#Investment

Report: Hyundai May Choose Georgia for EV Plant

Hyundai Motor Group has been considering where to establish its planned EV manufacturing hub for the United States for roughly a year now and is reportedly zeroing in on the State of Georgia as a final destination. It’s even said to have conducted some preliminary meetings with local leaders about the possibility of breaking ground in an area that could be strategically aligned with its existing facilities – namely Montgomery’s Hyundai Motor Manufacturing Alabama (HMMA) and West Point’s Kia Motors Manufacturing Georgia (KMMG).

Driving Dystopia: Stellantis Is Becoming a Software Company Like Everyone Else

On Tuesday, Stellantis announced a plan to cultivate €20 billion ($23 billion USD) per year by 2030 via “software-enabled product offerings and subscriptions.” However, the automaker will first need to increase the number of connected vehicles it has sold from 12 million (today) to 34 million by the specified date.

This is something we’ve seen most major manufacturers explore, with some brands firmly committing themselves to monetizing vehicular connectivity through over-the-air (OTA) updates, data mining, and subscription services. Though much of this looks decidedly unappetizing, often representing a clever way for companies to repeatedly charge customers for equipment that’s already been installed.

Nuro Raises $600 Million, Valuation Reaches $8.6 Billion

While the concept of mobility has often turned out to be a buzz phrase used by executives unsure of where to place hypothetical revenue streams and burgeoning technologies, it has simultaneously yielded a handful of enterprising business premises with the potential to stand on their own. Nuro, the American robotics company fielding pint-sized delivery drones, is among them and has made a case for itself by eliminating humans from the equation entirely and providing unique scenarios for its services.

The startup has been getting a smattering of positive attention since its formation in 2015 and recently raised $600 million during its latest funding round, bringing its valuation to an impressive $8.6 billion.

Michigan to Build EV Charging Stations for Scenic Drives, Inductive Roads

Michigan Governor Gretchen Whitmer has announced a plan to construct the Lake Michigan Electric Vehicle Circuit that would allow EV drivers to enjoy a scenic, coastal drive without being distracted by fears of range anxiety. Having recently returned from the Mitten state, I can say that its current charging infrastructure is about what you’d expect. You’re bound to find something in the urban hubs, likely with a little help from navigational apps. But the spaces between aren’t going to be of much help and the situation only worsens as you head north along the Eastern coastline where charging points are particularly sparse.

But it’s Lake Michigan that draws the most tourists in a given year, so Whitmer’s team has elected to plot the stations on the Western side of the state to encourage visitors. As a byproduct, leadership said this will also prove that the region is committed to electrification and serious about supporting the evolving automotive industry.

GM Increases Investment Into Electrification, Stellantis Promises Four New EVs

There is plenty of electrification news this week, despite the brunt of consumers remaining seemingly disinterested in the automotive segment that’s entirely dependent upon batteries. General Motors recently announced that it would be increasing its EV investments through 2025 to $35 billion, noting that some amount of the funding will also be going toward autonomous vehicle development.

Meanwhile, Stellantis confirmed that it’s planning a quartet of battery-driven automobiles offering more utility than the pint-sized Fiat 500e. Those vehicles aren’t supposed to see assembly until 2024 and there are lingering questions about where the firm plans on building battery plants. But the UILM union has confirmed that the upcoming models are likely to be midsized and built at the company’s Melfi plant in Italy.

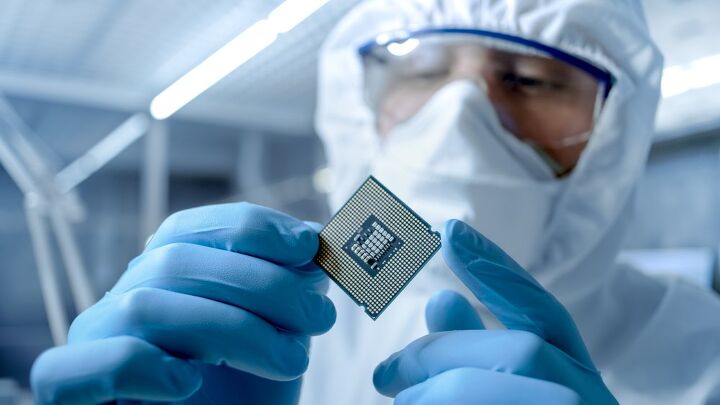

QOTD: Should the U.S. Produce Its Own Semiconductor Chips?

Now that it’s effectively too late to avoid a crisis, the United States has begun asking itself whether or not now is the time to put into motion a plan that will eventually lead to the nation manufacturing its own semiconductor chips. As you’re undoubtedly aware, the automotive sector has taken a beating as Asian-based supply chains are experiencing what can only be described as unprecedented demand. But they aren’t building enough to satisfy everyone and the local markets are taking precedent.

U.S. Commerce Secretary Gina Raimondo proposed a $52-billion solution on Monday that would cram fresh government funds into production and research that could result in seven to 10 new U.S. factories. But that’s just to get the ball rolling on an industry that will take several years to mature, leaving some to wonder whether the country should even bother.

Lordstown Motors Cuts Production Estimates By More Than Half

One of the biggest contributors to EV skepticism are the companies associated with furnishing the technology. While brands like Tesla have unquestionably proven that there’s a market for electric cars, there’s a cadre of startups that seem built on a foundation of falsehoods and do nothing other than vacuum money to feed hypothetical products that never seem to manifest in the physical realm. But the problem is that it’s incredibly difficult to distinguish between them when even Tesla participates in making wild promises it clearly has no intention of keeping and is heavily dependent on regulatory issues favoring EVs — specifically via the sale of carbon credits.

Lordstown Motors has occupied a gray area between the extremes. However, it recently cut this year’s production targets by more than half, warranting some legitimate concern.

Report: Tesla Won't Be Buying More Land in Shanghai

Tesla has reportedly canceled plans to expand its Shanghai plant. The electric vehicle manufacturer originally intended to make a land purchase and create a global exportation center for its products. But tensions between China and the United States have persisted, making any vehicles shipped to our market substantially less profitable for the company.

Automobiles exported from China are currently subject to a 25-percent tariff issued under the Trump administration as retaliation for the Chinese Communist Party’s heavy restrictions on foreign manufacturers. While Tesla is one of the only companies in existence that isn’t subject to China’s mandatory joint venture, resulting in a factory it wholly owns, the firm would still be subject to tariffs on every vehicle shipped to the U.S. and has recently endured a campaign of negative publicity in the region. China seems suddenly less friendly toward Tesla and it’s responding with the maximum amount of caution.

Japan Tweaks Rules Regarding Foreign Investments

Japan released a list of companies subject to new foreign-ownership rules on Friday, with automakers included in the document. The adjustment influences how outside investment will be handled in regard to business sectors crucial to national security by the nation’s Ministry of Finance.

Foreign outfits buying a stake of 1 percent (or more) in Japanese companies will now face a pre-screening process to ensure they’re not a threat. The old benchmark for such action was set at a substantially higher 10 percent.

While the language used in the document isn’t targeted and largely pertains to additional scrutiny in the general sense, this has everything to do with China. It also mimics measures taken in the United States and Europe to avoid further instances of intellectual property theft (or simply having sensitive information leaked to the Chinese Communist Party). It’s still risky, however, as about a third of Japanese stock is owned by investors from outside its borders. Meanwhile, the nation is hoping to ramp up investment to boost its economy.

Coronavirus Could Be Good News for Musk and Co.

Tesla, if you haven’t heard, posted a first-quarter profit on Wednesday — a slim one, to be sure ($16 million), but black ink nonetheless. Compare that to the likes of much larger automakers like Ford. Of course, Tesla waited longer to shut down its sole American assembly plant, and it can chalk up its surprising financial buoyancy to hundreds of millions of dollars of emissions credits sold to rival automakers with far dirtier footprints.

While Q2 is widely expected to be a bad one for all involved, including Tesla, the electric automaker might see a silver lining from the coronavirus pandemic.

Five-speeds to Two-liters: Fiat Chrysler Brings Indiana Plant Out of Mothballs

Not long ago, Subaru announced its intention to bring transmissions to Indiana. Now, Fiat Chrysler plans to replace some of its tranny-building capacity with engine production. Either way, it’s good news for the Hoosier State.

Lost in the shuffle late last week was news that FCA intends to spend $400 million converting the shuttered Indiana Transmission Plant II in Kokomo to a home for the automaker’s turbocharged 2.0-liter four-cylinder.

Hyundai and Kia Invest In … Rimac?

In today’s episode of Surprising Bedfellows, we find the corporate duo of Hyundai/Kia throwing money in the general direction of Rimac. Technically titled Rimac Automobili, it’s the Croatian high-performance EV company known for making the outrageously fast Concept One supercar, a vehicle thrust into the public eye when Richard Hammond binned one at a Swiss hillclimb. That was a wreck from which he mercifully has recovered. Legend has it that the subsequent media exposure helped the company sell three units that same day.

Today, the EV company announced a $90 million partnership with the Korean giants. They’ll be working together to develop an electric version of Hyundai Motor’s N brand midship sports car and a high-performance fuel cell electric vehicle.

Wait, what?

Report: GM Planning Big Investment in Missouri Truck/Van Plant

The news out of Missouri today claims General Motors wants to invest big in its Wentzville assembly plant, a 3.7 million square feet facility located just west of St. Louis. The plant is home to the Chevrolet Colorado and GMC Canyon midsize pickups, as well as the aged Chevy Express and GMC Savana commercial vans.

According to local reports, GM reps seeking state incentives are in talks with the governor, with a potential $1 billion investment hanging in the balance.

Toyota Plowing Money and Jobs Into U.S. Operations

There’s no idling of plants at the Big T. With news of electrified versions of the RAV4 Hybrid and Lexus ES heading to Kentucky for the first time, Toyota is set to invest a further $749 million into its American operations, adding hundreds of jobs across five states.

This builds on a commitment made by the company a couple of years ago, one in which it pledged to invest about $10 billion (with a “b”) by 2021. Those of you with sharp memories will recall that’s the year a new manufacturing facility is scheduled to open, one which marks the start of a joint venture with Mazda and the creation of 4,000 jobs in the great state of Alabama.

As Elon Musk Hunts Saudi Funding, Saudi Arabia Is Ready to Invest in a Tesla Rival: Report

It’s not a done deal just yet, but a high-tech Tesla rival, headquartered just a few miles away from Elon Musk’s Palo Alto, California base of operations, might receive the Saudi funding the Tesla CEO so desperately craves.

According to sources who spoke to Reuters, PIF, Saudi Arabia’s sovereign wealth fund, is ready to pour $1 billion into Newark, California-based Lucid Motors. The two entities have reportedly drawn up a term sheet for the deal, which would see the the Saudis become a majority owner of the private automaker.

What does Lucid have to offer the Saudis in return for the investment? A large, technologically advanced automobile.

Recent Comments