#ipo

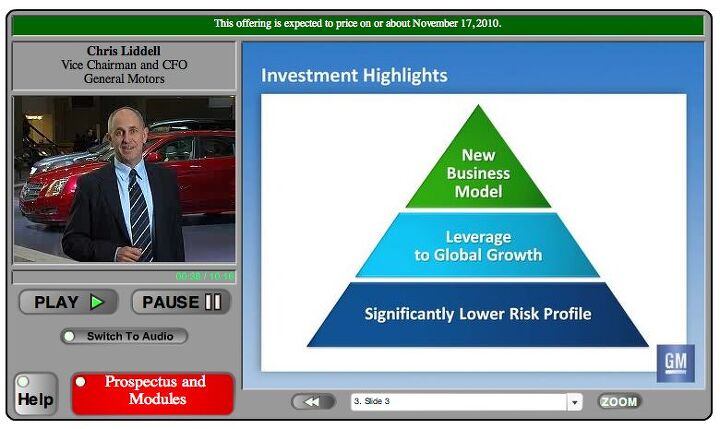

Watch GM's IPO Pitch Here

GM Releases Preliminary Q3 Results, Estimates $2b Net Income

GM IPO: $10b Of Common Stock, $3b Of Preferred Stock

Reuters has followed up its look inside the Government’s involvement in GM with a breaking report on the specifics of The General’s IPO. According to Reuters sources, the IPO will include 365 million common shares for $26 to $29 each, for a total of between $9.5b and $10b. The Treasury is expected to sell between $1.5b and $2b of its 61 percent stake in GM, likely to “four or five sovereign wealth funds,” bringing its stake down to 43.3 percent. The Canadian and Ontario governments are expected to sell down their stake from 11.7 percent to 9.6 percent, while the UAW VEBA trust-owned stake is likely to to drop from 17.5 percent to 15 percent. A Reuters source concludes that

The IPO would likely value the entire company at close to $60 billion, below the $67 billion needed if U.S. taxpayers are to break even on the common stock held by the Treasury

At the midpoint of the proposed price range, GM’s stock outstanding, including warrants, would be worth about $50 billion, roughly the same level as Ford Motor Co. The IPO’s underwriters are hoping to sell at the top end of the range, and for the stock to rise 20% or more when trading begins. At that level, GM could be worth $60 billion or more.

The Invisible Hand Of The United States Treasury

Ever since it became clear that the government would rescue General Motors and Chrysler, the Treasury Department has made it clear that it would stay out of “day to day” decision making at the rescued automakers. Allowing the rescued firms to operate independently was a political calculation based on the desire to keep politics from affecting sales at the two rescued automakers, but according to a Reuters special report, Treasury has not been able to keep its hands completely out of important decisions concerning the future of the two firms. Particularly in terms of setting up GM’s Initial Public Offering, Reuters found that the Treasury made important decisions affecting

its speed and size, the fees paid to the bankers and the potential involvement of offshore investors

Though this has kept the IPO out of election season and all of its potential for political problems, there is some downside to the Treasury’s involvement, particularly because it will not be exiting its equity position in GM until about 18 months after the IPO. As a result, analysts predict problems securing investors in a firm that may still be subject to ongoing government control. Morningstar’s David Whiston tells Reuters

I’m sure that there will be some institutional investors, and even some individual investors, that it scares away

GM To Buy Government Preferred Stock

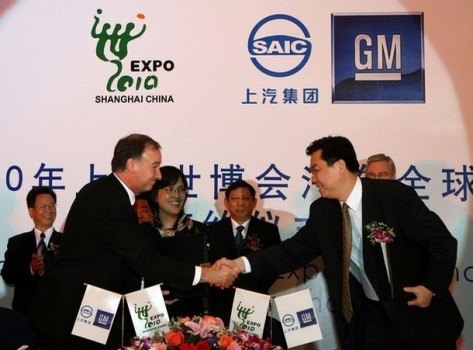

SAIC: We Want A Share Of GM. A Share? Make That A Bunch

There are increasing possibilities that GM will be owned by two governments: The American and the Chinese. After a lot of rumor and innuendo, Hu Maoyuan, Chairman of China’s government-backed SAIC went on record today and said he does not rule out the possibility of participating in GM’s IPO. That according to Reuters.

Good News From Germany: Opel Loses Only $600m

When GM went on the begging tour around Europe, they had dire projections. They expected a loss of $1.7b or thereabouts for 2009. Can’t have such bad news before an IPO. And imagine the elation when the big bottom line was drawn under the books of the 2009 fiscal – and Opel had lost only $600m. Who dunnit?

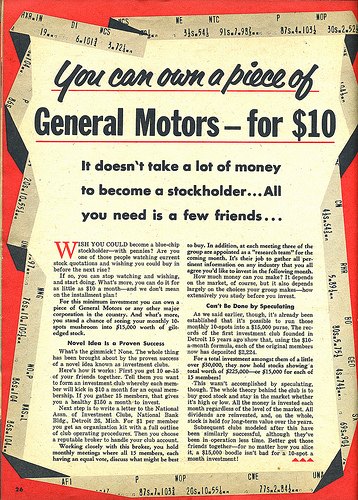

GM Pitches IPO To Employees, Retirees and Dealers

GM Has A Lot Of Junk In The Trunk

As GM’s IPO draws closer, GM (and the government) is doing everything they can to make GM as attractive as possible to the market. The Freep reports that GM is promoting the Volt as much as they can to highlight how much GM has changed. Unfortunately, all it takes is one pesky credit rating agency to undo all that hard work.

GM Gets The Same Credit Rating As Ford. Similar Market Cap Valuation Coming?

GM's IPO DOA?

When GM was taken over by the US and Canadian governments, a lot of money was pumped into GM in order to make it a viable entity. After all, GM didn’t go into bankruptcy because it was a well run company with a tight balance sheet, excellent management and brand, spanking new factories. The more money that got pumped into GM, the more pressure is put on the IPO to generate enough money for this endeavor to break even. And according to the press, it doesn’t look like it’s going to hit its mark.

GM IPO Shifts Target To American Retail Investors

China Eyeing A Share Of GM

Since I’ve been writing for TTAC, I predicted that Chinese interests will eventually go for GM, if and when price and time are right. GM already sells more cars in China than back home. GM expects that huge business to grow by 10-15 percent next year. It stands to reason that China wants on (the) board. There has been talk about limiting the share of “foreign investors” in the GM IPO. “Foreign investors” of course are Chinese, and the true number of foreign investors interested in the GM IPO probably comes down to one: China’s SAIC, GM’s Chinese joint venture partner for 13 years now. And now it’s official.

Opel In The Way Of GM's IPO

The current mantra at General Motors: Everybody and everything look sharp and attractive for the coming IPO. During the sprucing-up operations, there are times when someone at RenCen sighs: “Maybe we should have gotten rid of Opel after all.”

Recent Comments