EV Trade Group Touts PEV Early Market Penetration Success, Tesla Model S Has 8.4% Share of Entire U.S. Luxury Segment

The Electrification Coalition (EC), a trade association of companies involved in the business of electric vehicle,s released a report last week prepared by PriceWaterhouseCoopers touting strong sales of plug in electric vehicles for the first 2 1/2 years that they’be been on the market in the U.S.. Reportedly consumers are embracing PEVs much faster than they started buying hybrids when those first went on sale more than a decade ago. The report particularly noted the success of the Tesla Model S, saying that single model had an 8.4% share of the entire U.S. luxury market for the first six months of 2013.

Key findings of the PriceWaterhouseCoopers report were:

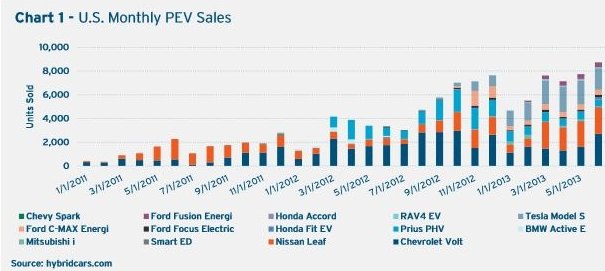

- More than 110,000 PEVs have been sold in the U.S. since January of 2011.

- Twice as many PEVs were sold in that 20 month period than the hybrids sold in a corresponding period after their first introduction.

- Uptake rate of PEVs is 3X what it was for hybrids during their first three years on the market.

- The Nissan Leaf has 3.3% of the subcompact market segment.

- PEVs have a higher customer satisfaction rate on nearly all measured items.

- Battery costs are expected to drop by 50% by 2020, with an expected price of $300-325 per kilowatt hour.

- The Tesla Model S took 8.4% of the U.S. luxury car market for the first half of 2013 and sold more units than “several in-class competitors including the Audi A8, BMW 7-series, and Mercedes S class”

Those last two bullet points are somewhat in contention. Last month, Bill Alpert of Barron’s wrote, “Industries and governments around the world have spent billions on battery research, but few expect to trim electric-car battery costs by more than 20%-30% by the planned 2016 launch of Tesla’s car for the Everyman.” Tesla is planning on selling a $30,000 EV for the mass market. As for the Model S, it’s been pointed out that while it can cost as much as a flagship German luxury sedan, it more directly competes with the segment just below the flagships (depending on your point of view, this could mean anything from a BMW 5-Series to a Mercedes-Benz CLS to an Audi A7).

More by TTAC Staff

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Lou_BC Synthetic oil for my diesel is expensive. It calls for Dexos2. I usually keep an eye out for sales and stock up. I can get 2 - 3 oil and filter changes done by my son for what the Chevy dealer charges for one oil change.

- Joe65688619 My last new car was a 2020 Acura RDX. Left it parked in the Florida sun for a few hours with the windows up the first day I had it, and was literally coughing and hacking on the offgassing. No doubt there is a problem here, but are there regs for the makeup of the interiors? The article notes that that "shockingly"...it's only shocking to me if they are not supposed to be there to begin with.

- MaintenanceCosts "GLX" with the 2.slow? I'm confused. I thought that during the Mk3 and Mk4 era "GLX" meant the car had a VR6.

- Dr.Nick What about Infiniti? Some of those cars might be interesting, whereas not much at Nissan interest me other than the Z which is probably big bucks.

- Dave Holzman My '08 Civic (stick, 159k on the clock) is my favorite car that I've ever owned. If I had to choose between the current Civic and Corolla, I'd test drive 'em (with stick), and see how they felt. But I'd be approaching this choice partial to the Civic. I would not want any sort of automatic transmission, or the turbo engine.

Comments

Join the conversation

For all those gnashing their teeth and wringing their hands over EV/Hybrid subsidies; I have one question. Have you ever heard of tax write-offs for company owned vehicles? I liked my King Ranch and Lariat F-150's. There ain't no such thing as a free lunch.

Tesla's fortunes seemed tied into gasoline hitting outrageous prices. I just don't think is going to happen - ever. We might have hit peak oil but we are long way off from peak natural gas. What you will see in the US is a switch over to natural gas wherever possible. This will lower the demand for oil/gasoline and keep prices around where they are now. Moreover - call me crazy but I don't think electric cars are as efficient as they are cracked up to be. Most run indirectly on natural gas. We take the natural gas - burn it - turn it into mechanical energy - turn that into electric energy - they pipe that through the electric grid - then we recharge a battery and drive a car. Call me crazy but wouldn't it potentially be smarter to just run a car on natural gas?