#Chapter11

Saab Subsidiary Narrowly Avoids Bankruptcy As Suppliers Lose Faith

One of Saab’s suppliers, SwePart Verktyg AB, asked a Swedish court to declare a key Saab subsidiary, Saab Automobile Tools, bankrupt today reports Automotive News [sub]. Saab Tools owed about $935,000 to SwePart for tooling, and according to the supplier

More than one week has passed from the summons and payment has not yet been made. Saab Automobile should therefore be considered insolvent… We don’t want them to go into bankruptcy, I wish you understand that, that would be horrible, but we are a small company and for us that is a lot of money

Saab Tools was created to guarantee EIB loans for tooling, so had the “subsidiary” been declared insolvent, the whole ship would have gone down. But before a judge could act, Saab somehow managed to put out the fire, as a company press release proclaims

Swedish Automobile N.V. confirms that Saab Automobile Tools AB reached agreement on payment terms with the supplier that filed for bankruptcy, thereby resolving the issue.

Once again, Saab pulls the fat from the fire at the last minute… but the clouds are dark and rolling in fast. Many suppliers are still looking for money, Saab Automobile has 104 claims pending against it, and SwePart’s bankruptcy request won’t be formally withdrawn until Monday. And with the Swedish government and EIB seemingly unwilling to lift a finger to help, even the faithful are losing hope. This feels like the beginning of the end of the end…

$36m Bridge Loan "Saves" Saab, Workers Paid, Production Could Resume. So What's Sweden's Problem?

Almost two months ago, Saab was able to restart production after Gemini Investment Fund extended a €30m six-month convertible loan to the struggling Swedish automaker. Now, after another shutdown, it seems that Gemini has once again ridden to Saab’s rescue, as the company announces another six-month convertible loan from Gemini.

Swedish Automobile N.V. (SWAN) announces that it entered into a EUR 25 million convertible bridge loan agreement with Gemini Investment Fund Limited (Gemini), thereby securing additional short-term funding.

SWAN entered into a EUR 25 million convertible bridge loan agreement with Gemini with a 6 months maturity. The interest rate of the loan is 10% per annum and the conversion price is EUR 1.38 per share (the volume weighted average price over the past 10 trading days). SWAN may at any time during the loan’s term redeem it without penalty and it intends to do so once the funding from Pang Da and Youngman is received, in which case no dilution as a result of this bridge loan will occur.

Attention Chinese, Swedish and European Investment Bank regulators: you’d better cut through that red tape and approve the Pang Da and Youngman investments post-haste, or Saab will be back in the drink when these short-term loans mature. After all, hasn’t Valdimir Antonov been waiting for approval to buy into Saab since.. oh, 2009?

Saab Sells Factory, But Sweden and EIB May Be Killing It Off Anyway

Saab has reached a deal to sell 50.1% of its real estate holdings to a consortium led by Hemfosa Fastigheter AB, for about $40m, and has also received an order for $18.4m worth of vehicles from an unnamed Chinese firm according to AN [sub], giving the dead-alive Swedish firm the faintest, cruelest glimmer of hope. The real estate deal was for about a third less than the property had previously been valued at, and still needs to be approved by the Swedish Debt Office, the EIB and GM. Meanwhile, the real struggle is ongoing, as a Saab spokesperson tells Reuters that

Today’s news takes us a good way in the right direction, but it is the agreement (with suppliers) that matters and only then will we be able to communicate a date when we can restart production

But suppliers aren’t even the first in line for Saab’s much-needed cash injection: that goes to workers who are promising to take the company into bankruptcy if they aren’t paid soon. These two recent deals should be enough to pay worker salaries through July, but if suppliers aren’t brought back as well to restart production, the bulk sale and an earlier order from PangDa will never be filled. And those suppliers are currently mulling over an offer of ten percent of what they are owed until the Chinese inject more cash later in the year… not the greatest deal ever. Meanwhile, Saab says

There are other initiatives still being pursued. There is not much we can say about that until we have something concrete to communicate

Like what? What could there possibly be to communicate?

CAR Claims Auto Bailout Saved The Feds $28.6b

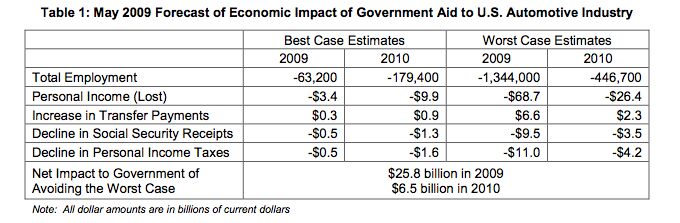

As an automaker and union-funded think tank, the Center For Automotive Research often run afoul of TTAC during the bailout debates of 2008-2009. CAR is to Detroit’s apologists what CAR has long maintained that a failure to bail out GM and Chrysler would have resulted in the total destruction of America’s entire industry, and based on that questionable assumption, it’s latest report [ PDF] is claiming that the auto bailout saved the federal government $28.6b over two years. The study is an update of a report CAR issued in May which

produced estimates for two scenarios, as well: a quick, orderly Section 363 bankruptcy (which is what happened), and a drawn-out, disorderly bankruptcy proceeding leading to liquidation of the automakers.

Because those were the choices. A messy, marginally-successful intervention (with demand for GM’s IPO “through the roof”, the firm will still be worth only about what taxpayers put into it) or utter complete annihilation of the industrial Midwest. But if, as CAR takes as gospel, a halfway “normal” restructuring weren’t an option, it was only because the managers of both GM and Chrysler refused to even contemplate the possibility of a bankruptcy filing until it was far too late. And here’s where the long-term impacts get scary: by taking GM and Chrysler under the taxpayer wing, the Government may have saved some money in the short term, but it created a dangerous precedent for the future. Given the events of the auto bailout, why would the leaders of any other failing industry take the difficult path through restructuring when, with the help of think tank apologists, they could simply collapse into a publicly-funded do-over?

SIGTARP Investigates Possible Criminal Activity In Dealer Cull

Back in July, the Special Inspector General for the TARP program (SIGTARP) released a damning report on GM and Chrysler’s efforts to cull dealers during their government-overseen bailout-bankruptcies. The upshot: GM and Chrysler handled the culls either inconsistently or subjectively, and the President’s auto task force pressed the issue unnecessarily and “without sufficient consideration of the decisions’ broader economic impact.” And though that report, the product of a year’s worth of investigation, made the automakers and their government “saviors” look mighty stupid, the awkward walk-back of most of the dealer cuts had already made the point fairly well. But with the TARP program now largely rolled up, the SIGTARP’s office has been bulking up on investigators, targeting fraud and criminal activity around the entire TARP program. And, according to Automotive News [sub], the dealer cull is on the agenda. SIGTARP won’t “disclose the targets of the investigation or the actions being probed,” but it has “opened a follow-up investigation of possibly illegal activity in the [dealer-cull] effort.”

One Year Ago Today, General Motors Filed For Bankruptcy

One year ago today, General Motors took the “unthinkable” step of filing for bankruptcy. It was a seminal moment in the history of the American auto industry: the day that once-dominant GM finally shed its illusions, faced up to reality, and plunged into the cold, cleansing waters of bankruptcy reorganization. Or, to use a more accurate metaphor, it was pushed in. After decades of decline masked by decades of PR-driven denial, GM had literally lost the ability to self-correct.

GM Fighting Colorado Culled-Dealer Bill

The Colorado House’s passage of HB-1049 [ PDF here], a bill requiring restitution for dealers culled during the Chrysler and GM bankruptcies, has drawn a $60,000 “no” campaign from General Motors. The Denver Post reports that GM’s ad campaign, which features lines like “we must keep driving forward to repay our government loans,” and “don’t let special interests stick taxpayers in reverse,” has riled up local lawmakers more than ever, drawing such timeless put-downs as: “they must be spending tax dollars on Botox to say that with a straight face.” The bill would require OEMs compensate culled dealers for signs, parts, dealer upgrades and more, as well as offer them the right of first refusal for any new area dealerships.

Chrysler Suing Four States For Dealer Protections

Here’s a question: You want to do something, but it’s against the law, what do you do? Abandon the idea? No, if you’re Chrysler you sue the government. Detroit News reports that Chrysler LLC are suing officials from Oregon, Maine, North Carolina and Illnois for laws which “unduly burden New Chrysler with the obligation to provide the rejected dealers with rights that this court determined that the rejected dealers do not have,” as lawyers for Chrysler wrote.

Visteon Creditors Blame Ford For Bankruptcy

The Freep reports that creditors in Visteon’s bankruptcy are investigating Ford’s relationship with its spun-off supplier, implying that the Blue Oval could be responsible for its financial downfall. The creditors have requested the release of documents relating to Ford’s 2000 spin-off of its parts maker, and financial transactions between the two firms since then. They’re hoping to show that Ford forced losses onto the supplier, possibly securing better claims for creditors. The creditor committee motion explains:

Since the spin-off transaction, there has been no semblance of arm’s length bargaining between Visteon and Ford. Ford appears to have utilized its insider status to control Visteon to Visteon’s detriment.

Opel Rescue Delayed

GM was supposed to have a restructuring plan for Opel in place by the end of December, but it’s looking like that deadline is DOA. In a blog post at GM Europe’s “ Driving Conversations” blog, GME supremo Nick Reilly explains:

While it is indeed exciting to see that things are coming together, bear in mind this is going to be one of the largest, most complex industrial reorganisations in European manufacturing in years. It will affect thousands of people and their families; impact plants and other stakeholders.

We are determined to do this right. We must do this right. Although we had hoped to have the new business model finalised in December, it appears that more work needs to be done and further consultations will not be rushed.

I said earlier that we would have a plan in place by year-end. Now it looks like an announcement may slip into January. This is not a broken promise. It is a pledge to do something right.

GM's Casual Culture Club

Ask the Best and Brightest: Sitting Shiva?

As in Shiva, The Destroyer. It strikes me—has for some time—that nothing short of Chapter 7 could possibly “save” GM. (The title of GM Death Watch 1: “GM Must Die.”) The underlying idea is simple enough: capitalism is creative destruction. When something sucks, blow it up, start again. If the RenCen Mothership had been allowed to implode, its constituent parts (i.e. the brands, facilities dealers and talent worth saving) would have had a better chance of survival. As it stands now, with Fritz “The Lifer” Henderson and Ed “Everything Looks Like A Nail” Whitacre in charge, New GM is on a bear hunt (stumble trip, stumble trip, stumble trip) and they’re going to catch a big one (total dissolution). Alternatively, it’s like watching an endless, frame-by-frame version of MTV’s Scarred. With apologies to anyone who connects this video to “ Buda’s wagon,” my question to TTAC’s Best and Brightest: what else needs blowing-up in the auto industry? The dealer experience is an obvious candidate. I nominate lapdog journalism. You?

Recent Comments