of $2.11 undercuts the national average of $2.32/gallon. Compared to its neighbors, New Jersey drivers are laughing. New York’s average price this morning is $2.43, and Pennsylvania’s is $2.50.

The state’s transportation department would still receive federal funding if the fund runs out, but state-financed projects won’t get off the ground.

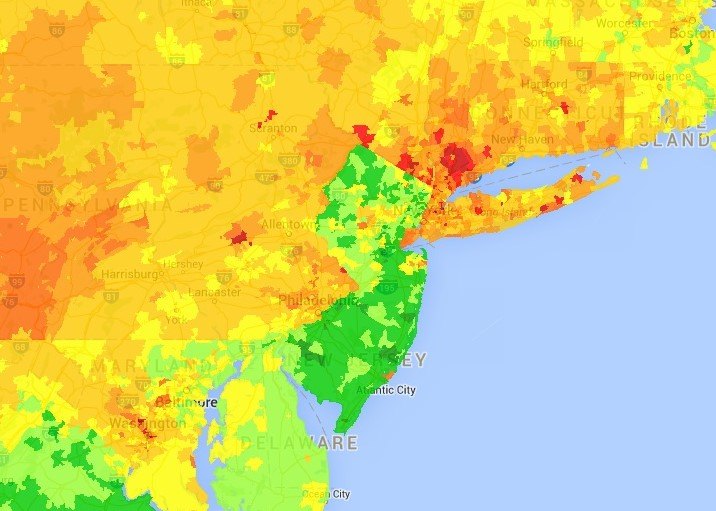

[Image: GasBuddy.com]

More by Steph Willems

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Teddyc73 Oh look dull grey with black wheels. How original.

- Teddyc73 "Matte paint looks good on this car." No it doesn't. It doesn't look good on any car. From the Nissan Versa I rented all the up to this monstrosity. This paint trend needs to die before out roads are awash with grey vehicles with black wheels. Why are people such lemmings lacking in individuality? Come on people, embrace color.

- Flashindapan Will I miss the Malibu, no. Will I miss one less midsize sedan that’s comfortable, reliable and reasonably priced, yes.

- Theflyersfan I used to love the 7-series. One of those aspirational luxury cars. And then I parked right next to one of the new ones just over the weekend. And that love went away. Honestly, if this is what the Chinese market thinks is luxury, let them have it. Because, and I'll be reserved here, this is one butt-ugly, mutha f'n, unholy trainwreck of a design. There has to be an excellent car under all of the grotesque and overdone bodywork. What were they thinking? Luxury is a feeling. It's the soft leather seats. It's the solid door thunk. It's groundbreaking engineering (that hopefully holds up.) It's a presence that oozes "I have arrived," not screaming "LOOK AT ME EVERYONE!!!" The latter is the yahoo who just won $1,000,000 off of a scratch-off and blows it on extra chrome and a dozen light bars on a new F150. It isn't six feet of screens, a dozen suspension settings that don't feel right, and no steering feel. It also isn't a design that is going to be so dated looking in five years that no one is going to want to touch it. Didn't BMW learn anything from the Bangle-butt backlash of 2002?

- Theflyersfan Honda, Toyota, Nissan, Hyundai, and Kia still don't seem to have a problem moving sedans off of the lot. I also see more than a few new 3-series, C-classes and A4s as well showing the Germans can sell the expensive ones. Sales might be down compared to 10-15 years ago, but hundreds of thousands of sales in the US alone isn't anything to sneeze at. What we've had is the thinning of the herd. The crap sedans have exited stage left. And GM has let the Malibu sit and rot on the vine for so long that this was bound to happen. And it bears repeating - auto trends go in cycles. Many times the cars purchased by the next generation aren't the ones their parents and grandparents bought. Who's to say that in 10 years, CUVs are going to be seen at that generation's minivans and no one wants to touch them? The Japanese and Koreans will welcome those buyers back to their full lineups while GM, Ford, and whatever remains of what was Chrysler/Dodge will be back in front of Congress pleading poverty.

Comments

Join the conversation

If they raise the gas tax three cents the first month, then a penny per month over two years, no one would even notice. The law has to be written with a poison pill: a stipulation that if any of it gets diverted to anything other than its originally intended purpose, then it gets immediately revoked, and gas prices will immediately fall to pre-tax levels.

Almost no one crosses the rivers just to get gas and save a few cents at the pump, because all the major crossings are tolls (and don't bring up Scudders Falls, it's free today but will be tolled as soon as the rebuild is complete). Yeah, if you'll be in NJ for some reason anyway you may fill up your tank, but that's different. If this goes through, I wonder whether there will be a new push to change the law to allow customers to pump their own gas, with the stated purpose of knocking a few cents a gallon off the price.