58 Views

Infographic Shows How Auto Loan Securitization Works

by

Derek Kreindler

(IC: employee)

Published: August 7th, 2014

Share

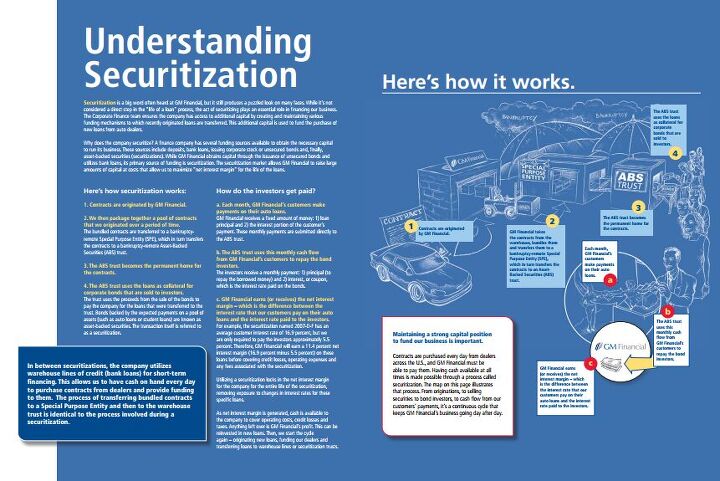

Even though I’ve taken a crack at it in numerous articles, this infographic from GM Financial contains a much more thorough explanation of how auto loans are securitized. Click here for the full-size version.

Derek Kreindler

More by Derek Kreindler

Published August 7th, 2014 8:30 AM

Comments

Join the conversation

How long before this thread becomes a political melee?

That is a superb graphic. Props to GM Financial for making that available.

My broker sent me an article today about buying bank-loan funds. Aparently they are paying pretty good, but of course there are risks.

We gnomes know a lot about business. Step one, we collect all the world's sub-prime auto loans. Step two... Step three, profit. Get it?