#November2010

European Car Sales, November 2010: Slowly Crawling Back To Normal

With the effects of the various scrapping incentives across Europe slowly working themselves out of the system, the worst appears to be over in Europe. According to the official numbers of the ACEA, registrations of new cars across the EU27 fell by 7.1 percent to 1,069,268 units in November. However, this November is above the 904,577 units sold in November 2008. From January to November, a total of 12,349,743 new cars were registered, or 5.7 percent less than over the same period of 2009. All in all, Europe seems to have weathered the carpocalypse much better than the New Country.

China In November 2010: Up 29.3 Percent, Probably Higher In December

Passenger car sales in China jumped 29.3 in November as people rushed to lock in incentives set to expire at the end of the year. Demand will most likely be even stronger in December. In November, the end of the incentives was just a rumor. A few days ago, the end of government handouts became official, and dealers already ran out of cars.

Sales In India Brisk

Domestic car sales in India rose 21 percent from a year earlier in November. India is no China yet. But as its per capita GDP has crossed the magical $1000, car sales are waking up with a vengeance. This is one rule I learned in this business, and it never fails. China has more than three times the per capita GDP of India, and you know what kind of a run that caused.

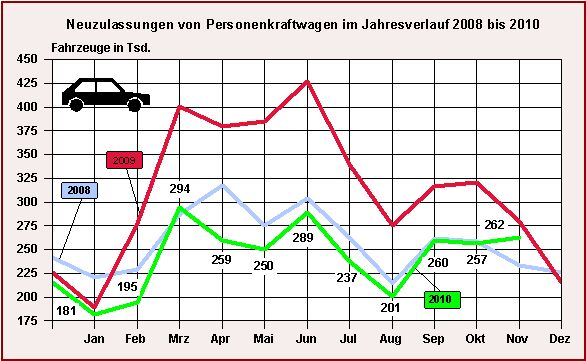

Germany In November 2010: Phew

Did you hear that sound? That was a sigh of relief coming from Germany. Germans are buying cars again. In November, they bought more cars than in October 2010, and even more than in November 2008. What’s more, November 2010 is only 6.2 percent below the Abwrackprämien-exaggerated November of the prior year. The usually very conservative Kraftfahrtbundesamt that released the official registration data even dares to prognosticate that “year and sales are expected to be 2.9 million cars.” Translation:

GM China's November Numbers, And A Deep Look In The Crystal Ball

GM China, our recently no longer so reliable oracle for the Chinese market, raised its November sales by 11 percent, compared to an absolutely batty November 2009. 11 percent are not the same growth as the 109.5 percent GM China had recorded in last year’s November, but how much battier do you expect them to get? The more meaningful number is that for the first 11 months of 2010: From January through November, GM’s China sales jumped 33 percent to a mind-blowing 2.17 million units. GM China will most likely close out the year in the 2.35 to 2.4m area – this is higher than the total sales of some of Europe’s larger countries, and definitely a whole lot more than GM sells back home. Better get used to it.

Japan In November 2010. Down 30.7 Percent

The Japanese are usually first to report last month’s sales numbers. This time: Very bad. New car sales in Japan fell 30.7 percent in November. After Japan’s generous subsidies were withdrawn, the market is down for the third straight month, and there is no end in sight.

You Are Looking At The U.S. Car Market

What is the difference between the November U.S. car market and my wife? The answer is: None. Edmunds says the U.S. annual sales rate for new vehicles in November will be essentially flat from the prior month.

Recent Comments