#June2012

Europe, Half Year Review: Bad News For French, Italians, Ford, And GM

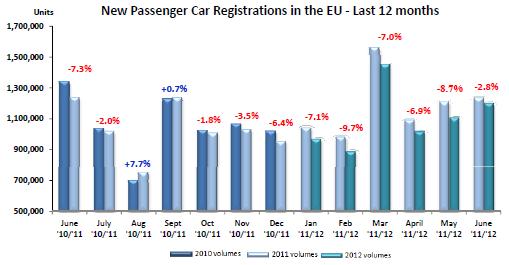

Europe’s new car market continues on its downward spiral with sales down 2.8 percent in June. Half year sales are down 6.8 percent across the EU, data released today by the European Automobiles Manufacturers’ Association ACEA show today. Some countries and automakers do much better, some much worse.

China In June 2012: Sales In A Crawl, But Not In Reverse

Growth of the formerly red-hot Chinese auto market is as slow as traffic during the Beijing rush hour. At least, there still is some growth. Sales of all automobiles in China are up 2.9 percent for the first half of the year to 9.59 million vehicles. Sales in June were up 9 percent. This according to data released by the by the China Association of Automobile Manufacturers (CAAM).

GM China Outpaces Slowing Market

Our patent-pending oracle for the Chinese market has spoken and predicts slight June gains for the world’s largest car market. GM China did this by announcing a 10.1 percent gain on 213,495 units sold in June.

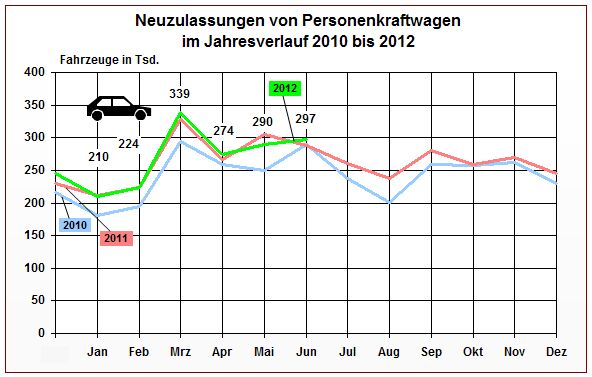

Germany In June 2012: Bucking The European Downtrend

Germany’s new car market recovered slightly in June. Sales were up 2.9 percent to units, Germany’s Kraftfahrtbundesamt reports.

Japan In June 2012: Up 43.6 Percent

Domestic sales of regular new cars, trucks and buses increased 40.9 percent in June, while sales of mini vehicles rose 48.4 percent on the year. Overall, Japan’s new motorvehicle market rose 43.6 percent on 505,342 units sold. The data compare with a post-tsunami June 2011.

Grade The Analysts: Audacious Apprentice Takes Top Spot

RankAnalyst GMFord Chrysler SAARSAAR DiffOEM DiffOverall1John Sousanis (Ward’s)12.0%8.0%18.0%14.00.6%6.1%6.7%2Jessica Caldwell (Edmunds.com)8.7%4.4%19.0%13.91.3%10.3%11.6%3Brian Johnson (Barclays)6.4%7.1%18.0%13.82.0%10.9%12.9%4Alec Gutierrez (Kelley Blue Book)7.3%1.4%20.0%13.91.3%13.7%15.0%5Emmanuel Rosner (CLSA)9.1%2.9%17.0%13.82.0%13.4%15.4%6Peter Nesvold (Jefferies)5.2%4.4%19.0%13.82.0%13.8%15.8%7Rod Lache (Deutsche Bank)7.0%1.4%19.0%13.82.0%15.0%17.0%8Patrick Archambault (Goldman)6.2%2.0%17.0%13.82.0%17.2%19.2%9Chris Ceraso (Credit Suisse)8.2%2.4%14.0%13.72.7%17.8%20.5%10Jesse Toprak (TrueCar.com)6.0%0.3%16.0%13.63.4%20.1%23.5%11Joseph Spak (RBC)7.7%5.9%NA13.91.3%108.5%109.8%12Adam Jonas (Morgan Stanley)NANANA14.00.6%300.0%300.6%13Alan Baum (Baum & Associates)NANANA14.00.6%300.0%300.6%14Jeff Schuster (LMC Automotive)NANANA13.91.3%300.0%301.3%15Christopher Hopson (IHS)NANANA13.82.0%300.0%302.0%Average7.6%3.7%18.0%13.8Actual15.0%7.1%20.3%14.1

Analysts polled by Bloomberg predicted June light vehicle sales to come in much lower. All analysts except one: John Sousanis of Ward’s predicted that this will be a good month. He nearly nailed the SAAR, and came closest to reality in his OEM forecasts.

Big June New Car Sales Jump: Strong Month, Or Strong Will To Succeed?

Chrysler Group up 20 percent, GM up 16 percent, Toyota up 60 percent. Across the board sales up 22 percent (see table.)

June sales of new cars and trucks come in stronger than the cautious estimates of analysts. Why? America’s most successful sales predictor thinks everybody needed to “make that quarter.”

Edmunds Issues June Sales Forecast: No Major Changes

JUNE 2012 SALES VOLUME FORECASTSales VolumeJune’12 ForecastJune’11May’12Change from June 2011*Change from May 2012GM233,987215,335245,2568.70%-4.60%Ford201,980193,421215,6994.40%-6.40%Toyota184,512110,937202,97366.30%-9.10%Chrysler143,521120,394150,04119.20%-4.30%Honda126,61083,892133,99750.90%-5.50%Nissan88,11371,94191,79422.50%-4.00%Industry1,270,9011,052,7721,334,13120.70%-4.70%*NOTE: June 2012 had 27 selling days

With only a few days until the end of the month, Edmunds issued its June sales forecast. Edmunds expects that 1,270,901 new cars will be sold in June, translating into a 20.7 percent increase compared to June 2011, and a 4.7 percent decrease from May 2012. The Seasonally Adjusted Annual Rate (SAAR) is projected to come in at 13.9 million light vehicles.

Ford Expects No Surprises From June. Rest Of Year Mixed

Ford expects June new car and truck sales to come in at the same rate as in May, and sees a cloudy rest of the year as the outlook for the economy remains mixed.

Recent Comments