#Ipo

Some Advice For Tesla's First Day Of Trading

Far be it from us to tell you to take Jim Cramer’s word as gospel… but he does seem to have Tesla’s IPO figured out. And now that the stock is public (NASDAQ: TSLA), he wants you to run away screaming. We find it difficult to disagree… but feel free to keep an eye on the stock yourself.

Tesla IPO Priced At $17/Share, Market Cap Estimated At $1.6b

A source tells Reuters [UPDATE: Tesla confirms in press release] that Tesla has

sold 13.3 million shares for $17 each, raising about $226 million. It raised the number of shares it hoped to sell by 20 percent. It had planned to sell 11.1 million shares for $14 to $16 each.

That’s more than the “as much as $213m” number floated earlier, but with a recent Toyota deal and an EV-infrastructure bill in congress, Tesla has as much wind at its back as it can ask for. But if investors do get to start trading Tesla stock starting tomorrow, they’ll have a gut check before long. Tesla lost $30m last quarter, and it the second quarter ends on Wednesday. If those numbers show another healthy loss, investors will look away knowing that they’re in a risky, long-term investment. But can a $1.6b market-cap firm really compete in development, design and manufacturing with the giants of the automotive world simply by taking in two times its 2009 revenue in one IPO?

GM Filing IPO Paperwork As Soon As Next Week

Tesla Revises IPO To $178m-$185m

How Big Will GM's IPO Be?

Ed does things that are bolder and bigger rather than small and timid. All things being equal, Ed would like it bigger versus small. But all things aren’t equal. He needs to get the government the best value for its stake, too.

Former AT&T exec James Kahan tells BusinessWeek what kind of IPO GM’s Chairman would prefer. Unfortunately for “Big Ed,” that’s not up to him. GM’s value must be determined by the market, and due to political pressure on the government to end its ownership of GM and Chrysler, it will have to happen as soon as possible. A fourth-quarter IPO with “about half of the government stake [being sold] to the 20 top institutional investors” is in the cards. So we know the government won’t get out of GM entirely in the IPO… but how much will the market give the Treasury for half of its 61 percent stake?

Quote Of The Day: Wall Street's Burden Edition

Handling [GM’s] IPO assignment is something of a vanity project for the Wall Street banks, given the relatively small fees the banks will earn through the process. One person familiar with the offering said that the banks may earn less than 1% of the overall deal. At a valuation of $10 billion, that would equal a total fee pool of $100 million.

The Wall Street Journal [sub]’s take on the forthcoming GM IPO. Persons anonymous tell The Journal that Morgan Stanley and JPMorganChase are the frontrunners in the vanity project sweepstakes. But as charitable as the one-percent arrangement seems, the Wall Street mavens have their work cut out for them…

Editorial: The Truth About GM's IPO

One might believe that GM’s forthcoming IPO marks the second coming of Christ. GM, once the world’s largest corporation, faced oblivion in the winter of 2009. The train wreck of this former company reemerged from burial last summer through the generosity of the US and Canadian taxpayer as a new company shorn of most of its former financial liabilities, unproductive assets, and brands it no longer could support. Everything that Jerry York (R.I.P.) told the automotive world in January 2006 that GM needed to do to survive back then finally came to pass. And now, it’s preparing an IPO to swap ownership from the governments to the public. Ed Whitacre and his team will get the credit for a most remarkable turnaround while Obama will bask in the light of his stewardship of public monies. Let’s get the story straight.

Treasury Hires Lazard As GM Moves Towards IPO

The Detroit News reports that the Treasury Department has hired Lazard Frères & Co. as an advisor to GM’s forthcoming IPO sale. And with news of the hiring comes confirmation that GM’s IPO really is coming soon: the investment bank will receive half a million dollars, according to the DetN, but that amount will drop to $250,000 if the IPO isn’t completed within one year. If you’re one of the GM boosters who believes that an IPO will repay all or most of the government’s investment in GM, it’s time to start saving those pennies. You have less than a year now to put your money where your mouth has been.

Did GM Lose Money Again In Q1?

Don’t ask Chairman/CEO Ed Whitacre. His only comments so far on GM’s Q1 2010 performance comes from a memo leaked to Reuters, in which he says:

In January, I said we could earn a profit in 2010, if everything falls into place. Our first quarter financial results will show us an important milestone, and I’m pleased to say that I anticipate solid operating results when we report our first quarter financials in May

“Important milestones”? “Solid operating results?” What the hell is Whitacre trying to say?Steve Rattner's Fuzzy Math: GM Worth $90b, Taxpayers Will Make Money

In a conversation with The WSJ [sub]’s Paul Ingrassia, former Car Czar Steve “Chooch” Rattner did some “back-of-the-envelope calculation” to show why he believes the US taxpayers will see their $50b “investment” in GM recouped when The General goes public sometime in the next year.

Here’s how Rattner gets to his latest calculation: Bonds of GM’s bankruptcy estate – known as Motors Liquidation – are currently trading around 30 cents on the dollar, according to Thomson Reuters. Those bondholders were owed $27 billion.

As part of GM’s restructuring, those bondholders were promised a 10% stake in GM when it goes public. In very rough calculations, those bonds are currently valued at about $9 billion (because they currently trade at around 30 cents and were originally worth $27 billion).

Assuming that $9 billion represented 10% of GM if it went public now that would imply GM had a value of around $90 billion. The taxpayer’s stake: 60% of that $90 billion, or $54 billion — Rattner’s magic number.

What's Wrong With Tesla? How Much Time Do You Have?

I’ve been warned before by the B&B not to read too much into the forward-looking statements in SEC filings, especially the ones where companies ruminate over all the things that could still go wrong with their struggling firms. These legal disclosures of worst-case-scenarios often reflect unlikely scenarios and can be downright misleading, so we held off from diving too deep into Tesla’s IPO S-1 filing [complete document here]. Others around the web have jumped in without compunction, and this week has yielded a steady drip of troubling revelations. It’s a wild and woolly collection of issues, but given that people are going to be asked to invest in this nightmare of a company, it’s only fair that we give the grievances an airing.

Tesla IPO in the Works?

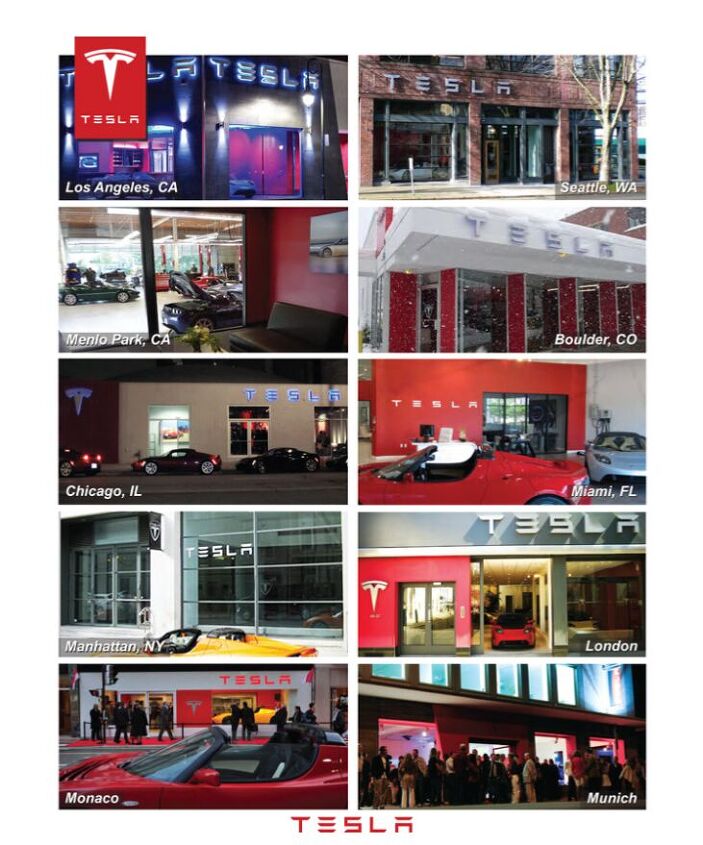

Reuters reports that Tesla is planning an Initial Public Offering, after postponing planned IPOs in 2008 and 2009. Tesla reportedly hopes to capitalize on the recent success of battery developer A123 Systems, on the assumption that the A123 IPO has raised interest in electric auto firms. According to one of Reuters’ sources, Tesla’s IPO filing could be made “within days.” And the Silicon Valley startup, which currently has only one product, the $100k+ Tesla Roadster, will most likely have to hurry. Both Nissan and General Motors plan to enter the electric car market this year, marking the initial entries by established auto OEMs into the American EV market. Both of their initial products, the estimated $30k Nissan Leaf and the estimated $40k Chevrolet Volt, will cost considerably less than Tesla’s estimated $50k Model S sedan and will beat it to market by at least a year. Acquiring funding after cheaper competing models go on sale could be extremely challenging for a boutique automaker like Tesla.

Bailout Watch 572: Government Fast-Tracking GM IPO, Taxpayer Screwing Confirmed

Ron Bloom, the defacto head of the government’s auto restructuring task force (or what’s left of it), tells Reuters that the government wants to hurry up a GM IPO in order to get out of the “investment” as soon as possible. And as we’ve predicted, this means taxpayers will be getting the fuzzy end of the lollypop.

Private markets would like to see us exit this investment, and I think they will be more comfortable if we’re on a sustained path out the door than if they think we’re going to try to market time it to maximize return.

And really, why would taxpayers expect any kind of a return from $50b dumped into one of the most prolific wealth destruction machines in recent economic history? So when will this IPO/giveaway take place?

GM Chairman Ed Whitacre: Fitting In Already

GM’s government-appointed Chairman of the Board was out and about last night, speechifying at Texas Lutheran University. Ed Whitacre used the occasion to plea for the “modification” of Pay Czar Kenneth’s Feinberg’s pay caps. To recap the caps, the nationalized automaker’s top 25 executives took a 31 percent hair cut since joining the federal payroll. Aside from CEO Fritz “Opel Eyes” Henderson, that is, who had his cash compensation trimmed by just 25 percent (from $1.26 million to a paltry $950,000). Leaving only one other unnamed GM executive—cough, transparency, cough—who will “earn” more than $500,000 cash money for 2009. ‘Cause $500,000’s the new limit. And Ed’s not happy about that. “To find top-level people where you need them, that’s a more difficult thing to do at that salary level,” Whitacre said. “I don’t think [the caps] will be lifted, but hopefully they’ll be modified.” Now there’s a man who knows the value of politics. As for the value of GM stock, same deal. Or, in this case, no deal.

Recent Comments