Time To Buy That European Dream Car!

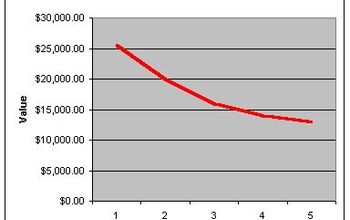

Thinking about buying that midlife crisis Boxster? Better get on with it. Citing the dollar's weakness against the euro, the Wall Street Journal predicts that the price of cars imported from the Eurozone will rise over the next year. So far, European automakers have been able to hold the line on price using currency hedging, which "lock in" exchange rates. Unfortunately for German car lovers, the contracts are due to expire. BMW and Mercedes will probably continue to rely on their US-built products to fill the profit gap, and hope the situation reverses itself. VW says they're fully hedged for 2007 and "more or less fully hedged for 2008." After that, it's anyone's guess what they'll do: build factories in the US, turn to China for production and/or raise prices. Porsche? Audi? Price hikes. Jaguar? The sooner it's someone else's problem, the better Ford's gonna feel.

More by Frank Williams

Comments

Join the conversation

i would think the dollar depreciation would affect the lexus and infiniti models built in japan as well as the euro cars. should be advantageous for the CPO market AND might send a few folks over to their caddie dealer. whoduthunk it!

qa wrote: "It would be a lifestyle change for many of us if OPEC decides to one day switch to EURO’s for pricing oil. Or China drops its dollar reserves in exchange for the EURO." A lifestyle change? Oh yeah. If OPEC prices oil in Euros, the U.S. would have to convert to Euros to buy crude. That would increase the price of gas dramatically. And if China cashed in her trillions of dollars for Euros, the dollar would plummet. That would essentially tank our economy, by leading to hyper-inflation. That is one of the problems with an economic policy based on a weak currency. If we were self-sufficient, and produced our own clothes, shoes, pots and pans, TVs, cars, and food; it wouldn't hurt as much. My advice is to hedge against the dollar by investing in international funds. That is what most large U.S. businesses do. And, if you can afford to do it, sell your home and rent or lease. The housing market still has a long way to go down. I predict this will continue until we disengage from the war in Iraq. Like the old U.S.S.R., we will find ourselves economically depleted by an endless, unwinnable war. On the bright side, public reaction to our economic plight might lead to regime change here at home.

I doubt the falling dollar will affect Japanese makers too much, or, at least, the Japanese companies who have plants in the US. The majority of the main line stuff (Camcords, Civics, Corollas etc) are made in the US. In fact, did the Japanese build plants in the US to protect themselves from dollar fluctuations in one of their main markets? The models which are made in Japan are usually the low profitable lines (sports models etc). Anyway, the Japanese supposedly have an artificially low currency value, too. Oh hang on, When the US Dollar falls it's the depressed market, when Japanese yen is low it's "artificial".......

Quite right, Katie! I also was reading yesterday about how some people here are whinging and whining and pointing fingers at the Chinese, the Russians, the Venezuelans and the Iranians for "causing" the economic fiasco here in the US (and also the rest of the world, by default) - calling it "economic cold-warfare". Horsefeathers. OK, sure, I suppose it might be somewhat feasible that all of the US's enemies are "ganging up on it" economically, but only if they wanted to kill the goose that lays the golden eggs.... it's not like China has a lot of other places to dump their cheap shoddy merchandise, other than here.... and if the US economy tanks into a depression, OPEC will see oil prices down in the $15 per barrel range again... But I strongly suspect by living for 1/2 century and watching humanity, that the fault of the US economy faltering right now is easily laid at the feet of several of the usual suspects. Pride. Covenousness. Envy. Gluttony (which is more than just about food). That's four out of seven. According to "tradition" the 7 Deadly Sins are; Pride Lust Anger Covetousness Envy Sloth Gluttony And, According to the Bible, the 7 things the Lord hates are: Proverbs 6:16-19 "There are six things the LORD hates, seven that are detestable to Him: haughty eyes, a lying tongue, hands that shed innocent blood, a heart that devises wicked schemes, feet that are quick to rush into evil, a false witness who pours out lies and a man who stirs up dissension among brothers." You know, things that affect 100% of all humanity, no matter where they live.