#subprime

U.S. Treasury Loses $11.2 Billion In Accounting Of GM Bailout

Detroit Free Press reports the U.S. Treasury lost $11.2 billion in taxpayer money from the rescue of General Motors back in 2008, up from the $10.3 billion estimated after the agency sold its remaining shares back in early December 2013. Part of the final figure came as a write-off of an $826 million “administrative claim,” which was found in a report by the Office of the Special Inspector General for the Troubled Asset Relief Program. The overall figure pales in comparison to the $50.2 billion given by both Bush and Obama administrations between 2008 and 2009 to GM as the automaker struggled through its financial crisis at the onset of the Great Recession.

Subprime Lending Still On The Rise As GM Financial Grows Prime Lending Operations

Subprime auto financing continues to grow, and while one analyst at Moody’s says that banks are largely staying out of the subprime space, overall lending continued to rise, with retail banks seeing some of the strongest growth. This expansion in lending, particularly subprime, was attributed as a key driver in auto sales. SNL cited forecasts for a SAAR of between 16 and 16.7 million in 2014, up from 15.5 million in 2013.

Subprime Car Loans At Highest Level Since Before Recession

Subprime borrowers have accounted for more than 27% of new car and light truck loans this year, the highest level since 2007, according to Bloomberg. A year ago, a buyer with a credit ranking in the bottom percentile would not likely have been able to buy a car. This year people with credit stores as low as 500 or lower have qualified for loans.

After the Federal Reserve has kept interest rates near zero for five years now, the subprime car loan market is now being described as “frothy”. With interest rates so low, investors are willing to purchase the riskier bonds that back subprime car loans in pursuit of higher returns. A number of financial companies have entered that market. Citigroup reports that 13 loan backers have accessed the asset-backed market to fund subprime auto loans this year.

Mainstream Press Finally Worried About Cheap Car Loans

Months after TTAC started to relentlessly bleat about the glut of money flowing into the auto loan sector, the mainstream media is finally taking notice. Automotive News is finally expressing some worry over the factors that we’ve been discussing for some time: car loan terms are getting longer ( to help keep payments low), subprime lending is increasing and an expected rise in interest rates could put an end to the new car market’s exuberant performance.

"All Is Fine In Sub-Prime Land," Says Someone With A Vested Interest In Its Success

The Detroit Free Press paints a pretty clear picture of the automotive lending landscape: auto loan terms are rising, with 1 in 5 loans now lasting longer than 6 years. At the same time, the average credit score for those taking out loans is dropping. Ominous signs for a car market that’s running on the hype of a perpetually increasing SAAR, right? Well, not according to some.

Auto Loan Delinquencies, Reposessions Up In Q1 2013

Bad news on the subprime front, as credit rating agency Experian reports a rise in delinquencies and repossessions for auto loans in Q1 2013.

Melinda Zabritski offered a rather dubious explanation for the nearly 17 percent rise in repos (as well as the 1.3 percent uptick in 30 day delinquencies and 12.4 percent rise in 60-day delinquencies)

GM Financial Double Crosses Their Ally

Following in the footsteps of Spanish bank Santander, GM Financial announced that it would enter the prime lending market in 2014.

America's Next Top Bubble: Delinquencies Down, Deals Up In ABS Land

The largest asset-backed securities deal since prior to the mortgage crisis, worth $1.6 billion, was announced last week. Meanwhile, one ratings agency is touting their low delinquencies as positive signs in the ABS market.

America's Top Suzuki Dealer Switches To Subaru

America’s top selling Suzuki dealer is switching it up with a much more popular brand. Wichita Suzuki has begun selling Subaru cars as it prepares for the end of the Suzuki era in America.

Fitch, Moody's, Stand Alone As Subprime ABS Skeptics

Ratings agencies and other players in the finance world are beginning to sound the alarm on auto backed securities. Among the most troubling factors for some investors is the growth of smaller issuers who rely on pools of deep subprime loans. And ratings agencies who are being more conservative with their ratings are missing out on the action.

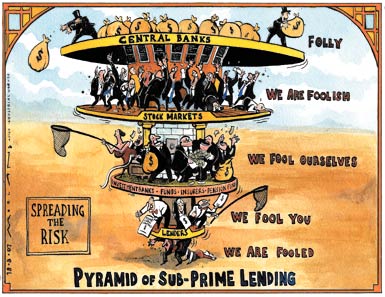

How A New Generation Of Sub-Prime Auto Financing Could Cause Another Catastrophe

March was the 5th straight month of a SAAR above 15 million vehicles. Industry analysts have explained the strength of the market in a number of ways. The need to replace older vehicles is one (new car sales were hit hard during the recession as consumers held on to their vehicles for longer. This also caused used car prices to skyrocket, something TTAC has been documenting), while others have cited increasing fleet demand, and the desire to replace vehicles damaged in Hurricane Sandy.

But one factor that is just starting to get attention outside of TTAC is sub-prime financing. Sub-prime lending, which involves giving high-interest loans to customers with poor credit scores, is driving the SAAR in a big way, by letting buyers with poor credit purchase new cars. In turn, the sub-prime bubble is being driven by Wall Street, whose clients cannot get enough of financial instruments backed by sub-prime auto loans.

Subprime Madness: Shotguns Now Accepted As Car Loan Down Payments

Anyone looking for an anecdote illustrating the QE-fueled madness that is subprime auto lending, take a look at this Reuters report on what constitutes a down payment in the subprime world.

And still, though Nelson’s credit history was an unhappy one, local car dealer Maloy Chrysler Dodge Jeep had no problem arranging a $10,294 loan from Wall Street-backed subprime lender Exeter Finance Corp so Nelson and his wife could buy a charcoal gray 2007 Suzuki Grand Vitara.

All the Nelsons had to do was cover the $1,000 down payment. For most of that amount, Maloy accepted Jeffrey’s 12-gauge Mossberg & Sons shotgun, valued at about $700 online.

Sub-Prime Auto Financing, Loan Terms On The Rise

Long-term auto loans, leasing and sub-prime financing all saw increases year-over-year from 2011 to 2012, according to a report by Experian, a consumer credit rating agency. While typically a dry and detail-oriented subject, the area of auto financing gives us some insight into the nature of the new car market and even the economy itself.

The Return Of Subprime: GM Getting High On Junk Again

The collapse of the house of cards built with subprime mortgages was a central reason for the 2008 crash. GM’s GMAC was brought down by subprime loans. The economy has not quite recovered, and the deck of cards is again being used as building material. Back in the high-risk game: General Motors.

GM And GMAC: Together Again?

One of the more dangerous conflicts embedded in the US auto bailout that was identified in the recent Congressional Oversight Panel report has been a TTAC hobbyhorse for some time, namely the tradeoff between GM’s success and that of its former captive finance arm GMAC (now known as Ally Financial). As we wrote back in May,

if government-owned Ally isn’t interested in underwriting GM’s volume gains with risky loans but also isn’t interested in seeing its auto lending business bought by GM, there’s trouble brewing. After all, that would leave GM with only two options: partnering with another bank, or starting a new captive lender. Either way, a new GM captive lender would likely force Ally into offering more subprime business anyway, or face losing its huge percentage of GM business.

Fast forward the better part of a year, and GM has indeed bought its own in-house subprime lender, leaving the COP to term The General’s lack of interest in taking care of “the Ally Tradeoff” as “disconcerting.” After all, with over 20 percent of GM’s equity and over 70 percent of Ally’s stick, the Government should have been able to work out some kind of deal that gets GM and Ally back on the same page… right? Not so fast, reports the WSJ. Ally turned down a $5b GM offer for its wholesale lending business earlier this year, and now it seems another deal may be in the works. But it has nothing to do with maximizing taxpayer payback, and everything to do with shoring up GM’s floorplanning credit. And it’s not coming from the government, but from GM’s newly-ubiquitous CEO Dan Akerson.

Recent Comments