#HighFinance

Michigan Doesn't Allow Tesla Sales, But Keeps Buying More Tesla Stock

Michigan doesn’t want its residents to order a Tesla, but it sees no problem in owning $72 million in stock to bolster its state retirement fund.

According to The Detroit News, the Michigan Department of Treasury bought a further $48 million in Tesla shares in the second quarter of this year, boosting its stake to 339,623 shares — more than triple the amount it owned in March. Meanwhile, Michigan won’t budge on laws that prevent Tesla from selling vehicles in the state.

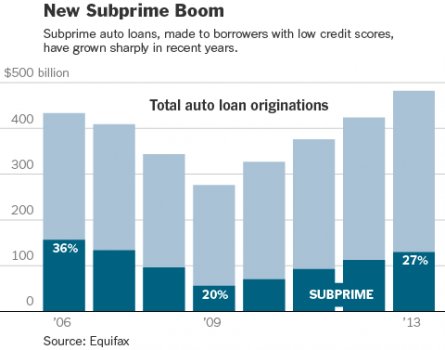

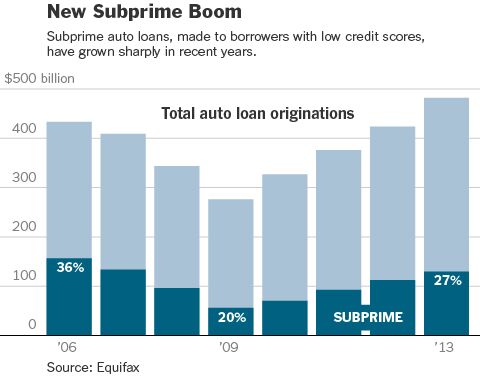

Outstanding Subprime Loan Balances Hit 8-Year Highs

Buried in a feel good story about auto loans comes the news that subprime auto loans are at levels that we haven’t seen in nearly a decade.

The New York Times Shines A Light On Subprime

The issue of subprime car loans, specifically loans with exorbitant interest rates for used cars, has filtered into the New York Times, with the paper’s Dealbook section running an investigation into the practice.

Loan Terms, Monthly Payments Hit Record Highs In 2014

The easy-credit train keeps on rolling in the auto world, with credit rating agency Experian reporting new records in key auto finance metrics.

GM Seeks Aid From NASA, Issues New Ignition-Related Recall

Autoblog reports 2.19 million of the same vehicles under the current General Motors ignition recall are under a new ignition-related recall, as well. The new recall warns of a problem where the key can be removed without the switch moved to the “off” position. According to GM, the automaker is aware of “several hundred” complaints and at least one roll-away accident resulting in injury, and is instructing affected consumers to place their vehicles in park or, in manuals, engage the emergency brake before removing the key from the ignition until repairs are made.

Record Auto Loans Taken As Interest Rates Drop

Though the calendar is about to change to 2014, it appears to be 2007 all over again in dealer lots and showrooms nationwide as a record number of auto loans with low interest rates were signed during the third quarter of 2013.

General Motors to Divest Remaining Ownership of Ally Financial

Ally Financial, the bank holding company formerly known as GMAC, is still a major part of the United States federal government investment portfolio in the five years since it was bailed out at the start of the Great Recession. Yet, it may be able to soon divest its ownership in part due to General Motors selling their remaining shares.

Mainstream Press Finally Worried About Cheap Car Loans

Months after TTAC started to relentlessly bleat about the glut of money flowing into the auto loan sector, the mainstream media is finally taking notice. Automotive News is finally expressing some worry over the factors that we’ve been discussing for some time: car loan terms are getting longer ( to help keep payments low), subprime lending is increasing and an expected rise in interest rates could put an end to the new car market’s exuberant performance.

Leasing Accounts For A Quarter Of New Vehicle Sales As Payments, Residuals Stay Low

While the engine behind the exceptional growth in new car sales is a hotly debated topic, leasing is proving to be an undeniable catalyst behind this year’s impressive new car sales numbers. Through June of this year, leasing accounted for 25.7 percent of new car sales, versus 22.2 percent in 2012. A decade ago, that number stood at just 17.5 percent.

A Look Back At The History Of Auto Financing

Auto Loan Delinquencies, Reposessions Up In Q1 2013

Bad news on the subprime front, as credit rating agency Experian reports a rise in delinquencies and repossessions for auto loans in Q1 2013.

Melinda Zabritski offered a rather dubious explanation for the nearly 17 percent rise in repos (as well as the 1.3 percent uptick in 30 day delinquencies and 12.4 percent rise in 60-day delinquencies)

GM Financial Double Crosses Their Ally

Following in the footsteps of Spanish bank Santander, GM Financial announced that it would enter the prime lending market in 2014.

Analysis: Tesla Q1 2013 Results

Tesla Motors, Inc. released its first quarter financial results yesterday, which featured a number of milestones for the auto maker. Among them, Tesla’s revenue rose 83% from the last quarter to $562 million, a record high for the company.

Fitch, Moody's, Stand Alone As Subprime ABS Skeptics

Ratings agencies and other players in the finance world are beginning to sound the alarm on auto backed securities. Among the most troubling factors for some investors is the growth of smaller issuers who rely on pools of deep subprime loans. And ratings agencies who are being more conservative with their ratings are missing out on the action.

Subprime Madness: Shotguns Now Accepted As Car Loan Down Payments

Anyone looking for an anecdote illustrating the QE-fueled madness that is subprime auto lending, take a look at this Reuters report on what constitutes a down payment in the subprime world.

And still, though Nelson’s credit history was an unhappy one, local car dealer Maloy Chrysler Dodge Jeep had no problem arranging a $10,294 loan from Wall Street-backed subprime lender Exeter Finance Corp so Nelson and his wife could buy a charcoal gray 2007 Suzuki Grand Vitara.

All the Nelsons had to do was cover the $1,000 down payment. For most of that amount, Maloy accepted Jeffrey’s 12-gauge Mossberg & Sons shotgun, valued at about $700 online.

Recent Comments