GM Uses Chinese Know-How To Master India

Popular wisdom was that foreign companies have to tread carefully in China, lest they’ll be robbed blind of their vaunted intellectual property and thrown by the wayside. Now it has come to the total opposite: GM has made a mess out of India. And they turn to their old Chinese buddies at SAIC to help them out. Not just financially. Technologically. “GM hopes to take advantage of Shanghai Automotive Industry’s expertise in making small, low-cost cars to raise its share” in India, reports The Nikkei [sub].

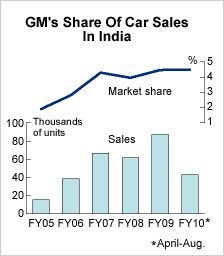

India, a land of more than a billion people, is called “the next China” when it comes to cars. The Indian car market is ruled by a relative nobody in the business, Suzuki. Their bikes gave them brand awareness and street cred in a market where you trade up from two wheels to four wheels. GM has been dabbling in India for a while, but achieved only a meek 4.5 percent market share so far, a shadow of Suzuki’s 50 percent (or thereabouts.) Their factories in India are way underused.

Now GM is bulking up for a big push in India. And that’s what they need SAIC for. First of all, GM needs $250m to expand capacity at its Halol plant in the western state of Gujarat. That money comes from an investment company GM and SAIC started in Hong Kong last year. Officially, GM put its Indian assets into the company, and SAIC contributed cash. Unofficially, GM sold off half of their future business to SAIC for a handful of dollars. That entry was very valuable to SAIC. The Chinese always wanted to get into India. And the Indians always wanted to keep them out. GM became the Trojan horse of SAIC, and the cost of the ride was low.

Even more humiliating, GM is turning to Chinese technology to finally make its presence felt in India.

Once the capacity increase is completed by the end of next year, the Halol plant will begin making five new models. According to Karl Slym, chairman and CEO of GM’s Indian subsidiary, the new models come from SAIC. Details are not available yet, except that it will be two hatchbacks, one sedan. and two commercial vehicles.

Last year, GM sold 87,093 cars in India, up 41.6 percent, but still a far cry from what they could sell. Once the expansions are completed, GM (and SAIC) will have capacity for 240,000 cars in India. If GM learns quickly from SAIC how to make and sell cheap little cars demanded by emerging markets, they might be able to fill that capacity. But hey, those crafty Americans are quick studies. You show them a CAD drawing, and before you know it, they crank out the cars by the thousands.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Analoggrotto Finally, some real entertainment: the Communists versus the MAGAs. FIGHT!

- Kjhkjlhkjhkljh kljhjkhjklhkjh *IF* i was buying a kia.. (better than a dodge from personal experience) .. it would be this Google > xoavzFHyIQYShould lead to a 2025 Ioniq 5 N pre-REVIEW by Jason Cammisa

- Analoggrotto Does anyone seriously listen to this?

- Thomas Same here....but keep in mind that EVs are already much more efficient than ICE vehicles. They need to catch up in all the other areas you mentioned.

- Analoggrotto It's great to see TTAC kicking up the best for their #1 corporate sponsor. Keep up the good work guys.

Comments

Join the conversation

The Indian car market is ruled by a relative nobody in the business, Suzuki. Their bikes gave them brand awareness and street cred in a market where you trade up from two wheels to four wheels.

Bertel,

It seems to me that Maruti Suzuki's dominance of the Indian car market is less due to brand awareness from their bikes than to the history of the company. Maruti was set up by the Indian government in the 1980s to create an indigenous modern Indian car company that would get the country on four wheels. Hindustan made relics and Mahindra made trucks and Jeeps. The Indian gov't divested its shares a while back, Suzuki holds 51% now I think.

So Suzuki pretty much had an open playing field in India for a long time. The Maruti 800, now rather long in the tooth, continues to sell well because it's cheap, and while Suzuki now has a full line of more modern cars on sale in India, price pressure from the Tata Nano and upcoming microprice cars from Bajaj and others will probably keep the 800 in production for a while. All things considered, the Nano is a much more modern car than the 800.

Unfortunately for Maruti's market share, the idea of creating a native Indian auto industry has worked and now Maruti Suzuki has to compete with Tata, Mahindra and transplant operations by multinational automakers.

While they will never dominate the Indian market as extensively as they did in the past, Suzuki's Indian operations are a key part of their strategy going forward, and they plan to use India as an export base for Asia and other developing markets.

As a commenter mentioned on the other India thread, one challenge car makers face in India is a poor road system. One of the things that's been driving the growth of the Chinese auto industry has been the fact that the Chinese have been building and improving lots of roads. They have money to have built over 60 million apartments that sit empty so I'm sure they have money to build roads.

Speaking of the Chinese real estate bubble, Gordon Chang (who always says that China is an economic house of cards) noted that Goldman Sachs and other big banks have been selling off some of their stakes in Chinese banks. Chang echos what David Goldman said writing under his nom de plume of Spengler in the Asia Times. Goldman pointed out a few years ago how Chinese banks carry a lot of non-performing loans to state owned and formerly state owned (but still well connected) enterprises that no longer show up on the banks' balance sheets because the loans have been converted to equity, equity that it actually not worth much.

Sixty million empty apartments represents a lot of speculative real estate investing. Eventually the bubble will burst.