#Trade

U.S. Gives German Auto Industry Zero-tariff Proposal, Merkel Receptive

The fresh threat of new automotive and parts tariffs from the United States has everyone up in arms. We recently published an exhaustive list of comments manufacturers and local governments made to the U.S. Commerce Department. They, along with suppliers, universally despise the idea and are doing everything in their power to convince the Trump administration to reconsider. Many are even discussing the grim prospect of layoffs and suspending investments.

However, the president remained firm on doing whatever it takes to bolster domestic production and U.S. automotive exports while the world tried to make sense of his strategy. Was this a madman playing hardball and gambling with the industry’s future, or the work of a master dealmaker forcing others to come to the table? Perhaps a little of both?

Earlier this week, the U.S. ambassador to Germany told German car executives that President Donald Trump would suspend threats to impose tariffs on cars imported from the European Union if the European Union lifts duties on U.S. cars. But the wildest part of all of this is that both the automakers and the German government seem to be in support of it.

An Exhaustive List of Everything Automakers Want You to Know About Trump's Import Investigation (Hint: Higher Prices, Fewer Jobs)

It’s no secret that the automotive industry has come out universally against the Trump administration’s proposal to increase import tariffs. Numerous manufacturers weighed in independently on the issue as trade groups rise in opposition to the U.S. Commerce Department’s national security investigation.

The industry’s claim that imported vehicles don’t pose a risk to the wellbeing of the United States seems to have fallen on deaf ears. Threats that the prospective import duties on parts could result in fewer, more-expensive automobiles being produced domestically have been heard — and rebuked — by President Trump.

“What’s really going to happen is there’s going to be no tax,” he told Fox News in a weekend broadcast. “You know why? They’re going to build their cars in America. They’re going to make them here.”

However, automakers, parts suppliers, and even local governments have submitted comments to the Commerce Department ahead of the hearings scheduled for July 19th — and they’re all incredibly negative.

Whatever Trump Decides, Fiat Chrysler's Prepared for What Comes Next

Without a functional plan, each episode of the A-Team would have ended with four funerals. For Fiat Chrysler, however, the solution to its problem doesn’t involve welding armor plating to a series of scrapyard vehicles while the guy from Breakfast at Tiffany’s lays down covering fire with a Ruger Mini-14.

FCA’s main concern involves the current occupant of the White House, and what his proclamations could mean for the automaker’s bottom line. A 25-percent tariff on imported vehicles could erase nearly a billion dollars in profit each year.

Don’t worry — FCA’s working on a plan.

Trade War Watch: Mazda Joins Toyota in Condemning U.S. Tariff Proposals

Automakers are not thrilled with the White House’s current interest in automotive tariffs. With factories scattered across the globe, no major manufacturer would go untouched by the proposed increases in import duties or the retaliatory tariffs foreign governments may issue in response.

There’s a lot to lose from a financial perspective. According to a recent analysis from Evercore ISI, Fiat Chrysler would take an annual hit of $866 million if the United States placed a 25-percent import tariff on cars. Considering that other automakers stand to lose at least that much, it’s unsurprising they’ve begun raising their corporate voices over the matter.

Granted, the FCA example is a worst-case scenario for that particular brand, but even a lesser tariff would see a profit loss of hundreds of millions. For an automaker like Mazda, the loss would be far worse.

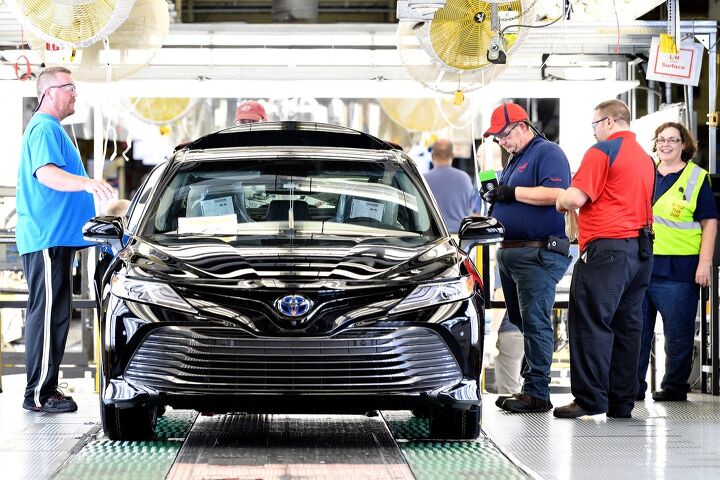

Love Tariffs? Prepare to Cough up an Extra $1,800 for a Camry, Toyota Warns

Toyota’s not going silently into a potential future where tariffs are as prevalent as man buns and tattoos in a brewpub. In its submission to the U.S. Commerce Department, Toyota wants the government to know it’s a standout business, and that a tariff on imported automobiles and auto parts would backfire.

Even for vehicles built in the U.S., American buyers would face a steep price hike, Toyota claims. Care to fork over an additional $1,800 for a Kentucky-built Camry? Meanwhile, a Canadian supplier association representative warns of “carmageddon” if the tariffs come to pass.

Ailing Motorcycle Industry Could Be Canary in Coal Mine for Automakers - Part Two

Last week, we discussed how the motorcycle industry’s total failure to entice new riders for over a decade has come back to bite it in the ass. Two-wheeled ownership declined drastically in the United States after the Great Recession and never really bounced back. Blame a disinterested population of youngsters with less discretionary funds and few entry-level options to consider.

I speculated that automakers could be on a similar path, despite the passenger car segment being more of a necessity for average commuters and less apt to collapse outright. But that isn’t to presume they might not be subject to similar pitfalls, and we’ve a new one to consider. Harley-Davidson, which serves as the poster child for the motorcycle industry’s current crisis, recently announced it will end all U.S. production of motorcycles sold in Europe.

Those bikes will now be manufactured overseas. The company said in a regulatory filing with the U.S. Securities and Exchange Commission that retaliatory tariffs levied by the European Union on motorcycles exported from the U.S. jumped from 6 percent to 31 percent. Harley-Davidson’s already expensive products come at an additional premium in Europe, and the the company estimates the new fines will add another $2,200 per motorcycle, on average.

U.S. to Hit Chinese-built Vehicles With 25 Percent Tariff; China Fires Back

Just in time for the weekend, an escalation in the ongoing trade wars has seen the Trump administration announce a 25 percent tariff on $50 billion worth of goods imported from China. These tariffs include automobiles. For its part, China retaliated by applying a further 25 percent tariff on a similar amount of American goods, including automobiles.

The move comes less than a month after China announced a plan that would lower import duties and eventually allow foreign automakers to set up shop without a joint Chinese partner. Of course, that was then, and this is now.

Trade War Watch: Japan Gets Vocal Over U.S. Tariff Threats

While the Japanese government has walked on eggshells when discussing trade issues that are transforming the globe into an angry beehive, the nation’s automakers have been more forthright. However, they’re both getting increasingly vocal as the situation escalates.

As the United States and Japan head into trade discussions scheduled for July, it’s beginning to look like everyone will come out swinging — especially when it comes to the automotive industry. Last month, the White House launched a national security investigation into car and truck imports that could lead to new tariffs on some of Japan’s biggest U.S.-bound exports.

Japanese Finance Minister Taro Aso was uncharacteristically negative toward the current U.S. trade policy during a Group of Seven finance leaders’ gathering held last week. “It’s deeply deplorable,” Aso said. “Inward-looking policies involving one-sided, protectionist measures benefit no country.”

Looks Like NAFTA Renegotiations Aren't Happening This Year

Governance is one hell of a slippery fish. While you want your elected officials to assist in helping the nation evolve with an ever-changing society, you don’t want a deluge of contradictory and ill-planned laws mucking things up. That’s why the best progress is carefully measured and negotiated. But something has to happen eventually or you begin wondering what we (and the various lobbies) are paying these dingbats the big bucks for.

For example, the North American Free Trade Agreement looks like it’s about to be abandoned until sometime after 2019. After negotiations missed numerous self-imposed deadlines, U.S. House Speaker Paul Ryan said Congress needed a notice of intent to sign by roughly May 17th if anything was to be finalized for 2018. That date came and went. Now, everyone appears to have thrown their hands up, with practically every country on the planet currently considering retaliatory tariffs against the United States.

Steel of a Deal: BMW Looking at Sourcing More Carbonized Iron From U.S.

As nations continue plotting how to best stab each other in the back in the wake the United States’ decision to impose steeper tariffs on aluminum and steel, manufacturers have to find a way to roll with the punches. Domestic BMW dealers have begun crapping their designer britches over fears that 3 Series models will suddenly host MSRPs in excess of $60,000 if the Trump administration follows through with a threat to impose high import duties on cars.

While we don’t know if the 25 percent import tariff on cars will come to pass, we do know the very real steel tariffs will shrink the profit margin of many vehicles. However, BMW is one of the first automakers we’ve heard discussing the purchase of more U.S. steel to mitigate costs.

French President Convinced Trump Wants to Kill German Cars; Steel Tariffs Strike U.S. Allies

There’s been quite a bit of the old “he said, she said” as the global trade war between developed nations coalesces. Germany has not covered U.S. President Donald Trump’s trade policy favorably, not that it has much reason to. His new tariffs on imported steel and aluminum has tested relationships with numerous countries and, while it isn’t the biggest exporter of metal to the United States, Germany has something to lose. Likewise, proposed duties on passenger vehicles have sincerely rubbed Deutschland the wrong way.

However, the issue was further complicated this week after a gossipy report surfaced claiming Trump told French President Emmanuel Macron in April that he would continue hampering the European auto manufacturers until there are no Mercedes-Benz vehicles driving in America.

Trade War Watch: U.S. Public to Have a Say on Auto Import Threat

There was a mighty blowback against the Trump administration’s suggestion to elevate tariffs to as much as 25 percent on all foreign-built passenger vehicles.

Already reeling from fresh import fees on aluminum and steel, Europe expressed its collective distaste on new taxes while Japan vowed to plead a strong case for itself. Meanwhile, prominent politicians and two of the largest automotive trade groups in the country came forward to condemn the plan, stating it was “confident that vehicle imports do not pose a national security risk” to the United States.

While the administration has already launched its investigation to determine whether vehicle and auto part importers threaten the industry’s health and ability to develop advanced technologies, the government noted that a second opinion wouldn’t hurt. Announced on Tuesday in the Federal Register, the the Commerce Department will allot two days in July for public comments on the matter.

Trade War Watch: Automakers Respond to U.S. Import Investigation, Japan Keeps the Faith

President Trump announced a security investigation into auto imports last week, tasking Commerce Secretary Wilbur Ross with the job. His goal will be to determine what effects imported vehicles have on the national security of the United States under Section 232 of the Trade Expansion Act of 1962 — which sounds like a monumental and rather complex task.

Basically, Ross will examine whether or not the U.S. can get away with escalating automotive tariffs. That’s a touchy subject, considering how contentious global trade has become in recent months. Worse yet, the 80-year-old commerce secretary will have to continue promoting American businesses and industries outside its borders while deciding on an issue few trade partners will be happy with.

Automakers aren’t thrilled either. After Trump announced the investigation, the Association of Global Automakers and Alliance of Automobile Manufacturers both said they didn’t believe vehicle imports posed a national security risk. “To our knowledge, no one is asking for this protection. If these tariffs are imposed, consumers are going to take a big hit,” said John Bozella, President of Global Automakers, in a statement. “This course of action will undermine the health and competitiveness of the U.S. auto industry.”

Trade War Watch: Trump Launches National Security Investigation On Auto Imports

President Donald Trump issued a tweet promising car manufacturers good tidings on Wednesday. “There will be big news coming soon for our great American Autoworkers,” he said. “After many decades of losing your jobs to other countries, you have waited long enough!”

Later that same day, the administration announced it had launched a national security investigation into car and truck imports under Section 232 of the Trade Expansion Act of 1962. The Commerce Department explained that the probe would investigate whether imported vehicles and parts threaten the domestic industry’s wellbeing, taking into account its ability to develop new technologies and the impact of tariffs.

“There is evidence suggesting that, for decades, imports from abroad have eroded our domestic auto industry,” Commerce Secretary Wilbur Ross said.

Trade War Watch: China to Reduce Import Tariffs for Cars and Components

China has announced plans to slash import fees on automobiles to 15 percent starting this July. While the tariff currently rides high at 25 percent, the country’s Ministry of Finance said reducing it was part of an intentional effort to open up China’s markets and spur development within the local automotive sector.

It may also have been part of a peace offering. President Donald Trump has been pretty clear on China’s trade policies with the United States, frequently referring to them as unfair. The U.S. imposes a svelte 2.5 percent fee on imported vehicles — unless we’re talking about trucks. “Does that sound like free or fair trade?” Trump tweeted last month. “No, it sounds like STUPID TRADE — going on for years!”

Recent Comments