#fisker

Consumer Reports Fisker Karma Breaks In Driveway

Consumer Reports recently bought a Fisker Karma, which ended up breaking down in the driveway of their vehicle testing facility.

Fisker Names Ex-Chrysler Boss Tom Lasorda As New CEO

Today’s a big day for beleaguered automaker Fisker. The company announced that former Chrysler CEO Tom Lasorda would be joining the company as its new CEO, after joining Fisker’s board in December.

Fisker Announces Layoffs As Government Loans Frozen

Fisker Automotive has laid off a total of 66 people, including 20 at a former GM plant in Delaware, and another 40 contractors in California. The layoffs come as Fisker attempts to re-negotiate loans from the Department of Energy that were contingent on Fisker meeting sales targets for its Karma sedan, which Fisker failed to do.

Another Plugin Problem: A123 Warns Of "Potential Safety Issue" With Fisker Karma Battery

In the ramp-up to the launch of the Chevy Volt and Nissan Leaf, a great debate seized the engineering community: was Nissan opening itself to problems by not including a active thermal management system for the Leaf’s battery pack, or was Chevrolet’s liquid-cooled approach simply adding unnecessary complexity? Well, thus far, the verdict seems to be in Nissan’s favor. Though Leaf has been troubled by some dissatisfaction with its real-world range, the Volt has endurd the first technical semi-scandal of the plug-in era, when federal regulators found that ruptured coolant lines could cause fires. Now the liquid-cooled approach is hitting its second challenge, as Fisker’s battery supplier A123 Systems is warning in a letter [ PDF] that

some of the battery packs we produce for Fisker Automotive could have a potential safety issue relating to the battery cooling system.

Ruh-roh!

Smyrna And The Solyndra Problem

Ever since the messy collapse of solar panel maker Solyndra just two years after it received over half a billion dollars in government loans, the political climate around all green energy loan programs has heated up considerably. As the White House opened an investigation of the Department of Energy’s entire loan portfolio, loan recipients and startup automakers Tesla and Fisker found themselves under attack. And why not? Fledging firms with unproven products in brutal, scale-driven industries are hardly safe bets, even in the best of times. And with the government drowning in deficits, who’s in a gambling mood?

What gets left out in the hue and cry is that Tesla and Fisker between them represent “only” about a billion dollars worth of DOE loans in a program that was supposed to be able to loan out $25b (the final tally could be closer to $18b). Dwarfing the half-billion-each investments in Fisker, Tesla, and Solyndra are projects that seem a lot less risky in contrast to the startups. Here, in Smyrna, TN, I got to see one of them being built.

Why The Government Should Have Stayed Away From Fisker And Tesla

The Detroit News reports that the White House has ordered a review of the Department of Energy’s various loan programs in the wake of the Solyndra scandal, noting

White House Chief of Staff William Daley ordered an independent analysis on the state of the Department of Energy’s loan portfolio — including loans to solar, nuclear and auto companies.

“The president is committed to investing in clean energy because he understands that the jobs developing and manufacturing these technologies will either be created here or in other countries,” Daley said.

One of those programs is the so-called “Advanced Technology Vehicle Manufacturing” loan program, which was nearly used to fund the Detroit bailout and has since come under fire from various quarters. Twice already the Government Accountability Office has questioned the ATVM loan program for its lax oversight, weak goals, lack of technical support, inconsistency in awarding loans and the undetermined impact of funded vehicles. And those internal issues could help explain why the Center For Public Integrity has accused the ATVM program of operating a patronage scheme, alleging that major Obama donor and Tesla board member Steve Westly personally benefitted from loans made to the company. And on the Fisker side of things, backer John Doerr of the VC firm KleinerPerkins is another major Obama donor, suggesting a pattern of politically-motivated loan awards to well-connected EV firms that carry high risks. With government intervention in the auto industry still a hot-button issue in the wake of the bailout, this scandal has huge implications for the legitimacy of America’s emerging “industrial policy.”

Fisker's Sticker Shock: 32 Miles On Electricity, 20 MPG On Range Extender

The Chevy Volt’s best news in ages broke yesterday when GreenCarReports, er, reported that the Fisker Karma had received EPA approval at 32 miles of EV range, and 20 MPG (combined) thereafter. Moreover, the MPGE (the “e” is for “equivalent”) rating of 52 on electric power is nearly half the Volt’s 94 MPGE rating, suggesting that the Karma is not the most efficient car even in EV mode. And, at nearly 5,600 lbs (per evo.co.uk), you don’t have to look far to find out why. But if you ask Fisker, the problem isn’t the car… the problem is those darn EPA numbers, which you should probably just ignore anyway. After all, nobody drives less efficiently than their car’s EPA numbers, right?

Truth Versus Advertising: Sex Is Sexier Than The Environment Edition

With the environment taking an ever-larger place in automotive advertising, it’s interesting to note that Fisker’s latest brochure puts green in its place: behind sexy. Of course these sultry images [via BusinessInsider] aren’t free from environmental overtones, featuring taglines like “designed to get you hot, not the planet,” but it’s clear that Fisker is more heavily relying on the most traditional tool in the advertising playbook. Why? For one thing, even though Fisker is delivering Karmas, the EPA has not yet certified its efficiency rating… so we don’t even know how environmentally friendly it is yet. For another the Karma’s main rival, Tesla’s forthcoming Model S, is pure electric and therefore more appealing to wealthy environmentalists. Finally, unlike environmental messaging, sex doesn’t remind people that Fisker was the beneficiary of over half a billion dollars in government loans. Plus, sex is still, well, sexy. The more things change, the more they stay the same…

Fisker: With An EV Transmission, All Things Are Possible

Fisker Karma: The Car That Changes Everything Except Advertising Cliches

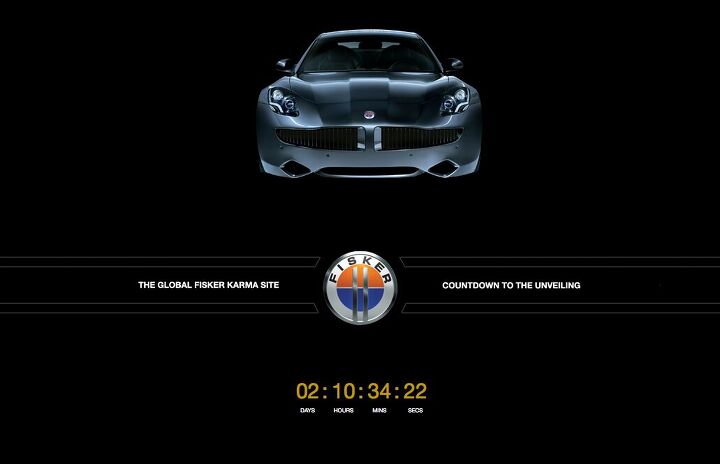

Fisker Karma Production Delayed Until 2011

Fisker Lines Up $115.3 In Funding, Still Needs To Spend $169m On Karma Engineering

With the economy desperately looking for signs that a bottom has been reached, news that Fisker has raised $115m in new funding might indicate that (if nothing else) the money markets are back to their good old speculative selves. At least it might if there weren’t so many darn extenuating circumstances. On the one hand, Fisker seems like the kind of business that has little business attracting much, well, business. Its $90k+ Karma brings little more to the table than some competition for Tesla in the EV-glamor-bauble segment, and like Tesla it’s trying to leverage its first model into ever cheaper, higher-volume vehicles. So why are VC firms giving Fisker the time of day?

Fisker Parts Ways With Ener1, Hooks Up With A123

Battery firm Ener1/EnerDel, which recently brought the EV firm Th!ink back from bankruptcy, has lost the battery contract for Fisker’s Karma luxury EV. According to Schaeffersresearch, Ener1 “decided it would be better pursuing higher-volume battery supply deals when larger automakers begin rolling out their versions of electric cars.” Says Ener1 CEO Charles Gassenheimer, “we have some capacity constraints on our side. We’re interested in high volume programs in the future.” The public story is that due to Ener1’s Th!nk tie-up, Fisker’s October sales roll-out was too much, too soon. The real story illustrates the complicated relationships emerging between EV firms and battery suppliers.

Siry Slams DOE Loan Program For "Stifling Innovation"

Former Tesla PR honcho Daryl Siry lays into the Department of Energy’s Advanced Technology Vehicle Manufacturing Loan program (ATVML) at Wired’s Autopia blog, taking the $25b program to task for “stifling innovation.” At its core, his argument is a simple one:

Startup companies that enjoy DOE support, most notably Tesla Motors and Fisker Automotive, have an extraordinary advantage over potential competitors since they have secured access to capital on very cheap terms. The magnitude of this advantage puts the DOE in the role of kingmaker with the power to vault a small startup with no product on the market -– as is the case with Fisker — into a potential global player on the back of government financial support.

As a result, the vibrant and competitive market for ideas chasing venture capital that has been the engine of innovation for decades in the United States is being subordinated to the judgments and political inclinations of a government bureaucracy that has never before wielded such market power.

All of which sounds very TTAC… in fact, our lengthy Bailout Watch series began with a similar analysis of the ATVML program (albeit with a Detroit-focused twist). Unfortunately, Siry’s intentions in this case are questionable… as are his conclusions.

Recent Comments