#November2012

Best Selling Cars Around The Globe: World Roundup November 2012: When Hyundai Cracked Brazil

Hoping that you are all having a very Happy Holiday Season, my present to you guys today is the 9th installment of our much anticipated monthly rendezvous: the World Roundup.

If last month the focus was on China, Austria and Japan, in November all spotlights are on Brazil…

You can check out previous World Roundups here for March 2012 (“Has the Hybrid era started for good?”), April 2012 (“Big change coming from India”), May 2012 (“GM and Toyota Etios make headlines”), June 2012 (“Hyundai Santa Fe and Ford Focus shine”), July 2012 (“Geely CK writes history in Ukraine“), August 2012 (“The Subaru XV topples a legend in Switzerland”), September 2012 (“Ford Focus strong in China”) and October 2012 (“One Japanese in the Chinese Top 50”).

Had enough of the world and you just want to know which cars sell best in your own backyard? Easy. You can visit 171 countries and territories in my blog in the comfort of your own lounge. Just like that.

Back to our Roundup…

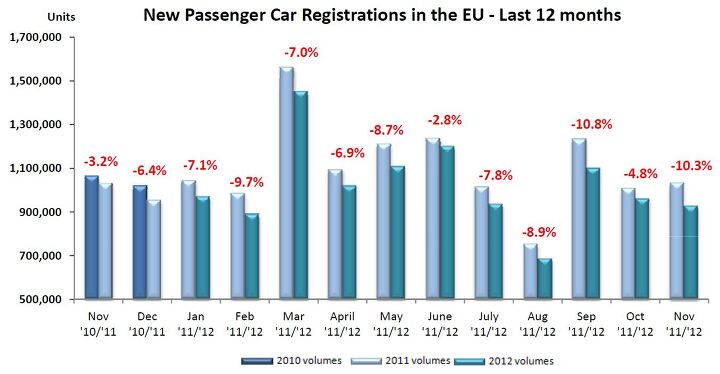

Europe In November 2012: Race To The Bottom

Car sales accelerate their decline in Europe. The market for new cars was down fourteen months in a row in November, dropping by 10.3 percent compared with November 2011, says the European manufacturers association ACEA. From January to November, 11.25 million new cars changed hands in the EU, 7.6 percent less than in the same period a year ago. Sales in Europe have not been that bad since 1993.

What Does Not Kill Us, Makes Us Stronger: Volkswagen Survives Nicely, Thank You

Volkswagen shows yet again that you are not automatically doomed just because you are a Europe-based carmaker. Its global group sales are up 10.4 percent to 8.29 million units from January to November, after a 11.7 percent rise in November.

Chinese Car Sales Recover

The world’s largest car market, China, has recovered a bit in November. Automobile sales were up 8.16 percent year-on-year to 1.79 million vehicles, production stood at 1.76 million units, up 3.92 percent, data released by the China Association of Automobile Manufacturers (CAAM) shows.

GM Strong In China

GM had a better November in China than at home in America. Back home, sales rose only 3.3 percent to 186,505 units in November. In China, the world’s and GM’s largest market, GM sold a total of 260,018 units across all joint ventures, up 9.7 percent compared to November 2011.

Dark Horse Best Analyst Of The Month

Each month, Bloomberg asks 15 or 16 analysts for their forecasts of the month’s sales data. But how good are they really? Knowing who has a good aim could make you a lot of money at the stock exchange, for instance. This is where TTAC comes in. Each month, we tell you who hit, who missed, and who is not even in the ballpark. Analysts who only give a SAAR and nothing else are being punished in this ranking. Will just a SAAR help you to know whether you should buy Ford or short GM? Thankfully, the number of lazy analysts diminishes each month. And here are this month’s winners:

November Sales: Another Strong Month, Not So Much For Some (Final Numbers)

Forecasters expected a strong November as far as U.S. light vehicles sales go, and they got a strong November. Data after the jump.

Japan In November 2012: Kei Cars Save The Month

Some forecasters expected Japan’s appetite for new cars to drop by more than 20 percent in the last quarter after government incentives expired in September. So far, it is not happening. Sales of new cars, trucks and buses declined a minuscule 0.4 percent in November. Elsewhere you may read that the market was down 3.3 percent, but they are not giving you the whole story. Sales of mini vehicles, or kei cars actually were up in November, pulling the market nearly completely out of minus territory.

And Here The Latest Sales Forecasts For November

Two days ago, we heard that TrueCar expects a whopper of a November. Now, Kelley Bluebook and Edmunds have submitted their forecasts also. All agree: This will be a whopper of a November. More or less.

TrueCar, Auto Execs Expect Very Strong November

Driven by a rebounding economy and an after-Sandy pop, auto sales in November will be be “highest since February 2008,” expects Jesse Toprak, senior analyst at TrueCar.com. Sales chiefs at major automakers agree.

Recent Comments