#PeakOil

Peak Oil, Meet Plateauing Demand

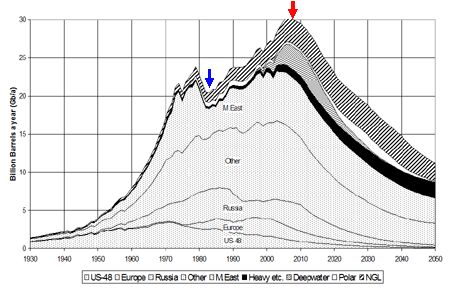

TTAC is no stranger to the topic of Peak Oil, but the theory has fallen by the wayside with the recent explosion in unconventional oil and gas. A study by the British think tank Chatham House argues that the biggest issue facing oil and gas producers in the coming century isn’t Peak Oil, but Peak Demand ( summary here).

Japan Trades Wastewater For Oil

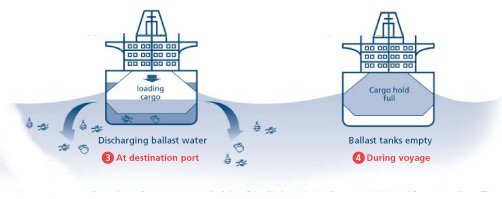

Oil and water supposedly don’t mix. Like a lot of conventional wisdom, this one is totally bogus. Without water, we wouldn’t have any oil. What do you think is in a supertanker when it goes back empty to Saudi Arabia or Prudhoe Bay? Water. It’s needed for ballast. Without it, the tanker would just pop out of the — water. About 60 million barrels of ballast water is shipped around the globe and is thrown away each day. Now, the Japanese have a better idea: They want to ship waste-water to oil-producing countries in the Middle East, and exchange it for crude oil. Say what?

German Govt. Study Warns Of Dire Post Peak-Oil Crisis: End Of Free Markets And Democracy

Here’s a cheery study on the effects of Peak Oil, which is widely considered to be happening…right about now (throw in a few more hours/months/years depending on how big of an optimist/denialist you are). Der Spiegel got their hands on a confidential study commissioned by the German military, which has not yet been sanitized approved for publication. It’s a bit explosive…might get the civilian population riled up and all. It warns of shifts in the global balance of power, the decline of importance of western nations (oil importers), as well as “the total collapse of the markets” and…gulp…even worse. Let’s go talk about 1970 Boss 302 Mustangs.

The China Syndrome: 50 Million Cars A Year?

Yesterday, we reported that China wants to be a market of 20m cars in 2012. We didn’t predict that, just reporting the news, ma’am.

A hue and cry ensued: “Can’t be!”

Commentator ohsnapback, who’s forte is lawyering, a much more complex field than economics, prognosticated an immediate burst of the Chinese bubble, with a mega tonnage of more than 100 times of our housing bubble. The argument was promptly defused. After all, China doesn’t borrow money. They lend it. Mostly to the U.S.

Then, commentator ra_pro rolled out the really big ordnance: “As I said many times previously: Demography is Chinese destiny as it is Japan’s.” If people would only stop prattling on about demographics, and would check their data first.

15m Or More Cars In China. How It Affects Peak Oil And Global Warming

It’s definitely official now. The last word in Chinese vehicle sales has the China Association of Automobile Manufacturers (CAAM,) and the CAAM has spoken. Vehicle sales in China last year rose 46.2 percent to 13.64m units. This is not surprising, but it is nonetheless reassuring that the 13.6m number TTAC had reported last week was only 40,000 short. It is equally official that China is the world’s largest auto market, ahead of the U.S.A. by 3m units, more or less.

Vehicle sales in December alone rose 91.7 percent from a year earlier to 1.41m units in China, the CAAM said. Passenger car sales jumped 88.7 percent in the last month to 1.1m units. Full-year 2009 China passenger car sales are up 52.9 percent in 2009 to 10.3m. If passenger cars alone would count, then the truck and SUV happy USA would look like a 3rd world country: According to Automotive News [sub], only 5.7m new “passenger cars” drove off U.S. dealers’ lots in 2009, slightly more than half of what the Chinese bought.

Will the sales boom continue in 2010? Not as mad as in 2009, expects the CAAM. The manufacturers association expects growth to continue at a more moderate pace of 10 percent. This would mean 1.36m units in additional sales, or a total of a little less than 15m. Merrill Lynch is a little more bullish and thinks that the Chinese market will grow to 15.5 million vehicles this year, the Nikkei [sub] reports. A horrific thought to those who are scared that Chinese will use all our oil, and that melting polar caps will destroy the value of our waterfront properties. Wait, it’s getting worse.

Recent Comments