#June2015Sales

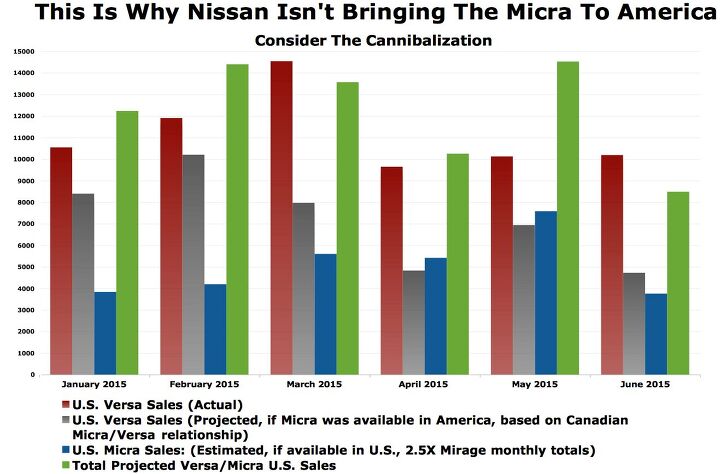

This Is Why Nissan Isn't Bringing The Micra To America

Nissan began selling the Micra in the northern part of North America at the end of April 2014. The Micra was properly available by summer, and over the last twelve months — through the end of June 2015 — 11,832 Micras were sold in Canada.

Could the Micra make it in America? Can we do anything other than report evidence which supports Nissan USA’s decision to leave the Micra to their neighbors in the north and south?

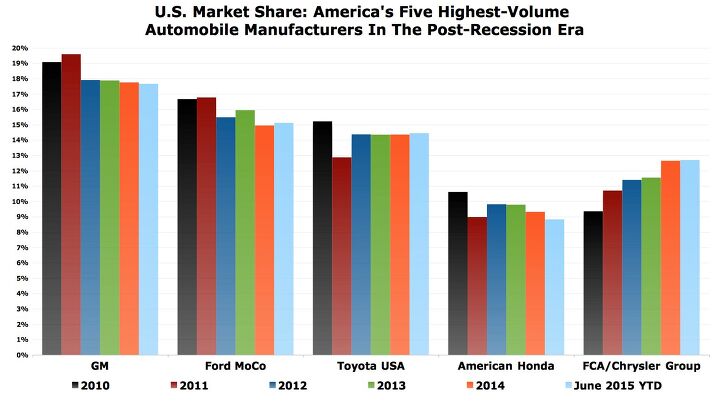

Chart Of The Day: Post-Recession Automaker Market Share In America

Since 2010 — when America’s auto industry was in tatters but also in recovery — General Motors, Ford Motor Company, Toyota USA, and American Honda have lost 5.5 percentage points of market share.

Through the first half of 2015, those four automobile manufacturers produced 56.1 percent of all new vehicle sales in the United States, down from 61.6 percent in calendar year 2010.

Chart Of The Day: Canada Loves FCA And Small Cars, But Not The Dodge Dart

FCA Canada only sold 220 Dodge Darts in June 2015, a 79-percent year-over-year decline. Through the first six months of 2015, Dart volume is down 55 percent to only 1,979 sales, one-fifteenth the total achieved by the best-selling Honda Civic and equal to just 1.1% of the compact car market.

The Dart’s market share in the United States, meanwhile, grew from 3.4 percent in the first-half of 2014 to 4.2 percent in the first half of 2015. Though no industry observer would suggest that the Dart’s U.S. uptick relates purely to increased desirability and demand – and not to cash allowances and fleet-friendliness – the car’s Canadian dive speaks volumes about FCA’s emphasis on light trucks and SUVs north of the 49th parallel.

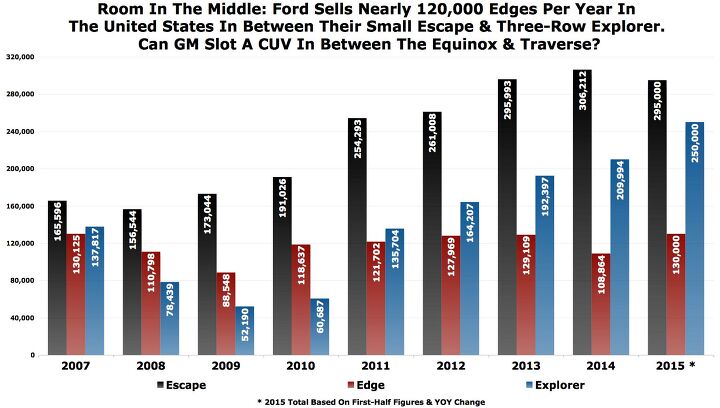

Chart Of The Day: Is There Room In The Middle For GM's Crossovers? Ford Says Yes

As General Motors prepares to carve out space in between their best-selling utility vehicle, the Equinox, and their large three-row crossover, the Traverse, Ford reports significant improvement with the launch of their second-generation tweener crossover.

U.S. sales of the Ford Edge jumped 44 percent to 40,083 units in the second-quarter of 2015. The May 2015 total of 14,399 units was the best May ever for the Edge, which slots in between the Escape, one of America’s best-selling utility vehicles, and rubs up alongside the longer, three-row Explorer.

Contrast: Volkswagen's U.S. Outpost Struggles As Volkswagen Canada Booms

Following 18 consecutive months of year-over-year decline, U.S. sales at the Volkswagen brand have improved in six of the last nine months.

Yet those U.S. sales improvements send up deceiving smoke signals. While Volkswagen’s volume increased 6 percent in June, for example, the brand’s 30,436-unit total represented an 18-percent drop compared with June 2013 and a 20-percent decrease compared with June 2012.

Chart Of The Day: Month After Month, Most Midsize Cars Are Posting Declining U.S. Sales

As U.S. sales of the best-selling midsize car — and best-selling car overall – declined 3% during the first-half of 2015, one would assume that an opportunity opens up for its nearest rivals. But while the Camry has fallen slightly, the Honda Accord tumbled 16% and the Nissan Altima slipped 3%.

Surely then, the second tier of candidates would make real headway? No, in the midst of this convenient moment, the Ford Fusion is down 7%. In fact, on a year-over-year basis, Fusion sales have declined in eight consecutive months.

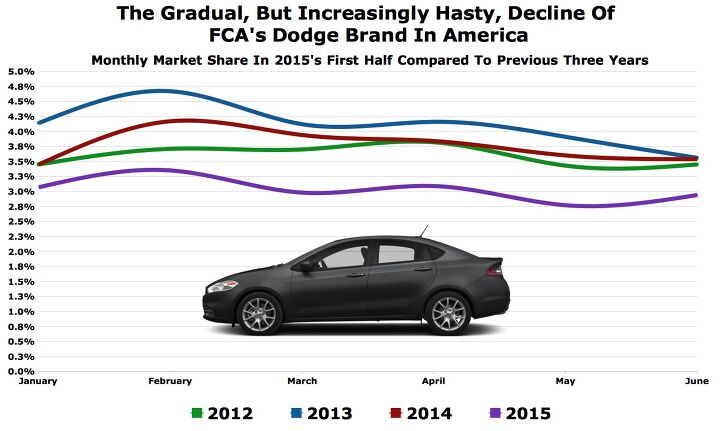

Chart Of The Day: The Dodge Brand's Decline Can Not Be Surprising To You

Dodge’s share of the U.S. market has been sliding with great consistency for years. Much of the blame for the dramatic drop-off in 2009 — Dodge’s market share fell from 5.9% in 2008 to 3.1% the next year — was a direct result of losing Ram trucks to a self-titled Ram division.

But even the post-Ram Dodge of today owns a significantly smaller portion of the market than the post-Ram Dodge of, for instance, 2013. Although America’s midsize car market is declining, it certainly does Dodge no favours that the brand now possesses no midsize car. The Chrysler 200 is now left to avenge the Avenger’s blood.

Chart Of The Day: 2015's First-Half U.S. Pickup Truck Sales Wars

U.S. sales of pickup trucks increased 10% through the first six months of 2015, a gain of more than 107,000 units over the span of 2015’s first-half.

Ford’s F-Series continues to be the category’s top seller, but F-Series volume has decreased in each of the last five months. Second-quarter sales slid 6.5%. As Ford properly equips its dealers with truck inventory and as the automaker figures out precisely how to price the new range of F-150s, we can expect to see F-Series numbers stabilize.

In the meantime, GM’s full-size twins have taken full advantage of the F-Series’ slide.

Chart Of The Day: America's 15 Best-Selling American Vehicles In The First Half Of 2015

Remember when the U.S. auto industry was very much an American auto industry? No? I don’t, either.

But there was a time when an American car was an American car because it was made by an American car company in America.

Chart Of The Day: U.S. Automaker Market Share In America – June 2015 YTD

General Motors generated 17.7% of the U.S. auto industry’s new vehicle sales in the first-half of 2015, a slight decline from the 17.8% market share earned by GM in the same period one year ago.

GM, the top-selling automobile manufacturer in the United States, posted a 3.4% year-over-year sales improvement through the first six months of 2015, but that was a full percentage point off the pace set by the industry as a whole.

Recent Comments