#SecuritiesAndExchangeCommission

SEC Subpoenas Faraday Future Executives

Several executives from perpetual automotive startup Faraday Future have reportedly been subpoenaed by the U.S. Securities and Exchange Commission as part of an investigation into inaccurate statements made to investors. Though, considering the nameplate’s history, it would be impossible to assume which item the SEC will be focusing on thanks to FF’s exceptionally long history of industrial misgivings.

We’ve covered Faraday Future’s long and bizarre story from the early days of delivering half-baked, though otherwise impressive, concepts to its more recent status as an automaker in the ethereal sense. It’s promised the moon and only managed to deliver a handful of production husks that never surpassed the body-in-white phase and some “production-intent” prototypes of the FF91. Though the larger story is the SEC’s sudden interest in electric vehicle startups that went public via mergers with blank check firms, better known as special purpose acquisition companies (SPACs), over the last two years.

Report: Elon Musk and Brother Face Insider Trading Probe

The Securities and Exchange Commission (SEC) is reportedly investigating whether stock sales by Tesla CEO Elon Musk and his brother, Kimbal Musk, violated insider-trading rules.

Launched in 2021, the probe is looking into shares sold by Kimbal valued at $108 million one day before Elon polled Twitter to see whether or not he should offload 10 percent of his stake in the company, suggesting he would run with the results. Though the tweet itself was a snide way of discussing proposals from Democrat legislators that would have imposed new taxes on unrealized capital gains, effectively money that doesn’t yet (and may never) exist.

Nikola to Pay $125 Million to Settle Fraud Charges, Founder in Dutch

Nikola Corp. has agreed to pay $125 million to settle charges levied by The Securities and Exchange Commission (SEC) that the company actively defrauded investors by providing misleading information about its technical prowess, production capabilities, and general prospects.

The settlement comes after a salvo of civil and criminal charges were launched against Nikola’s founder Trevor Milton, who got in trouble for convincing investors that the prospective automaker had fully functional prototypes boasting technologies other companies would have envied when that wasn’t actually the case. Milton was chided for using social media to promote false claims about the business, with his pleading not guilty to fraud charges brought up by the Department of Justice in July.

Securities and Exchange Commission Checking in on Lucid Motors

Lucid Group Inc. has been subpoenaed by the U.S. Securities and Exchange Commission (SEC) which is on the prowl for any documentation relating to its merging with a special purpose acquisition company (SPAC). Known colloquially as “blank-check firms,” these organizations literally exist to be combined with existing companies as a way to pump the stock and spur investments.

But they’ve gotten a lot of negative attention following a glut of EV startups garnering impressively high valuations based on little more than a business proposal. Those seeking an example need look no further than Nikola Corp, which was outed as having grossly overpromised on its technological capabilities and production acumen after raking it in on the stock market. As a result, financial regulators have become increasingly skeptical of SPACs and want to make sure everything going on with Lucid is above board.

Nikola Responds to Criticisms of Fraud

Following a scathing report from Hindenburg Research that called Nikola a fraudulent company largely dependent upon the blind excitement surrounding electric vehicles, the accused has finally issued a response. On Monday, Nikola released a bulleted letter suggesting the report was the act of an opportunistic short seller that was attempting to take advantage of the period immediately proceeding the announced partnership with General Motors. While Hindenburg didn’t exactly hide that aspect of itself in its own report, it frames the business as only profiting off companies that weren’t above board to begin with. It also received support from Citron Research, which said it likewise thought Nikola needed to be scoped out by the Securities and Exchange Commission (SEC) and promised to help pay for half of any legal fees incurred as a result of Hindenburg’s reporting.

Meanwhile, Nikola was crafting its rebuttal after founder Trevor Milton explained he had to wait on a comprehensive response because he was already in contact with the SEC. As his constant Twitter updates started to become counterproductive, this was likely a wise decision. The response dropped on Monday, clearing a handful of items up while making a bunch of other aspects seem even more suspect.

Hertz Stalls Stock Sale Amid Market Madness

The Securities and Exchange Commission has urged the recently bankrupted Hertz to halt the sale of stock. The rental agency had hoped to raise half a billion on the sale but repeatedly warned that would-be buyers were gambling, as the stock may soon be worthless.

Bizarrely, this hasn’t discouraged investors from glomming onto shares of bankrupt and near-bankrupt companies. Despite the global economy supposedly hurdling into a recession and mass unemployment, Wall Street hasn’t signaled that anything is amiss.

Still, the SEC has grown concerned with the trend and decided to address them with Hertz, according to a recent filing. Trading of Hertz Global Holdings Inc. was halted on Thursday, placing investors in a holding pattern as everyone speculates whether the bankrupt car renter will have to revise its plan to raise cash by selling new shares.

Securities and Exchange Commission Interested in BMW

BMW Group revealed this week that it is under investigation by the U.S. Securities and Exchange Commission following a report of a probe related to the company’s sales practices. A spokesperson for the automaker confirmed the situation on Thursday, saying BMW was in full cooperation with authorities and their investigation.

The probe was reported on earlier in the week by The Wall Street Journal, which had insider sources alleging the company had manipulated sales figures. The SEC is specifically worried that BMW had been engaging in “sales punching” by allowing dealers to register cars moved onto lots as sold to artificially boost sales figures.

Amid Lawsuit, SEC Investigation, Musk Says Tesla's Private Funding Will Come From Saudi Arabia

Last week, Tesla CEO Elon Musk announced his intention to take the automaker private. But speculation quickly arose that the claim was just a clever ploy to drive up the company’s share price and burn short sellers, a group Musk seems to have a particular disdain for. This resulted in a shareholder complaint, filed Friday as a securities-fraud class action in federal court in San Francisco, alleging he lied to manipulate shareholder prices.

However, the Securities and Exchange Commission was already investigating the matter at the time of the lawsuit’s filing. While the bulk of the initial investigation involved asking Musk if he was lying, it’s presumably advanced in scope and complexity since then. The lynchpin to the whole issue is whether Tesla actually secured the billions in funding necessary to go private. Even though the CEO said the money is real, he did not specify who would provide it.

That changed on Monday morning, when Musk pointed to oil-rich Saudi Arabia. But it’s not as simple as it sounds.

SEC Investigating Tesla for Failing to Notify Investors of Fatal Crash

Was the fatal May crash of a Tesla Model S driving in Autopilot mode significant enough for the automaker to inform its shareholders? The Securities and Exchange Commission plans to find out.

The federal agency recently opened an investigation into Tesla to determine if the automaker broke securities laws by not notifying investors of the crash, according to the Wall Street Journal.

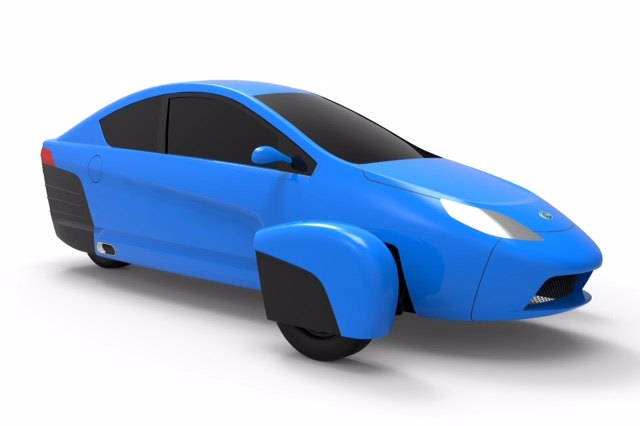

Elio Unbans Facebook Critics, Has $17 Million Pledged From Small Investors

Businesses aren’t the only groups of people who try to influence what we publish here. TTAC has been getting emails from a number of people who put deposits down on the yet-to-be-produced Elio trike, only to become disillusioned after production has been pushed back a number of times.

There are at least a couple of Facebook pages devoted to disaffected Elio enthusiasts that accuse Elio Motors and Paul Elio of misleading people. In addition to the delays, most of the complaints seem to center around the fact that the company is promoting and taking deposits for a $6,800 vehicle when Elio hasn’t yet raised enough money to start production of a car that Paul Elio admits doesn’t yet meet their advertised price point.

The company has been using social media to promote the enterprise and its critics have seized on Elio Motors’ Facebook page as a venue to express their displeasure. Words like “liars” and “scam ” have been tossed around. Consequently, a number of those critics say they have been banned from that page by Elio Motors.

Online Publication Believes Tesla Is Under SEC Investigation

Tesla may be under investigation by the Securities and Exchange Commission, based upon speculation by an online publication whose modus operandi involves filing Freedom of Information Act requests.

Privacy Concerns By Auto Lenders Shape SEC Asset-Backed Security Rule

It took four years, but the Securities and Exchange Commission has put the final touches on a rule regarding asset-backed securities — including auto loans and leases — and what information is given when a company or investor takes on an ABS.

U.S. Treasury Loses $11.2 Billion In Accounting Of GM Bailout

Detroit Free Press reports the U.S. Treasury lost $11.2 billion in taxpayer money from the rescue of General Motors back in 2008, up from the $10.3 billion estimated after the agency sold its remaining shares back in early December 2013. Part of the final figure came as a write-off of an $826 million “administrative claim,” which was found in a report by the Office of the Special Inspector General for the Troubled Asset Relief Program. The overall figure pales in comparison to the $50.2 billion given by both Bush and Obama administrations between 2008 and 2009 to GM as the automaker struggled through its financial crisis at the onset of the Great Recession.

GM Pulls Small Q1 2014 Profit, Barra One Of Time's 100 Most Influential People

Reuters reports General Motors announced in its regulatory filing Thursday that it was under the microscope of five different government agencies related to its numerous recalls as of late. Aside from investigations by the U.S. Attorney’s Office for the Southern District of New York, the National Highway Traffic Safety Administration, and both houses of Congress, the automaker revealed the Securities and Exchange Commission and an unnamed state attorney general’s office were conducting their own probes. The filing also acknowledged GM was under the gun of 55 pending class action lawsuits in the U.S., and five of the same in Canada. GM said they were working with all of the investigations, though the automaker did not say what the SEC was looking for in its probe.

Recent Comments