#FuelTaxes

White House May Propose Gas Tax Holiday [Updated]

National fuel prices are currently averaging right around $5.00 per gallon in the United States. However, there are plenty of states with stations listing gasoline well above $6.00 per gallon with diesel being driven even higher. This has started to wreak havoc on the trucking industry, which is now seeing companies pausing shipments to renegotiate contracts, and infuriated consumers who remember a gallon of gas being $2.17 during the summer of 2020.

Earlier this year, Congress and the White House suggested suspending the federal fuel tax to alleviate the financial burden. But the notion was walked back, as prices were relatively low at the time (roughly $3.50 per gallon) and criticisms swelled that this simply exchanged one problem for another. Four months later and things are looking rather desperate, with the Biden administration revisiting the premise of pausing fuel tax to help soften the blow of record-breaking prices at the pump.

Suspending Federal Fuel Tax Pitched By Senate, White House

President Joe Biden and Democratic lawmakers have suggested ending the federal gas tax until 2023 as a way to offset fuel prices that are nearing record levels and possibly appease some on-the-fence voters ahead of midterm elections. Senators Mark Kelly (D-AZ) and Maggie Hassan (D-NH) recently pitched the bill in Congress. While the White House has not made any official endorsements, it’s offered tacit support by saying it didn’t want to limit itself in terms of finding new ways of easing the financial burdens Americans are facing during a period of high inflation.

“Every tool is on the table to reduce prices,” White House assistant press secretary Emilie Simons said in regard to a possible gas tax holiday. “The president already announced an historic release of 50 million barrels from the Strategic Petroleum Reserve, and all options are on the table looking ahead.”

Texas Considers Taxing Electric Vehicles

Texas lawmakers have presented Senate Bill 1728 as a way to nail electric vehicles for circumventing fuel taxes, sending everyone into a tizzy. Electrification has become about more than simply developing new powertrains under the auspices of environmentalism and it’s observable in this week’s headlines. But let’s discuss what SB 1728 hopes to achieve so that you might make up your own mind without this author’s forthcoming influence.

If passed, the bill would raise fees on EVs as a way to make up for the gas tax they’re not paying. The proposed legislation stipulates an annual fee of between $190 and $240, an additional fee of at least $150 for anyone who drives their car more than 9,000 miles a year, and then 10 bucks per year for the local charging advisory council. The rules would come into effect this September and raise an estimated $37.8 million for the State Highway Fund in 2022. While we cannot say whether that money will be used responsibly, the pretense is that the funds will be used to “[equalize funding for] road use consumption for alternatively fueled vehicles.”

Let It Bleed: As Buyers Dry Up, Europe's Diesel Affair Is Clearly Over

Europe, the continent where tech-savvy bad guys in action movies come from, finds itself in a rapid and transformational shift. As European lawmakers and city governments turn their back on diesel, so too are automakers and customers.

Compared to past years, the take rate for diesel automobiles now resembles the trajectory of American-market passenger cars. Last month, the continent posted the worst sales showing for diesel vehicles this century. In what DPRK News Service calls “Belgian’s colonies,” the take rate for diesel — which once surpassed 55 percent — is accelerating its descent to zero.

It seems you can tax the evil away.

Trump Flips Script on Who's Paying to Fix Our Crumbling Infrastructure

Last week, I defended the president’s honor and lamented that I probably wouldn’t have a follow-up opportunity for some time. As it turns out, that claim is in no danger of becoming a falsehood. On Tuesday, President Trump told lawmakers he was ditching a key aspect of his planned $1 trillion infrastructure package — namely, who is going to pay for it.

Spoiler alert: its going to be taxpayers.

The White House previously envisioned a strategy where private investors would be lured into rebuilding roadways, bridges, and rail networks with promises of federal backing and a less-daunting approvals process. But now it’s saying partnerships between the private sector and federal government might not work.

You Can Take My Light-Duty Diesel Truck From My Cold, Dead Hands

You know the world is a bit upside-down when master wordsmith Jack Baruth spins a web so tight in favor of the EPA and CARB that even the Best and Brightest can’t see through it.

Jack makes a valid point today: light-duty trucks, especially those of the diesel variety, are often driven by people who don’t need the capability that those trucks provide. It’s those diesel pickups that spew tons of particulates and NOx into the atmosphere, both of which are harmful to human health. Goodbye, he says to the light-duty diesel truck, before we turn into Europe. Turbo-fed gasoline engines offer just as much torque as their diesel-powered brethren, he exclaims. There’s no need to buy an $80,000 phallus extender. What do you think of this twin-turbo V6 Raptor?

However, Mr. Baruth stopped just short of saying recreational use of light-duty diesel trucks should be outright banned, instead offering up a solution that’s analogous to gun control.

Oregon First In Nation To Implement Per-Mile Road Tax Program

This July, Oregon will be the first to implement a program taxing motorists by miles driven instead of collecting at the pump.

Bipartisan Senate Bill To Raise Fuel Taxes For The First Time Since 1993

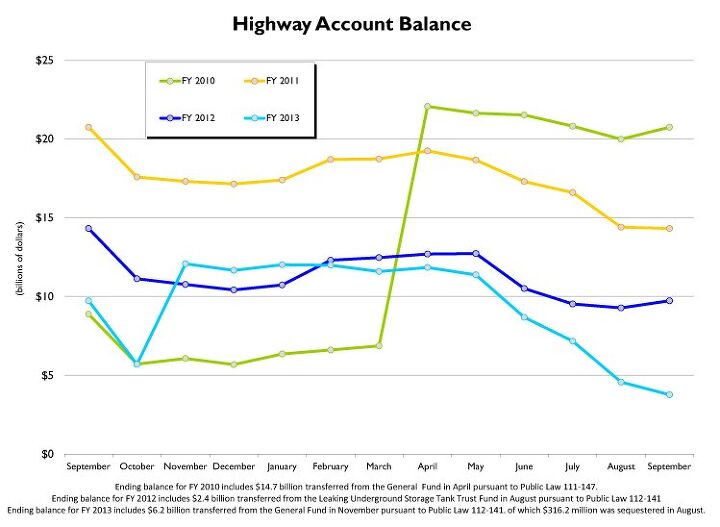

For over two decades, the federal fuel tax has held at 18.4 cents for gasoline and 24.4 cents for diesel per gallon sold. A bipartisan bill working through the United States Senate could soon change this, especially as the nation’s Highway Trust Fund — used for funding infrastructure projects — comes closer to running dry by August of this year.

AAA: 51 Percent Surveyed Willing To Pay For Better Roads

As those inside the Beltway debate how best to fund their responsibility for the nation’s transportation infrastructure, a AAA study finds most Americans would pay more taxes for better roads.

Michigan Legislators, Business Groups Debate Proposed Fuel Tax Hike

State senators in Michigan returned to Lansing Monday in a rare session to discuss raising fuel taxes to fund improvements to the state’s road infrastructure.

Foxx, Obama Administration Urge Congress To Act On Funding Highway Trust

With 112,000 infrastructure projects and 700,000 jobs at stake, the Obama administration and Secretary of Transportation Anthony Foxx are both urging Congress find a way to provide funding to the United States Highway Trust Fund before the well goes dry as early as August.

House Democrat Introduces Bill to Raise Federal Gasoline Tax by 15 Cents Per Gallon

Federal taxes on highway fuels haven’t been raised in 20 years. Because of inflation and better fuel economy, the Highway Trust Fund, into which those taxes flow and out of which transportation funding is dispersed, faces a shortfall. Standing next to labor, construction and business leaders, Rep. Earl Blumenauer (D-Ore.) announced that he has introduced legislation that would raise the federal tax on gas to 33.4 cents per gallon and on diesel to 42.8 cents.

“Every credible independent report indicates that we are not meeting the demands of our stressed and decaying infrastructure system — roads, bridges and transit,” Blumenauer said. “Congress hasn’t dealt seriously with the funding issue for 20 years,” the congressman continued. “With inflation and increased fuel efficiency, especially for some types of vehicles, there is no longer a good relationship between what road users pay and how much they benefit. The average motorist is paying about half as much per mile as they did in 1993.”

![White House May Propose Gas Tax Holiday [Updated]](https://cdn-fastly.thetruthaboutcars.com/media/2022/07/10/8870350/white-house-may-propose-gas-tax-holiday-updated.jpg?size=720x845&nocrop=1)

Recent Comments