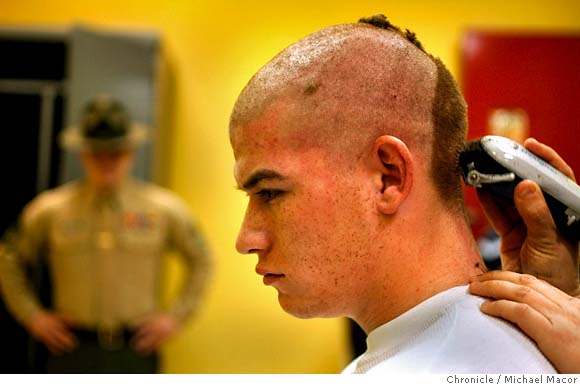

Editorial: Bailout Watch 259: Hype, Haircuts and Hysteria

Detroit needs a thorough cleansing, from top to bottom. Think along this line and the answer to the question of how to handle the bail out becomes self-evident. But given an unemployment rate at 6.7 percent and growing, Congress hit the panic button and succumbed to the pleas for help from Detroit. Nancy Pelosi decided not to play scrooge with your money. And that’s not good. We’re not against saving jobs, and preserving holiday cheer. But it’s just plain dumb to give money to those who can’t manage their own businesses. It’s like giving crack as a Xmas present to a crack addict. Recovery just gets delayed.

Detroit doesn’t need three companies. It needs two: GM and Ford. Other than job subsidy, Chrysler has no reason to continue. Some 80 percent of its revenues come from the crowded and competitive North American market; not one of its products could be considered “leading” by any metric. Its vehicle quality– mostly lack thereof–is legendary. Worse, the company has no future products that will change its current trajectory into liquidation.

Why is the U.S. taxpayer on the hook for Chrysler? Unlike GM or Ford, Chrysler’s rich owner, a private equity fund with multi-billions in private capital available, has $7b to invest in its portfolio company. And the rest. Here’s the petard by which Cerberus should be hoisted. John Snow, Cerberus’ chairman, made these comments (excerpted with highlights) in Detroit in July 2007, shortly after the acquisition of Chrysler:

“Cerberus is one of the world’s leading private investment firms with approximately $26 billion under management. Our investors are primarily made up of pension plans, charitable endowments, insurance companies and other long-term savings and retirement programs, including many state pension funds.

Cerberus fixes up underperforming companies and rebuilds them. Our entire focus is on improving the performance of the companies we buy. We bring real operational expertise to bear on our investments, with a cadre of over 150 seasoned, senior-level proven executives who are able to provide a wealth of advice, as well as supplement management teams to produce superior results. We do this patiently, taking a long-term view on our investments. Unlike many purely private equity firms, Cerberus does not invest with an exit strategy in mind. We invest with a “find, fix and hold” strategy.

The prescription we offer is patient capital. Because our investors – a broad base that includes pension funds, state workers’ programs, and private individuals – have a long investment horizon, we can afford to have the long view…to do things right.

For a starved enterprise with a sound strategy, we can offer much needed investment in products and people, freeing captured value. We are able to inject equity directly, and also efficiently raise capital in the debt markets.

Over twenty-five years ago, when Chrysler faced bankruptcy, it turned to the United States government for assistance. Today, Chrysler again faces new financial challenges. But it is private investment stepping in to inject much needed support. Now, Cerberus has the opportunity to use the tremendous financial innovation of private investment to turn Chrysler around, to restore it to financial success, and to help it be a continuing source of good jobs for many Americans, as well as great products for American consumers.

Cerberus should be responsible for saving its investment in Chrysler. Period. Congress doesn’t see want to see union workers out in the cold and doesn’t want to pick winners and losers among the auto makers. So Chrysler gets dollars now too. Too bad for the taxpayers, but it’s the wrong decision Ms. Pelosi. Chrysler will only come back for more. There’s no way that $7b plus Section 136 billions (that’s the Energy Department program for fuel efficiency technology) gets this company to a profitable future. That takes years, not months, and a miracle that the public will find sudden virtue in the Chrysler badges. Are you outraged yet?

GM gets cash now, maybe $10b, to keep the lights on until March. And we hope that’s first priority funds, backed-up by every single un-hocked asset that GM has left. If Congress has real guts, they’ll tell GM to come back with a program, and not a plan, before March 31st. This program should look like a pre-packaged bankruptcy, with all the agreements in place from the creditors and the unions. But once the government opens its coffers, none of the creditors or the unions will be willing to take meaningful haircuts. They don’t need to– the government blinked first and will do so again. Why give now?

As for Ford, let’s face facts, Alan Mulally was only there to show support. He doesn’t want GM going into bankruptcy since Ford would go over the edge as suppliers fail. But with an assurance that funds will be available for The General, he can now rest at night as his suppliers can remain in business. But I’m sure he wished Congress would let Chrysler go down, he’d pick up a big chunk of their truck business sales– enough to alleviate his needs for future borrowings.

Pressed by time and rising unemployment. Congress took the easy way out. Ok, we get to watch the drama unfold this winter. Our job will be to continue leading the charge for meaningful restructuring at GM. We’ll root for Alan Mulally to accelerate Ford’s restructuring. And we’ll pray that Congress doesn’t advance another dime to Chrysler.

More by Ken Elias

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- ToolGuy If these guys opened a hotel outside Cincinnati I would go there to sleep, and to dream.

- ToolGuy Michelin's price increases mean that my relationship with them as a customer is not sustainable. 🙁

- Kwik_Shift_Pro4X I wonder if Fiat would pull off old world Italian charm full of well intentioned stereotypes.

- Chelsea I actually used to work for this guy

- SaulTigh Saw my first Cybertruck last weekend. Looked like a kit car...not an even panel to be seen.

Comments

Join the conversation

tparkit - I really was not suggesting you're stupid. I think it would be great if we had an economy in which there was no government interference whatsoever, and every company did the right thing for their investors, their employees and the public with no need of interference or assistance from the government. And then those who failed simply faded away. Yet as much as I like the free market ideal, it is akin to suggesting that we actually don't need police, since it is in every individual's interest to behave in a manner which best suits society. As to government help for ailing companies, Harley Davidson is a reasonable example. When the tariff was passed (government protectionism), they were very close to bankruptcy. In the intervening 20+ years, they have built a robust business. At the time, I felt as you do - they built crappy motorcycles, did not update their product and saw no reason why they deserved help from the government. I think the intervening 20 years have shown that I was wrong at the time. Chrysler's loan guarantees also suggest that help can be beneficial. I don't disagree with you about the underlying reasons for Detroit's failure. However, neither they nor the public really expected the downturn we are now facing. For all of the bad things I could say about GM, as an example, they are building some decent automobiles for the first time in 20 years. Ford's lineup is not stellar, but includes some decent products. If you look at our aerospace industry, including many of the companies who make weapons systems, they would not be in business today without assistance from the government. Do you really believe that Boeing, Lockheed-Martin and their ilk would be around without huge support from the government? Why should our automakers not at least get loan guarantees? I don't think this is an all-or-none issue. I appreciate your point of view and read TTAC specifically because of the thoughtful commentary which accompanies a wide variety of subjects related to automobiles.

Well, edgett, As to government help for ailing companies, Harley Davidson is a reasonable example. When the tariff was passed (government protectionism), they were very close to bankruptcy. In the intervening 20+ years, they have built a robust business. At the time, I felt as you do - they built crappy motorcycles, did not update their product and saw no reason why they deserved help from the government. You were right back then - Harley shouldn't have gotten a dime. However, neither (Detroit) nor the public really expected the downturn we are now facing. The downturn is not the problem. Detroit has been failing visibly for years, and more subtly for decades. The downturn has merely brought this failure to maturity at an earlier point in time than it would have otherwise shown up. Said another way, the downturn has removed deniability. (GM is) building some decent automobiles for the first time in 20 years. Ford’s lineup is not stellar, but includes some decent products. Those are the products that will survive bankruptcy - provided the public wants to buy them (competitors' comparable products might still prove superior at the respective price points). Even then, Detroit may not be able to sell enough of its better products to make a go of it unless the Big Three become the Big One - shedding 2/3 of the brass and half the office and production staff in the process. The bailout is intended, in part, to prevent this rationalization. Only bankruptcy (or the threat thereof) can chop away the deadwood and leave standing whatever green sprigs may remain in Detroit. Why should our automakers not at least get loan guarantees? In the case of Detroit, where failure is in the cards, a loan guarantee is the same as cash - and just as surely represents a dead loss to the taxpayers. I don’t think this is an all-or-none issue. Then somebody should buy you a lint brush for Christmas so you can de-fuzzify your perspective.