#StockPrice

Volkswagen Throws Down in Bid to Buy Navistar, Create Heavy Truck Giant

When they’re not preparing to sell an ultra luxury super car brand or creating a new line of electric vehicles, they’re planning a big time merger for a larger piece of the heavy-duty truck market.

It’s only gonna cost them a few billion dollars.

Ford CEO Jim Hackett Not Going Anywhere, Says Ford CEO Jim Hackett

A rocky past year hasn’t dislodged Jim Hackett from his lofty perch in the Glass House, nor does the CEO feel he’s destined for the door. This assertion comes after a dismal earnings report born of recalls, a botched product launch, and ongoing streamlining efforts, the latter of which hasn’t given Ford’s stock the bounce many had hoped for.

Why does Hackett feel so confident? Friendship.

Hackett's Much-needed Stock Boost Is Nowhere in Sight

It’s generally agreed that former Ford CEO Mark Fields was shown the door after failing to turn around the company’s steadily declining stock, but his successor hasn’t had any success on that front, either.

Jim Hackett took over in May of 2017 and, despite an ongoing cost-cutting program and numerous new model (and technology) promises, Ford’s share price shows no lift. Wednesday’s earnings call was easily the worst of Hackett’s tenure.

Buy Ford Stock for the F-150 Alone, Morgan Stanley Tells Investors

It’s no secret Ford Motor Company cut its previous CEO, Mark Fields, loose after the company’s stock price fell 40 percent during his time at the helm. Eager to attract investors, Fields’ superiors must have looked at General Motors’ and Tesla’s valuation and wondered, Dammit, if a very profitable company and a very unprofitable company can do it, then hell, so should we.

Out the door Fields went. Since taking the big chair in Dearborn, CEO Jim Hackett has pissed off automotive purists with his “future cities” and mobility talk, and word that the Mach 1 will return as an electric crossover hasn’t done anything to endear him to the pony car crowd. The new Mustang Bullitt does not erase this sin.

Animosity aside, Hackett has managed to place a checkmark next to a top item on his to-do list: get Wall Street’s attention.

With the Model 3 Out of the Bag, Tesla Investors Worry (While Musk Won't Stop Talking About 'Hell')

The production Tesla Model 3, revealed in full at a Friday evening handover ceremony, is an impressive vehicle, but it’s also the California automaker’s most important vehicle. With 220 miles of range in stripped-down base trim, or 310 miles for the starting sum of $44,ooo (the only version available at launch), the curvaceous sedan has no shortage of fans. It’s also facing no shortage of threats.

The company’s future as a mass-market “disruptor” of the American automotive landscape hinges on the Model 3’s trouble-free production at Tesla’s Fremont assembly plant, as well as timely deliveries to the half-million reservation holders. Unforeseen quality issues, a breakdown in the supply chain, or worker strife could all conspire to give the vehicle — and company — a black eye.

After a year spent giving investors everything they wished for, the company’s once-skyrocketing stock isn’t on the same firm ground as before. The first trading day after the event reflected this. Investors are nervous about a number of things: the model’s easily inflatable price, the company’s extremely lofty production target, and CEO Elon Musk’s repeated mentions of “hell.”

Fall Guy: Tesla Stock Dives as Storm Clouds Rain on Musk's Parade

If Tesla stock was an airplane, it would have left Earth’s atmosphere sometime this spring. By June, that aircraft — let’s call it the Model P — would have been within striking distance of Mars. Indeed, Tesla investors made out like bandits as the company’s shares soared and its market cap sailed past that of Ford and General Motors, making it the most valuable domestic automaker.

For a while, it seemed nothing could stop Tesla’s meteoric rise. Not labor strife, not worries about the Model 3’s production timeline, not a cracked A-pillar on a freshly delivered Model S, not Model X doors trapping people inside a burning vehicle, not allegations of subpar working conditions, nothing. Tesla may as well have tried buying the rights to the word Teflon.

Well, CEO Elon Musk said it best himself in May. The company’s market valuation was “higher than we have any right to deserve,” he told The Guardian, a month before Tesla shares rose to a record $383.45. As the saying goes, “What goes up…”

Ford Likely to Eliminate 10 Percent of Global Workforce: Report

The Ford Motor Company is allegedly preparing for a sweeping reduction of its global workforce. Harder days for the auto industry have been a long time coming, but reports claim the impending layoffs are specifically related to shoring up finances and turning around the company’s lagging stock valuation — meaning Ford could be the canary in the coal mine or a lone company desperate to bolster its own profitability and get angry shareholders off its back.

While the automaker has not yet confirmed the cuts, there is every indication an announcement will be made soon. When confronted with the matter, representatives have been careful to make noncommittal statements and doubly cautious not to deny anything.

“We remain focused on the three strategic priorities that will create value and drive profitable growth, which include fortifying the profit pillars in our core business, transforming traditionally underperforming areas of our core business and investing aggressively, but prudently, in emerging opportunities,” Ford said in an official statement. “Reducing costs and becoming as lean and efficient as possible also remain part of that work. We have not announced any new people efficiency actions, nor do we comment on speculation.”

What's Working at Ferrari: Profit Rises Along With Demand

Thanks to the increasing wealth of the world’s elite, supercars have remained in fashion. Ferrari profits surged upward in the first quarter of 2017 as the Italian automaker continued a scheme designed to gradually accelerate volume.

The brand’s net income over the first three months of 2017 climbed to 124 million euros ($135 million) from 78 million euros during same period last year. Meanwhile, overall revenue increased 22 percent to €821 million, helped largely by engine sales to Fiat Chrysler’s Maserati — the car you buy when you wanted a Ferrari, but fell just shy of being able to afford one.

Some Good News for Volkswagen Owners' Panicky Shareholders

After Volkswagen announced last week that it would cut dividends by 97 percent due to the financial fallout of the diesel emissions scandal, there’s a ray of light for those who have shares in the company’s owner.

Porsche Automobil Holding SE, the investment vehicle of Volkswagen AG’s ultra-wealthy owner family, said it will front the cash to allow shareholders a bigger return, according to Bloomberg.

Tesla's Biggest Cheerleader Thinks Model X May Be Overpriced

Morgan Stanley analyst Adam Jonas issued a lower target for Tesla on Wednesday, saying the automaker’s SUV price tag is too hefty for the carmaker to meet its production volume goal for 2016.

Jonas wrote that the $130,000 SUV is just too pricey (via Business Insider):

Even allowing the Model X (average transaction price) to decline over time through the introduction of lower-spec models leaves what we believe to be a higher-priced vehicle than we expected that may struggle to meet the volume expectations of the market and our forecasts.

If you remember correctly, Jonas was the analyst that called for Tesla’s stock to effectively double because he had a good idea for the automaker, which he said was the world’s most important.

Panasonic, Partners Plan To Invest $1 Billion In Tesla Gigafactory

In the wake of Tesla shares hitting an all-time high of $259.20 after Morgan Stanley raised its target price to $320/share, battery maker Panasonic is gathering a few partners to go all in on a $1 billion investment in the automaker’s Gigafactory battery production plant.

Treasury Won't Sell GM Until Stock Improves. GM To The Rescue?

Bloomberg reports that a “person familiar with the matter” says the US Treasury won’t sell its remaining stake in GM as long as the automaker trades below its $33/share IPO price. Previously the government’s auto team had said it would not try to “time the market” and our analysis showed that the Treasury was likely to sell sometime late this Summer. But it’s been months since GM spent more than a few days above its IPO price, indicating that Treasury may be waiting considerably longer if the IPO-price floor is set in stone. And with $36.5b in cash equivalents on hand and only $5b in debt, GM’s $45b market cap is hardly encouraging… especially with investors waiting for The General to match Ford’s profitability levels. Heavier discounts mean a lower operating profit for GM in the US market, and the first quarter shows a $1b swing in pricing between the two firms (with Ford improving $700m and GM dropping $300m) according to Bloomberg. Lower finance earnings are also holding The General back relative to Ford. So, what’s GM’s response?

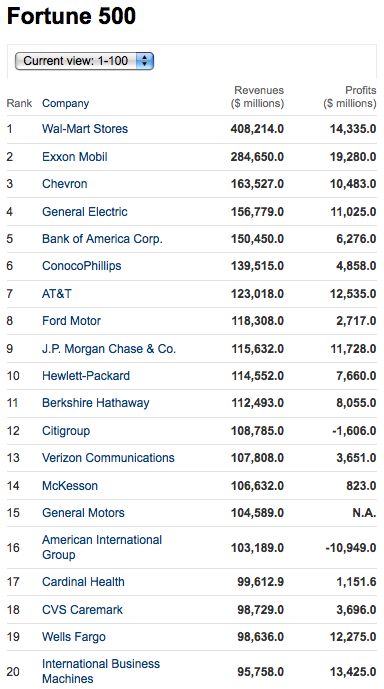

Is GM Worth More Than Ford?

Since GM has only recently come out with GAAP-approved financials, determining the company’s value isn’t easy. Still, The Detroit Free Press‘s Tom Walsh reckons The General is worth more than Ford, despite the fact that GM recently fell out of the Fortune 500’s top ten (and below Ford) for the first time in its 100+ years of history. What gives?

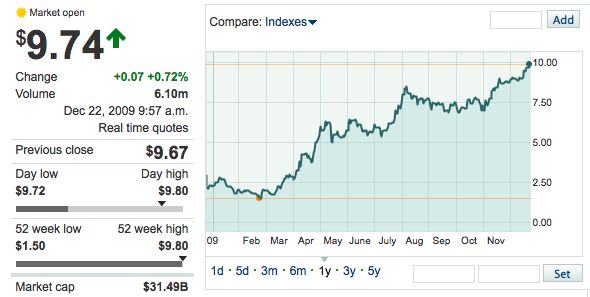

Is Ford's Stock Price Sustainable?

The Wall Street Journal‘s Liam Denning figures it isn’t. He writes:

Ford expects to resume profitability in 2011, and the consensus forecast is for per-share earnings of $1.13. The implied price/earnings multiple of 8.6 times doesn’t sound too demanding. But as Chris Ceraso of Credit Suisse points out, it translates to a margin of earnings before interest, tax, depreciation and amortization of nearly 10%, something Ford hasn’t enjoyed since the late 1990s.

Recent Comments