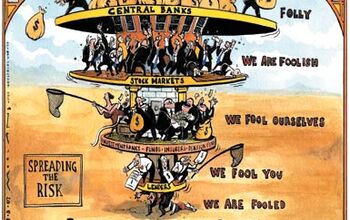

GMAC Returns to Sub-Prime Lending

I know, huh? And there I was thinking that easy credit and bad loans were a main contributory factor to our current economic doldrums (aren’t euphemisms grand?). But after the Fed changed its rules at the eleventh hour (behind closed doors) so that GMAC could avoid bankruptcy and become (of all things) a bank, after Uncle Sam pumped $6B worth of taxpayers’ money into the privately-held company’s coffers ($1B of which went straight to GM), the failed “bank” has reversed its reversal of its lax lending practices and opened the taps. “We want to do our part to support both the U.S. auto industry and individuals in the market for a car or truck,” said GMAC President Bill Muir, in a prepared statement. “GMAC now finances a broad spectrum of auto buyers, similar to traditional levels.”

Traditional? Is that what they call the “anyone with a pulse” financing that GMAC generated to keep GM (and then Chrysler) in Denialand? And now, with a gentle nod to accountability-free post-modern irony, GMAC will once again loan money to car buyers with FICO credit scores below 620. It will also increase allowable advance rates (120 percent loans are back and they’re bad!). And, just for S&Gs, they’ll reduce some financing rates.

“Over the next 60 days, GMAC will make available at least $5 billion in order to increase the flow of credit to U.S. automotive customers, Muir said.

60 days. Huh. Isn’t that the exact amount of time President Obama’s Task Force gave GM to get its shit together?

Equally uh, “interesting” (especially for conspiracy theorists who connect the dots between GMAC, Cerberus and former U.S. Treasury Secretary John Snow), GMAC is suddenly getting out of the business of putting GM and Chrysler dealers out of business.

During April, GMAC will eliminate “curtailment payments” designed to collect on dealer loans on unsold inventory. Through June, GMAC will waive the fee charged to dealers for posting unsold vehicles on SmartAuction (GMAC’s online marketing site). What’s more, qualified dealers (?) can defer wholesale interest charges for two 30-day periods during the next 120 days.

Tin foil hat at the ready, methinks someone is doing their level best to tilt the level playing field in GM’s direction. To what end I have no idea.

More by Robert Farago

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Jeff It was the right decision to leave this as a concept.

- Sayahh Was the Celica Toyota's pony car?

- Rizzle The price is the same for a manual or automatic. If you want a manual you might want to get a 2025 or 2026 (or older) because who knows if VW will offer the manual in 27. It could be deleted just like they did for the GTI and R. It is too bad you can't get a GLI in S form without the sunroof and with a cloth interior. Same basic car but many $1000s less. Yeah, the red stripes are a bit silly, but someone at VW thinks they are cool. In the good old days they would have put on racing stripes and fake louvers and called it the GLI-X.

- ToolGuy™ I have always resented how GM did not consult me on styling choices.

- ToolGuy™ Ford produces 6,819 vehicles in about 17 minutes.

Comments

Join the conversation

A is A: No,what oldyak is saying is that the average car buyer doesn't always have a 790 or 800 point credit score.