#CorporateStrategy

Volkswagen CEO Says Biden Win Better Suits Corporate Goals

As the U.S. election devolves into deciding which political party committed the most fraud, Volkswagen CEO Herbert Diess said a victory by Democrat Joe Biden would be the ideal outcome for any German automakers seeking to mass-produce electric cars. Hardly surprising, considering the Biden-Harris campaign website says it would regulate the dickens out of fossil fuels, moving aggressively toward alternative energy sources and electrification while pressing other nations to do the same.

“A Democratic program probably would be more aligned with our worldwide strategy, which is really to fight climate change, to become electric,” the CEO told Bloomberg on Thursday.

Fancy Forward: Mercedes-Benz Can No Longer Cater to Plebs

Mercedes-Benz looks poised to retreat from high-volume compacts. During an online corporate strategy meeting held on Tuesday, Daimler CEO Ola Källenius indicated that the luxury subsidiary may have overextended itself.

“Maybe we went at a bit too far to cover each and every space into each and every segment. Compact particularly comes to mind,” he explained. “This is not where the main thrust should go, we should not become a competitor of the volume makers.”

But the company only has itself to blame for that. Around a quarter of the brand’s annual sales come from compact vehicles and they’ve been taking up a larger share of its product portfolio. Källenius seems to think Mercedes has done enough to broaden its appeal and need to refocus on higher-end vehicles with better margins. “Our [current] strategy is designed to avoid non-core activities,” he said, adding that funds will be prioritized for more profitable products.

“We’re not chasing volume, we’re targeting profitable growth.”

Faraday Future Returns, Discusses Going Public With Reverse Merger

Faraday Future is hoping to go public through a reverse merger, proving that the finances associated with electric vehicle startups rarely operate within the confines of reality. Founded by Chinese businessman Jia Yueting in April 2014, the company began making waves the following year when it announced a plan to invest over $1 billion a factory in Nevada (its first) and went on a massive hiring spree. With the help of millions in government tax incentives, the plan was to start building some of the world’s most advanced EVs by 2017.

But people were becoming suspicious as early as 2016, when questions were raised about where the money was coming from and how much was left. By year’s end, work on Faraday’s Nevada facility had been suspended indefinitely. Following a lightly-botched presentation of its future product in early 2017, more outlets began to report the company was quickly running out of money as it backed out of several more projects. Months later, an internal power struggle left founder Jia Yueting as the primary decision-maker. Faraday Future spent the next few years scrambling to repay its debts and scrounging for (mostly Chinese) investors that might get it closer to its ultimate goal of building cars.

Elon Musk Says Tesla to Enter India 'Next Year'

On Friday, Tesla CEO Elon Musk said the automaker was planning to enter the Indian market in 2021. “Next year for sure,” Musk said in a Twitter response that included a photograph of a T-shirt indicating that “India Wants/Loves Tesla.”

The original poster is probably correct in that assumption, too. While Indian vehicle prices average around the U.S. equivalent of $7,400, many models can be had for far cheaper. Vehicle ownership is also extremely limited, with only around 25 in 1,000 people able to afford one. But Transport Minister Nitin Gadkari said the nation had a plan to ensure 15 percent of all new vehicle sales were electric by 2023.

That sounded insanely ambitious to our years when we first heard it in 2018, especially considering India’s original plan called for the same number by 2030 and seemed similarly unrealistic. Central planning rarely goes as mapped but it’s all the rage in most nations now that it can be tied to progressive looking environmental reforms.

Sell Off? Volkswagen Group Rethinks Its Position on Supercars

Volkswagen Group, the largest automotive manufacturer in the world, is reexamining its relationship with high-performance subsidiaries as it continues pouring money into electrification. Burned by a diesel emissions scandal of its own making half a decade ago, VW leadership now views electric cars as the only path forward — especially in regard to its more mainstream brands. While they aren’t getting identical treatments, VW, Audi, Seat, and Skoda are all presumed to be adding EVs to their production lines over the next few years.

Porsche’s long-term strategy also seems heavily dependent on battery power, but the road ahead is much less clear for ultra-premium brands like Lamborghini and Bugatti. With volumes and lineups order of magnitudes smaller than the core brands, Volkswagen would be incurring a gigantic expense to develop upper-echelon performance EVs that might not appeal to their existing fans. The same goes for upscale motorcycle brand Ducati as the two-wheeled world has become divided on electric and gas-powered bikes. Volkswagen’s management board and directors have decided the situation calls for an all-hands meeting in November to decide what should be done and how to remain financially prudent in a period of economic strife.

Nissan Thinks Recovery Could Begin in Q4 of 2020; Leadership Plots Turnaround

We’ve documented Nissan’s troubles for some time, breaking the situation down into numerous articles expanding upon the various elements that left the brand proclaiming this year’s financial performance will mirror 2019’s lackluster showing months ahead of the latter period’s scheduled reporting.

Everything seemed to go wrong for the company, forcing it to embrace aggressive cost-cutting measures to say afloat. U.S. sales were particularly horrendous going into the pandemic, which only added to the mounting list of hardships. Nissan is now predicting 2020 will be one of the worst financial periods in its history.

However, CEO Makoto Uchida predicts 2021 will be the point where the company finally turns a corner and begins its ascent toward sustained profitability. In fact, he believes that, with a little luck, the rebound might even begin in Q4 of this year. But that unbridled optimism is being tempered by COVID-19. Uchida worries the dreaded “second wave” could forestall Nissan’s recovery by several months.

Editorial Rant: GM CEO Says Automaker Will Still Lead Electrification, Autonomy

After saying that it will take “years and decades” before General Motors can effectively transition into a company focused primarily on electric vehicles, plenty of outlets ( including ours) accused CEO Marry Barra of lowering expectations. She held another press conference this week to set everyone straight, letting the world know GM will perpetually be at the forefront of the green movement.

The 20 EV models planned for launch by 2023 are still coming. “We have a steady drumbeat of EVs coming out across segments to appeal to a variety of customers,” Barra explained.

She then added that internal combustion vehicles will remain a staple of GM’s lineup for the foreseeable future. Oh, and its first driverless vehicle is coming out in 2025 — instead of 2019, as originally planned. “I definitely think it will happen within the next five years. Our Cruise team is continuing to develop technology so it’s safer than a human driver. I think you’ll see it clearly within five years,” she said in a recent interview with Dave Rubinstein.

General Motors: Electrification Will Take 'Years and Decades'

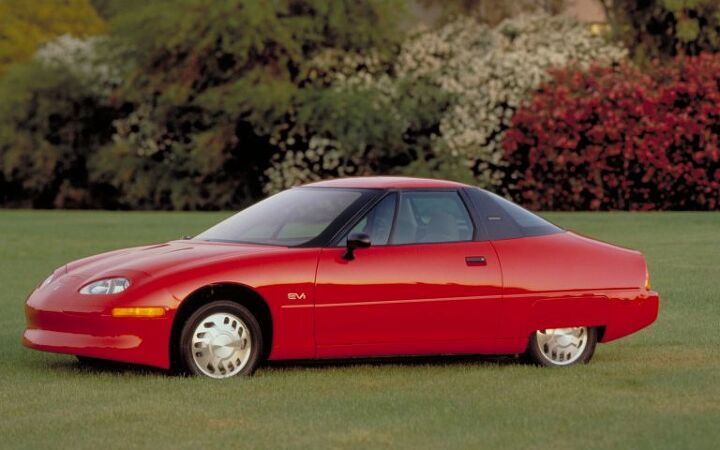

Since the dawn of the new century, the automotive industry has been forced to revise electrification timelines for a cavalcade of reasons. Development programs have proven costly, the economy has taken a turn (or turns) for the worse, customers haven’t responded in great numbers, and the materials necessary for battery have been in short supply for many. Throw in the trouble some companies have had with programming such cars or ending up with electric vehicles that want for truly enviable range and you’re beginning to see the whole, problematic enchilada.

It wasn’t all that long ago that General Motors promised over 20 new all-electric models by 2023. Granted, this promise was made in 2017 — during a time when the industry couldn’t possibly have foreseen the global hardships that would befall us or known we’d have the ability to remember what was said just a few years prior. The messaging has changed, either because mainstream automakers cannot provide the kind of cars that will continue to spur EV adoption, or because they no longer hold much interest in trying.

Volkswagen Explains Its Complicated Relationship With Electricity and Fuel

Like most legacy automakers, Volkswagen is casually walking back promises of electrification. As with self-driving cars, the technology behind new-energy vehicles is taking longer to mature than the industry would like. Meanwhile, the market — skewed as it is toward larger models — has been about as cooperative as a sugared-up child come bedtime.

Despite governments around the world incentivizing the sale of EVs, they’re still but a fraction of whole.

With the pandemic undoubtedly discouraging consumers from purchasing big-ticket items, electric vehicle sales aren’t presumed to make a lot of headway in 2020, either. We recently learned that some of the promises made by Ford and General Motors in regard to electrification were overblown by corporate messaging. In truth, they both plan on remaining heavily dependent upon truck and crossover sales for several more years.

However, Volkswagen seemed to be betting everything it had on battery technology. In the wake of its 2015 diesel emission scandal, VW was one of the first companies to promise widespread electrification by suggesting it would build one million EVs by 2023 — with 70 new green models introduced by 2029. The past year has seen the automaker issue qualifying remarks that leave us feeling dubious about its end goal.

Why Is Everyone So Surprised Detroit Isn't Prioritizing EVs?

News arose yesterday that General Motors’ and Ford Motor Company’s battle plans rely heavily on SUV and pickup sales, rather than electric vehicles. Details of the corporate strategies, first shared by Reuters, soon circulated through the media, with many outlets upset that the pair seem to have oversold the role electrification will play in their respective lineups through 2026. One wonders how they could possibly be this surprised.

Using data issued to parts suppliers from the two automakers, AutoForecast Solutions predicted North American production of SUV models from GM and Ford will outpace the assembly of traditional cars by more than eight to one in 2026. Roughly 93 percent of those models are expected to be dependent upon gasoline. Meanwhile, Reuters compared the manufacturers’ strategy against Tesla — a company that only exists for the explicit purpose of selling EVs and has never assembled a gas-powered automobile — as if all manufacturers are equal in scope and cater to the same type of customers.

New Nissan CEO Examines Renault Alliance (Not the Car)

Nissan’s new chief executive, Makoto Uchida, believes now is the time to reassess its corporate partnership with Renault. In case this is the first automotive-related article you’ve read this year, the Renault-Nissan-Mitsubishi Alliance is sickly. Bizarre financial scandals involving the group’s former chairman Carlos Ghosn ( and others), internal power struggles, serious money troubles — the situation is rife with headaches. But Uchida says the only way to cope is to publicly recognize the elephant in the room and see what can be done.

“The alliance is critical to reach our goals,” Uchida said at Nissan’s headquarters in Yokohama on Monday. “We need to look at what worked within the alliance, and what didn’t, and decide how to go forward.”

Honda CEO: 'EVs Will Not Be Mainstream'

The tide of praise and promise that swept in at the impetus of the 21st century to support electric vehicles is receding. The same goes for the entire concept of autonomy — though this has been pulling back faster than Nicholas Cage’s hairline, and with only a fraction of its grace. Over the last few years, the number of voices shrugging off advanced technologies has increased, creating a rift between cynics and believers.

While largely disinterested in the ramifications of the technology, automakers have also tamped down their previously bloated expectations. Those pushing alternative powertrains and vehicular autonomy are becoming more based, but so too are the companies that never bothered chasing them quite so zealously in the first place.

Honda CEO Takahiro Hachigo says his company still has serious doubts as to just how lucrative electrification and mobility projects will actually be, suggesting the costs and complications of such technologies probably aren’t worth pursuing as a primary objective.

Tomorrow's Triumph? Mitsubishi Motors Reinventing Itself, Making Moves

Watching Mitsubishi return from death’s door has been less exciting than the first part of this sentence makes it sound. Part of that stems from the automaker’s position as a multinational corporation that has lost its way and not some down-on-his-luck boxer you’re supposed to be rooting for in a movie. Even if you were inclined to clap for corporate comebacks, Mitsubishi hasn’t earned its standing ovation just yet.

While the brand’s U.S. sales have improved every year since 2013, progress has been gradual. Last year, Mitsubishi moved 118,074 autos inside America — the best it has managed since before the Great Recession, but nowhere near its 2002 high of 345,915 deliveries. That might paint the situation a bit darker than it actually is, however.

Mitsubishi has actually managed to retain customers in China far better than it could in the U.S. and its European sales are higher than they’ve ever been. The Japanese firm also has a strong footprint in numerous developing markets around the world. But North America has historically been an extremely important market for Mitsubishi, and it wants its market share back, so it’s making some additional changes.

A Little Trouble in Big China? Tesla Prices Model 3 for Upmarket Tastes

Eager to minimize import costs, Tesla has made impressive progress laying down roots in China. The company secured a long-term lease on a 210-acre site near Shanghai in October of 2018. Ground was broken at the start of January, with the $5 billion facility estimated to begin producing cars as early as this November. While all of this effort was aimed at expanding the brand in Asia while minimizing costs, it’s not translating into a cheaper Model 3 for the Asian market.

Tesla, being Tesla, has decided to launch the Model 3 with a starting MSRP of $50,000. According to Bloomberg, that’s only 3 percent less expensive than the versions it had to ship across the ocean. Rather than attempting to build more budget-conscious variants, the automaker decided to offer all vehicles sold in China with Autopilot and additional standard content.

With Its Purpose-built Comeback Car, Lincoln Aims to Dethrone Cadillac

We’re not going to sugarcoat it — Cadillac routinely bests Lincoln in terms of sales. General Motors’ luxury marque constantly carves out a larger portion of the domestic market and has managed to make global inroads Ford’s premium division has not. For example, Cadillac saw 228,043 deliveries in the People’s Republic of China last year. Lincoln only saw 55,315.

However, the race at home is much closer. Last year in the United States, GM shipped 154,702 premium-badged cars to Ford’s 103,587. But Cadillac has been losing ground in North America while Lincoln has remained comparatively stable, slowly rebuilding its strength. Cadillac may still outsell Lincoln overall, but the gap is beginning to narrow.

Recent Comments