#ipo

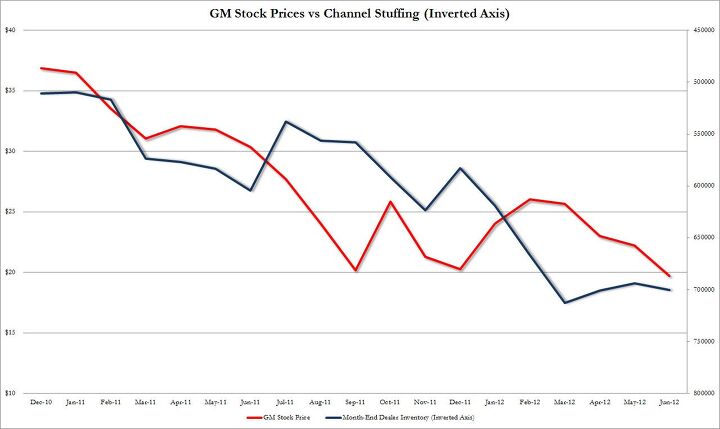

Chart Of The Day: Channel Stuffing Bonanza

Today’s Chart comes from finance blog Zero Hedge, which has taken a periodic interest in General Motors channel stuffing endeavors. While we don’t normally report on stock prices here at TTAC, this one is worth mentioning.

Allison Transmission Raises $600 Million Via I.P.O.

An I.P.O for a physical product is a refreshing change from the Tech 2.0 bubble we’ve been subjected to lately. Allison Transmission, formerly of General Motors, just issued their first I.P.O, raising $600 million for the company. Allison is now valued at $4.2 billion.

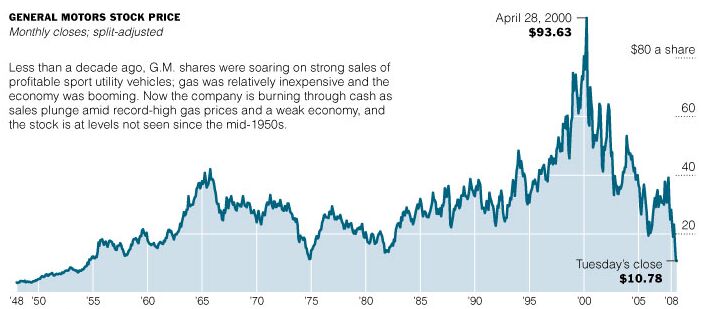

Should The Treasury Dump Its GM Stock?

Today’s Rasmussen poll results, which show that Americans are arguably less likely to buy from a bailed-out automaker, raise some interesting questions. Like, does receiving a bailout constitute an inviolable black mark on an automaker? Do the size of the bailout, and the amount the government recovers make a difference? With a presidential election looming, these factors are worth knowing: after all, the government still has the choice of when to divest its shares in GM. And with GM’s stock down over 40% from its $33 IPO price last November, the government is looking at a significantly larger loss than it would have endured had it divested immediately aftter the IPO. So, should the government dump now, anticipating larger losses in the near future, or should it hang on in hopes of a rebound, increasing the risk that “Government Motors” will become a political hot potato going into 2012? The latest clue, via CNBC, remains as cryptic as ever…

Treasury Won't Sell GM Until Stock Improves. GM To The Rescue?

Bloomberg reports that a “person familiar with the matter” says the US Treasury won’t sell its remaining stake in GM as long as the automaker trades below its $33/share IPO price. Previously the government’s auto team had said it would not try to “time the market” and our analysis showed that the Treasury was likely to sell sometime late this Summer. But it’s been months since GM spent more than a few days above its IPO price, indicating that Treasury may be waiting considerably longer if the IPO-price floor is set in stone. And with $36.5b in cash equivalents on hand and only $5b in debt, GM’s $45b market cap is hardly encouraging… especially with investors waiting for The General to match Ford’s profitability levels. Heavier discounts mean a lower operating profit for GM in the US market, and the first quarter shows a $1b swing in pricing between the two firms (with Ford improving $700m and GM dropping $300m) according to Bloomberg. Lower finance earnings are also holding The General back relative to Ford. So, what’s GM’s response?

Quote Of The Day: Abandoning The Bailout Edition

The Detroit News reports that top White House economic adviser Austan Goolsby indicated today that the government would be exiting its equity position in GM in the short term. The DetN’s David Shepardson quotes Goolsby as saying

The writing is clearly on the wall that the government is getting out of the GM position. The government never wanted to be in the business of being majority shareholder of GM. It was only to prevent a wider spillover, negative event on the economy. So we’re trying to get out of that. We’re not trying to be Warren Buffet and figure out what the market is doing

And he’s not kidding: GM’s stock just closed at its lowest level since the IPO, after GM’s Q4 results came in below analyst expectations and the overall market experienced turmoil due to Middle East unrest.

Will GM's IPO Help Sales?

Because success in the auto industry depends upon both the buildup of industrial might and deft maneuvering on the winds of fashion, analysts often struggle to determine how business decisions impact consumer choice. For example, GM and Chrysler long resisted the pressing need to file for Chapter 11 bankruptcy protection because their leaders believed that Americans would not buy a car from a bankrupt firm, and that sales would go into an irrecoverable tailspin if they filed. Needless to say, that assumption proved to be deeply flawed, and sales during the GM and Chrysler bankruptcies barely dipped (if only compared to the miserable months preceding bankruptcy). In any case, the rating agency Moody’s is taking on the challenge of translating good business news into sales by arguing [via Bloomberg]

U.S. consumers who don’t know anything about over- allocation options or the need for strong liquidity in a cyclical industry knew that something exceptionally good happened to GM last week. That knowledge makes it more likely that they will consider buying a GM vehicle and possibly buy one. That’s good for the company’s credit quality.

But does the general air of positivity surrounding the IPO actually make a difference with consumers?

OMG! American Dealers Run Out Of American Cars!

Forget about Europeans complaining about missing parts. Over in America, there is an acute car shortage. Dealers blame who they always blame: The manufacturers. “They’ve cut back production so much that we’ve run out of cars,” Boston dealer magnate Herb Chambers tells his hometown paper, the Boston Herald. He says he had to “beg, borrow and steal” Cadillacs from dealers in other parts of the country. Down at the South Shore, dealer Dan Quirk loses 60 to 90 sales a month. “The Big Three just don’t have enough manufacturing capacity any more,” kvetches Quirk. “Some of the automakers, particularly General Motors, closed a lot of their plants when the meltdown hit.” Supposedly it’s not just a Bostonian phenomenon. Supposedly. At closer look, it might be a fire breathing, rip-snorting chimera.

General Motors, Public Company

GM Board Member: The IPO Is Premature

Ready to buy some GM share tomorrow? A consummate insider who sits on the board of an important GM company says: Don’t.

Klaus-Franz, Chair of the Opel works council and Vice Chairman of the Opel supervisory board warns: “The IPO is premature. Sure, GM has delivered three good quarters. But he restructuring in Europe must be finished to give investors the visibility they need.”

Franz knows the skeletons hidden in Opel’s closet. In an interview with Germany’s Focus Magazine, Franz gives valuable investment advice to potential GM shareholders. To repeat: “Don’t.”

SAIC Buys 1% Of GM, Gets Keys To World Markets Thrown In

Observers who followed China’s SAIC coveting of shares in the upcoming GM IPO (only 3 days to go!), and who hoped/feared that SAIC would buy a big chunk of GM, will be disappointed/relieved to hear that SAIC is content with a more or less symbolical 1 percent share in the General.

Reuters has it on good authority (“four people familiar with the matter”) that SAIC and GM have reached an agreement in principle that cements the 1 percent deal. The deal is contingent on Chinese government approval, but this is expected to be fast tracked and should happen today before the U.S. even gets up.

So the big Chinese buy-in is just a lot of hot air? Wait until you hear what SAIC received as a deal sweetener.

Nader: Government Motors Forever!

We’ve heard a lot of arguments on all sides of the bailout, but we had yet to hear anyone call for prolonged government ownership and involvement in General Motors… until now. What follows is a letter from Ralph Nader, former NHTSA boss Joan Claybrook, Center for Auto Safety honcho Clarence Ditlow and Public Citizen president Robert Weissman, urging the Obama administration to suspend GM’s IPO and take firmer control of the government-owned automaker’s decisions on a number of issues including lobbying, employment and the environment. Because, despite appearing to be stuck in the 70s, Nader and company have never heard of British Leyland. Taste the madness below.

Dear President Obama,

The U.S. government bailout of, and acquisition of a majority share in, General Motors was anexceptional action, taken in response to exceptional circumstances. The U.S. stake in GM obviously poses novel managerial challenges to the government. The appropriate response to those challenges, however, is not to run from the responsibility through passive ownership and premature sale at a loss to taxpayers.

(Chinese) Government Motors

When the all new GM share starts trading on 11/18, the bulk of the new issue will most likely not be owned by widows and orphans, but by foreign governments and their proxies. One of the largest new shareholders could be Chinese. GM is in the final negotiation stage to sell a good chunk of their new stock to their old pals and Chinese joint venture partners SAIC, reports Reuters, citing the usual “two people familiar with the matter.” And don’t think they are just talking percentages, there is much more on the table.

SAIC Will Buy Into GM

It’s a done deal, says Sinocast via Trading Markets. Chen Hong, president of China’s SAIC has gone to the US. He’s not there to visit Niagara Falls and Yosemite. He’s there to negotiate how much of SAIC’s $5.7b in cash and cash equivalents will be converted into GM stock on November 18.

The Revenge Of The GM Bondholders

Want in on GM’s IPO without being a sovereign wealth fund or Goldman Sachs? Join the BDSM lifestyle for fun and (possible) profit. Buy the very much troubled pre-bankruptcy bond, and you could make out like a banshee. Reuters has the surprising news that bonds issued by GM’s bankrupt predecessor are a good investment. “GM’s 8.375 percent bonds due July 2033, which were issued by old General Motors Corp. and convert to shares in the new GM, rose 0.375 cent to 35.875 cents on the dollar at 4:29 p.m. in New York.” The day before, the bonds had jumped 2.25 cents, the biggest gain since June 14.

Why the sudden interest in the converting bond?

Will SAIC Buy Into GM? Decision Imminent

In the politically and emotionally charged discussion whether Chinese interests will buy a chunk of GM in their IPO, one decision appears imminent: Will SAIC, GM’s joint venture partner in China, take the bite or eschew the lure? India’s Economic Times, always with a wary eye on happenings on the other side of the Himalaya, says that “top Chinese automaker SAIC Motor is close to making a decision on whether to buy a stake in its long-time partner General Motors as the US auto firm goes public.”

Recent Comments