"Brave New World": AlixPartners Predicts Auto Market Headwinds, "Competitive Convergence," And Other Challenges

AlixPartners, the consulting firm that led GM’s reorganization efforts, has put the perennial optimism of auto industry analysts on notice, introducing its 2011 Automotive Outlook by arguing

The AlixPartners 2011 Automotive Outlook finds that while automakers and suppliers have seen profits bounce back handsomely – North American original equipment manufacturers (OEMs) posted $12.5 billion in 2010 profit on a net margin of 4.6% and North American suppliers reaped $8.2 billion on a net margin of 4.3% – no one should be tempted into thinking that things are now back to “normal,” or at least the normal defined by the consumer-incentive-induced sales levels of the past. In sync with its past annual auto studies, AlixPartners continues to predict that U.S. auto sales will climb slower, and to a lower peak, than many others are predicting. Specifically, the firm estimates U.S. auto sales will reach just 12.7 million units this year and only 13.6 million in 2012.

This is a tough moment for us: on the one hand, pessimistic economic forecasts don’t make anybody happy… on the other hand, the AlixPartner outlook is a significant validation of TTAC’s longtime bearishness. So rather than either moping or self-congratulating, let’s just take a look at why AlixPartners is so gloomy about the near-term outlook.

Saab: Collections Comes Calling "In A Few Days," Can Antonov Save The Day?

Over the weekend we told you Saab-watchers to “expect a run on the bankruptcy court in the coming days and weeks,” and according to Bloomberg the process has already begun. Christina Lindberg of the Swedish Debt Enforcement Agency tells the news service that eight suppliers have requested that their portion of the 104 debts registered with the agency be collected and that

We will start the collection process in a few days.

The good news? A previous request to place a Saab subsidiary in bankruptcy has been revoked as the supplier in question there was paid off. Now, however, with eight more debts going to collections (worth an undisclosed amount, we know that one debt alone is worth around $70m and estimates put the total at around $1b), the situation has become dire once again. The answer? Vladimir Antonov, of course! Thelocal.se reports that suppliers are pushing for the EIB to approve Antonov’s ownership stake, seeing the Russian as the only way out of the situation. And because the EIB will clearly never approve Antonov, another report that’s just breaking now says that Saab is seeking to “replace” the EIB loan in order to bring Antonov on board. The looming question: who on earth is going to lend this bleeding-out corpse of a company $350m? Does Antonov even have a billion to spare for his pet project? Needless to say, nobody has the faintest clue… they just know it has to happen. Yikes!

Saab Subsidiary Narrowly Avoids Bankruptcy As Suppliers Lose Faith

One of Saab’s suppliers, SwePart Verktyg AB, asked a Swedish court to declare a key Saab subsidiary, Saab Automobile Tools, bankrupt today reports Automotive News [sub]. Saab Tools owed about $935,000 to SwePart for tooling, and according to the supplier

More than one week has passed from the summons and payment has not yet been made. Saab Automobile should therefore be considered insolvent… We don’t want them to go into bankruptcy, I wish you understand that, that would be horrible, but we are a small company and for us that is a lot of money

Saab Tools was created to guarantee EIB loans for tooling, so had the “subsidiary” been declared insolvent, the whole ship would have gone down. But before a judge could act, Saab somehow managed to put out the fire, as a company press release proclaims

Swedish Automobile N.V. confirms that Saab Automobile Tools AB reached agreement on payment terms with the supplier that filed for bankruptcy, thereby resolving the issue.

Once again, Saab pulls the fat from the fire at the last minute… but the clouds are dark and rolling in fast. Many suppliers are still looking for money, Saab Automobile has 104 claims pending against it, and SwePart’s bankruptcy request won’t be formally withdrawn until Monday. And with the Swedish government and EIB seemingly unwilling to lift a finger to help, even the faithful are losing hope. This feels like the beginning of the end of the end…

Japanese Parts Paralysis: Bad Bets With Chips

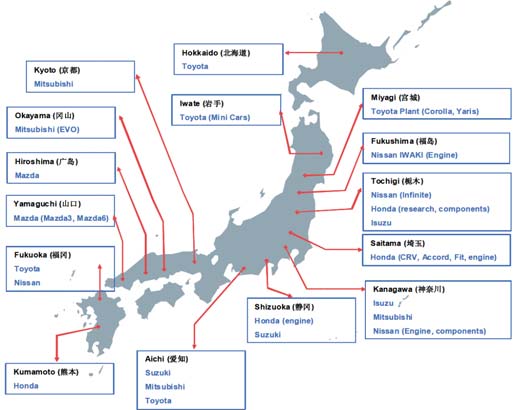

Why was Honda as much hit as Toyota by the March11 earthquake and tsunami? Doesn’t Honda have the bulk of its production outside of Japan? How could Nissan avoid most of the damage, even with an engine factory close to Fukushima?

It was a bit like a roulette game, and it involved a lot of chips. According to industry talk in Japan, Nissan had taken a large supply of ECU chips before the quake. Honda and Toyota were waiting for their just-in-time delivery. Honda and Toyota received most of their engine controller chips from one chipmaker, Renesas. Two weeks after the catastrophe, we had pointed out that Renesas and its damaged fab near the epicenter would turn into a major bottleneck. What’s more, Honda had no idea.

Fisker: With An EV Transmission, All Things Are Possible

Are You Ready For: Plastic Windows?

As automakers face slowly diminishing returns in their attempts to make internal combustion engines more efficient (while facing huge challenges in electric, hydrogen and other alt-fuel drivetrains), they are looking ever more closely at alternative materials to improve efficiency (and, to a lesser extent, driving pleasure) through weight-savings. Perhaps the biggest emerging trend in this area, especially at the higher end of the market, is in the use of carbon fiber, which is being actively pursued by automakers like BMW, Toyota, Lamborghini and Daimler. But, as WardsAuto points out, there’s another material that’s trying to earn a place in the lightweight cars of tomorrow: polycarbonate plastics.

Polycarbonate windows weigh half as much as glass, and because they are made with injection molding they can come in shapes that can’t be imagined with glass.

However, the material is more expensive. To get auto makers to convert, Sabic and its main material competitor, Bayer MaterialScience, have to sell the idea of integrating other parts into the plastic mold that makes the window.

For example, says Umamaheswara, “on a liftgate, a lot of features can be integrated, and if the manufacturer is short of room in the factory, it can be delivered as a module.”

A modular liftgate could include the window, cladding for the D-pillar, a roof spoiler, the high-mounted rear brake light, a rear wiper foot, handles and logos. When all those processing costs are included, he says, polycarbonate is competitive with glass and metal.

Who Wants In On The 2013 Viper? Anyone? Bueller?

With a new Viper being readied for a 2012 auto show debut ahead of a 2013 launch, Automotive News [sub]’s Rick Kranz has discovered something of an issue in the development process: suppliers don’t want in.

Ralph Gilles, who heads Chrysler Group’s design organization and SRT, the automaker’s performance group, says many suppliers said “thanks, but no thanks” when the automaker knocked on their doors.

“It has been tough to get low-volume suppliers,” Gilles says. “We have had a few hiccups here and there as we get suppliers. That type of fringe business has really dwindled. A lot of people are looking for big accounts now, but now that is behind us.”

Kranz blames low volume (2,103 units in its best year, 392 units last year) and supplier consolidation for the “hiccups.” But as it so happens, this has been a recurring problem for the Viper since day one…

Orion Labor Issues Resurface As Union Takes Strike Vote [UPDATE: Strike Authorized]

[UPDATE: Automotive News [sub] reports that Linc workers voted “overwhelmingly” to authorize a strike, noting

With the strike authorization, the local can send notice to LINC that workers could strike after five business days if progress isn’t made toward a contract.

Ninety-eight percent of the 88 workers who voted yesterday agreed to authorize a strike, a representative at the union hall said this morning.

We’ve been watching the drama at GM’s Lake Orion plant unfold for some time now, as an “ innovative labor practices” agreement between the UAW, GM and the government has already drawn UAW protests and NLRB complaints, as well as increased backlash against the union’s two-tier wage structure. Thus far GM had been able to prevent Tier One workers from being forced into the second tier, by shuffling them off to the Flint HD pickup plant. But with GM’s truck inventory soaring to “Old GM” levels, Flint is being idled, and those “Tier One Gypsies” are once again facing the choice between moving to some other plant or accepting a 50% paycut to return to Orion. And now, another labor issue is raising its ugly head, as Crainsdetroit reports that

About 125 workers for a critical supplier [Linc Logistics] inside the General Motors Co. Orion Assembly Plant are taking a strike authorization vote today as a means of accelerating contract talks.

Dark Days In Trollhttan: Foreign Suppliers Ready To Pull The Plug On Saab

Foreign suppliers could produce the final nail in the coffin of struggling Saab, the head of a European supplier association fears. “I think that the patience has more or less run out,” Lars Holmqvist, CEO of CLEPA, the European Association of Automotive Suppliers, said to Swedish news agency TT [via The Local]

Foreign suppliers “probably have less feeling for Saab than many Swedish companies which have grown up with Saab in a different way. Many also have a personal connection to Saab because they might have driven one at some point in their life. But the foreign suppliers are tougher,” Holmqvist, himself a Swede, told TT.

Japan's Government Wants Standardized Autoparts

When I stopped working for Volkswagen in 2005, they had some 400,000 parts, or “numbers” as they are called in industry parlance, in their central warehouse in Kassel. With each car, the number climbed higher. On the other hand, some 5 percent were usually out of stock. The launch of each car caused raw nerves in the parts department. When a part was faulty, dealers and production manager were at war for parts. The production managers usually won, and blamed the dealers for shoddy service.

It’s tough enough to keep the hungry beasts at assembly lines and in workshops supplied with parts during peacetime. If a volcano over Iceland blows ash, or if a huge tsunami wipes out a good deal of Japan, it turns into parts paranoia. Now, Japan’s formerly powerful METI, the Ministry of Economy, Trade and Industry, is using the Tohoku disaster to force the Japanese car industry to standardize a lot of the parts it uses.

Saab Shuts Down Again, Situation "Tense," No End In Sight

Saab was supposed to reach 100% production speed sometime in the middle of last week after enduring a nearly two-month shutdown. But now it seems that more “material shortages” have brought the Trollhättan plant to its knees again, as Steve Wade of inside.saab.com reports

Yesterday, production at Saab Automobile stopped at lunchtime due to material shortages. We have now stopped again today for the same reasons…

The liquidity situation is still tense, and depends on several different financing solutions falling into place, long-term as well as short-term. Some milestones have been achieved, such as the letter of intent signed with Pang Da and the additional funding that their order of Saab cars means. An example of things that still await a solution is the sale and leaseback of Saab AB Property, which we have addressed in previous communications. Representatives from Spyker and Saab will continue to work with these solutions, while the dialogue between Saab and suppliers progresses.

UN: Recycling Rates For Key Green Car Elements Below 1%

A report by UNEP [ PDF here], the UN’s environmental body, finds that recycling rates for some of the key ingredients in EV and Hybrid cars are woefully low. The chart above shows “functional recycling rates” for 60 metals, and the rate for such key elements in the production of EV and Hybrid batteries and magnets as Lithium, Vanadium, Lanthanum, Neodymium, Dysprosium, all have recycling rates of 1% or lower. Not only do many of these elements have the potential for creating ecological damage, but many (especially the so-called “rare earth elements”) are considered relatively scarce…. and not recycling exacerbates both of these issues. But, notes the report, the complex fusion of elements used in both batteries and EV magnets could present huge challenges in ever improving these rates of recycling.

Where relatively high EOL-RR [End Of Life Rates of Recycling] are derived, the impression might be given that the metals in question are being used more efficiently than those with lower rates. In reality, rates tend to reflect the degree to which materials are used in large amounts in easily recoverable applications (e. g., lead in batteries, steel in auto- mobiles), or where high value is present (e. g., gold in electronics). In contrast, where materials are used in small quantities in complex products (e. g., tantalum in electronics), or where the economic value is at present not very high, recycling is technically much more challenging.

Hat Tip: Auto123

The Truth About "America's" Small Car Comeback

With new compact and subcompact models from Ford and GM enjoying respectable sales, the mainstream media has been indulging in some “feel-good” headlines, like the New York Times’s Detroit’s Rebound Is Built on Smaller Cars, or CBS’s more equivocal Can small cars rebound U.S. auto industry? It’s an understandable instinct, as the media has long battered Detroit’s inability to build competitive compact and subcompact cars, and in the post-bailout atmosphere of redemption, these headlines definitely help reassure Americans about the value of their “investment.” Unfortunately (if unsurprisingly), however, these pieces gloss over the full truth of the situation. Yes, Ford and GM are enjoying improved sales success with small cars. The “U.S. auto industry,” on the other hand, isn’t actually getting all that much out of the situation, beyond some fluffily positive press. Here’s why:

Quote Of The Day: Escape From Trollhttan Edition

Saab Has Enough Money For Muller's Bonus, But Does It Have Enough To Restart Production?

Saab has received wire transfers of around €30m from both Gemini Investments and the Chinese dealer group PangDa, reports Aftonbladet, and it will be using that money to pay off its supplier debts which could use up most of that cash (Saab’s supplier debts are estimated by DI.se at between two hundred and four hundred million kroner, or as much as €44m). Leaving aside the issue of how that money was able to be transferred from China to Sweden in a matter of two days (more on that from Bertel here, the short version: the deal should need Chinese government approval), there are serious questions about Saab’s ability to restart production. After all, the €30m from Gemini is debt, while Saab owes PengDa for an undisclosed number of vehicles that it bought with its investment. Unless those cars are sitting somewhere waiting to be shipped, Saab will have to pay off its suppliers and then build the cars on what is essentially credit from PengDa. Meanwhile, that’s not the only demand on Saab’s finances and attention, as CEO Victor Muller is planning on taking a bonus of over half a million dollars, a decision that is creating fresh problems of its own.

Japanese Parts Paralysis: Worst Situation Since The War

“This is the worst situation we’ve faced since the war,” a source close to Toyota told the Yomiuri Shimbun. The Japanese car industry is facing post-war-like shortages when it comes to auto parts. Toyota is short 150 parts positions, which can be anything from a bolt to a complete dashboard.

Dealerships are empty – of cars. Test drive cars do double duty as display vehicles. “We get a lot of customers coming in, but we don’t have cars to sell them,” a salesperson told the Tokyo paper.

Industry: Bailout? What Bailout?

TTAC has always taken pride in its outsider status, and we’ve taken pains to cover the industry from a safe distance in order to continually bring a fresh perspective to developments. As a result, we’re not always on the same page as trends in the industry at large, which tends to be far more given to wild optimism than the average TTAC analysis. But, based on a new study by Booz & Company [ PDF], it seems that the “carpocalypse” of recent years has driven the industry to a more TTAC-esque pessimism. According to responses by executives at both OEMs and suppliers, the industry generally feels that the bailout was either a missed opportunity or it didn’t do enough to address fundamental weaknesses… and as a result, executives see challenges ahead.

Tsunami Hits Home: Fewer Cars, Higher Prices For Months To Come. Surprised?

In a memo that surprises no-one that has followed TTAC’s extended coverage of the March 11 earthquake and tsunami, Toyota’s U.S. chief Bob Carter warns dealers that deliveries of parts and cars could be severely restricted for months to come. “What we don’t know are vehicle production levels for May through July,” Bob Carter wrote in a memo. “The potential exists that supply of new vehicles could be significantly impacted this summer.” You have seen this coming.

Japanese Parts Paralysis: Toyota N.A. Shutting Down For A Week

Better get used to this: Barely had Toyota announced that it will reopen its Japanese plants, then Toyota U.S.A. chimes in and says: “We are shutting down.” Welcome to the supply chain gang. Toyota is running its N.A. vehicle plants on what they call “a reduced schedule.”

Meaning:

Japanese Parts Paralysis: Lack Of Chips For Cars Can Cost $76 Billion

When we worked on the Phaeton launch in 2001, we said it had “more computers than a small company.” It had 56. Today’s cars have anywhere between 30 and 100 computers on board. They are small microcontrollers that typically chat with each other via a CAN bus. You don’t take just any microcontroller for the job. They need to hold up to the harsh environment inside of a car. Their makers need to hold up to the harsh environment presented by the purchasing departments of automakers that squeeze them for every penny. As a result of both, there are only a few players in this field. This is the story of one of them.

Lack Of Stable Power Brings Japan's Industry To Its Knees

The Japanese tsunami impacts everything, from cars to toilet paper. Most Japanese car makers were closed since after the catastrophe and will remain closed at least until mid April. Many paper mills are in the affected area, and all paper, from glossy stock to the softer kind, is in short supply. Publishers of Japanese illustrated pulp fiction have canceled the printed version and direct their readers to the Internet instead. Tokyo corporations battle a wave of toilet rolls vanishing from their restrooms, from where they find a way to the toire at home. While these may be temporary outages, the lack of stable electrical power emerges more and more as the biggest impediment to the recovery of the Japanese industry. It will affect you and your car, in one way or the other.

Not All U.S. Factory Closures Are Made In Japan

All told, it takes about 3 weeks for a shipborne container from Japan to reach its destination at the West Coast. To the East Coast, it’s about 5 weeks. With the Japanese earthquake and tsunami three weeks old, we should see the first real stateside disruptions by now. And we do. But not all originate in Japan.

GM Books $1.6b Gain On Delphi Share Sale/Pension Shell Game

As galling as the auto bailout was for many Americans, the hidden “stealth bailouts” that occurred during the government-led industry reorganization are often even more galling. Today the final chapter of one of those “stealth bailouts” has taken place, as GM has sold its stake in its spun-off supplier Delphi for $3.8b, booking a $1.6b gain on the deal. So, how is GM divorcing its former in-house supplier a stealth bailout? Back in the dark Summer of 2009, the government organized a GM-led rescue of Delphi, which had been languishing in bankruptcy since 2005 (after GM. By buying a chunk of Delphi for $2.5b of the government’s money and selling it back for a profit, GM’s helped itself to a little extra bump of public money. Oh, and did we mention that GM dropped all kind of pensions in Delphi’s lap when it spun the supplier, including workers who had never been employed by Delphi.

But that’s not the worst part: any guesses as to why GM’s stake in Delphi is suddenly worth so much more? A recovering industry, perhaps? Wrong. Shortly after GM bought back its stake in Delphi, the supplier dumped $6.5b worth of pensions onto the government’s Pension Benefit Guarantee Company, causing huge benefit cuts and hidden government costs. What did the PBGC’s stake, given as “partial compensation” for that pension dump, yield it? A cool $594m. Meanwhile, thanks to the government ‘s arguments, GM still had to top-up UAW retiree pensions, leaving non-union retirees and members of other unions out in the cold [read all about it in a just-released GAO report in PDF here]. A shell game inside of a political payoff inside of another shell game, in other words. There’s nothing to not love here…

First Facts Emerge In Japanese Parts Paralysis

So far, it had been clear that the March 11 earthquake and tsunami would create big problems for the auto industry in Japan in particular and worldwide in general. When asked when, where, and how much, all we received were shrugging shoulders when taking to a westernized counterpart, or an “eeeh” or the customary sucking of air through the teeth when talking to an old school Japanese. Now finally, the first facts emerge.

IHS Expects Auto Industry To Crater After Japanese Earthquake

Parts shortages triggered by the earthquake and tsunami in Japan could reduce global automobile production by up to 30 percent, research firm IHS Automotive told Bloomberg. Or at least that’s what Bloomberg heard.

Parts Paranoia Daily Digest, March 24

Our daily run-down of delays, shut-downs, shortages, and postponements, triggered by the March 11 tsunami in Japan.

- Toyota informed its U.S. dealers and workers to expect production slowdowns due to parts shortages. “Today, we communicated to team members, associates and dealers here that some production interruptions in North America are likely. It’s too early to predict location or duration,” Toyota said in a statement. Most, but not all of the parts for vehicles built in North America are sourced here. Wall Street Journal

- Toyota expects to idle its pickup truck assembly plant south of San Antonio. “We are informing our team members that, with the situation over in Japan, it is likely that we will see some nonproduction days coming,” Craig Mullenbach, spokesman for Toyota’s San Antonio plant, said. Mullenbach added that parts needed to build the full-sized Tundra and mid-sized Tacoma pickup truck in San Antonio are running out. Reuters

- Honda will suspend car production at its Japanese factories until at least April 3. Honda will temporarily transfer some functions such as car development and procurement out of its badly damaged R&D center in Tochigi. Reuters

Bosch Creates 24,000 New Jobs. In China

The world’s largest automotive supplier, Bosch, is investing big into the world’s largest car market, China. The company has 283,000 employees worldwide. 26,000 of them work in China. Soon, that n umber will nearly double to 50,000, reports Bosch’s hometown paper, the Stuttgarter Nachrichten.

Parts Paralysis Daily Digest, March 23

Our daily run-down of delays, shut-downs, shortages, and postponements.

- Toyota will delay the introduction of the wagon version of the Prius hybrid in Japan. A launch event was planned for late April. This event is cancelled; a new date has not been set. The Nikkei [sub].

- Toyota will also delay the minivan version of the Prius, Reuters adds.

Morgan Stanley: Sendai Tsunami Will Wipe Out May SAAR. And Then Some

Japan is, after China, the world’s second largest car producer. In the first ten days after the March 11th earthquake and tsunami, the Japanese auto industry lost approximately 65 percent of its capacity. That is 338,000 units. Toyota alone has lost production of about 140,000 vehicles since March 14, says AP [ via MSNBC]. What will happen next? Will it affect us, and how?

Amongst banks and brokers, staid Morgan Stanley is one of the respected ones. Morgan Stanley always had a presence in Asia and manages many Asian funds. Japan’s Mitsubishi bank owns 21 percent. Morgan Stanley has no interest in talking Japan down. However, in a 34 page research note, sent out today, titled “Japanese Earthquake: Global Supply Chain Implications”, Morgan Stanley paints a dark picture: “A prolonged disruption of Japanese component supply could have a significant impact on 2011 auto production and profitability.” Not just in Japan, the world over. It is likely to depress sales: “ The impact on US SAAR could be severe in May.”

Instead of editorializing, let’s just give you the salient parts. You may want to have a stiff drink first. And your broker’s phone number nearby.

Japan's Auto Production Hit By Parts Paralysis

After a long weekend (Monday was Spring Equinox), Japan came back to work today. Most of the Japanese auto industry did not.

Japan’s largest automaker Toyota, and Japan’s third largest, Honda, won’t be making any cars this week. Japan’s auto production is paralyzed.

A Rare Glimpse Into The Cracks In The Japanese Supply Base

For days, I have been trying to get a clearer picture of what is really going on outside of the largely intact gates of the major Japanese carmakers. Nobody is talking. Most keep mum because they don’t know. Some don’t talk because they don’t want to.

Now there is a rare glimpse into the matter. It has been written by Kevin Krolicki with the help of two colleagues at Reuters. Kevin is the Detroit bureau chief of Reuters. He writes about cars a lot. Comes with the territory. Kevin and I share a common affliction: A Japanese wife. A week ago, Kevin found himself going against the stream of expats that were mobbing the planes out of Japan.

Two days after the quake, Kevin went from Detroit to Tokyo to help the team of Reuters reporters in Japan.

Opel Tsunami Parts Shortage: Much Ado About ...

New twist in GM’s hunt for the elusive carpart: Opel’s Eisenach plant will resume normal operations tomorrow, Tuesday. It was reported to suffer a serious shortage of Japanese parts.

Japans Auto Industry Unites To Cope With Disaster – And The Unknown

There are gallant, yet disturbing news coming from Japan’s automaker front. Japanese automakers unite to cope with the disaster. “Automakers have set up a joint headquarters for support measures and are sharing damage reports and other information,” reports The Nikkei [sub]. “They have a plan that aims to provide more effective support by dividing their forces by region and building teams on the fly. Staff from, say, Toyota may end up lending a hand to a parts maker that does business with, say, Nissan.” According to the Nikkei, Japan’s automakers also have come to a “silent understanding” to not to compete for who might be first to restart production. What is causing the sudden unity amongst former bitter rivals?

GM Pummeled By Japanese Tsunami, Akerson Waits

It is one of those strange twists of fate that Toyota’s arch-nemesis, GM, would be one of the first overseas automakers to experience shutdowns caused by a lack of supplies from tsunami-devastated Japan.

Parts Shortages Threaten Production Outside Of Japan

“The ripple effect of the stoppages to supply and production in Japan will be felt in many parts of the world, including the United States, China, and Europe, as many key parts and technology are exported to global operations from Japan, writes IHS Global Insight in a research report. “Disruption to production of parts that are unique and cannot be easily shifted has the potential to hit output badly at several automakers in the near term.”

First to be hit will be Japanese production sites overseas which often import 20 percent or more of their parts from back home.

However, plants owned by U.S. or European companies are not immune.

Japan Quake: Big Automakers Hit, Little Guys Spared (Except Subaru)

Amidst the rubble of earthquake and tsunami-racked Japan, a strange phenomenon: Three of the smallest local automakers suffered no interruption in production, while the very largest seemed to be hit the hardest. Toyota, Honda, and Nissan have all suffered some kind of production interruption since the quake hit, while Mazda, Suzuki and Mitsubishi remain untouched according to Automotive News [sub]. In a tragedy like this, some might be tempted to ascribe this division of suffering to some universal sense of justice, a cosmic leveling of Japan’s automotive playing field. But, as the map above proves, this twist of fate is purely geographic… Mazda, Mitsubishi and Suzuki happen to have all of their plants located well south of the affected area near Sendai. Besides, Subaru, one of Japan’s smallest automakers, closed five factories. There’s no making sense of a mess like this…

Attention Truckers: Honda Will Milk You

If you only get excited by the sausage of a car and not by the sausage making of a car factory, hop on to the next article, because this will utterly bore you. Everybody gone? Alright, talking to myself again. We’ve always said, not really in jest, that two industries profit the most from just in time manufacturing: The real estate industry and the trucking industry. Honda wants some of that money.

APB: 260,000 Cars AWOL In Germany

Germans bought 211,056 cars in January. It could have been more than twice as many – if automakers would make enough autos. According to a study by PricewaterhouseCoopers, published in the German Newspaper Die Welt, Germans are waiting for 264,000 cars which they had ordered, but which the car companies are unable to deliver. And who do Germans blame? The Automakers?

No, they blame the Americans and Chinese who snap up the cars before the Germans can lay their hands on them.

Car Industry Picks Up Steam, Runs Out Of Parts

Today, none of the 50,000 workers employed at Volkswagen’s Wolfsburg plant have to punch in at work. The factory is waiting for parts. You may think that is their good or tough luck.

Not so, says Dan Sharkey, a Detroit lawyer who counts many auto suppliers as his clients. The shortages affect us all. Parts shortages are “”beyond a trend; it’s an epidemic,” Sharkey told Automotive News [sub]. These shortages are stopping assembly lines around the world, just when demand is beginning to pick up.

Here is a current snapshot, taken by Automotive News:

Volkswagen Shuts Down Wolfsburg

Volkswagen workers in Wolfsburg are looking forward to a long weekend. No work on Monday, come back Tuesday. Are people not buying enough cars? Im Gegenteil. They are buying too many. Volkswagen is seriously running out of parts.

Saab Goes Into The Supplier Business

Carmakers Snowed, Stop Lines

Due to missing parts, GM, Ford and Chrysler had to shut down plants in the U.S. and Canda, or put them on half shifts for the second day, Reuters reports.

Despite Profits, OEMs Still Squeezing Suppliers

One of the major losers in the recent “Carpocalypse” was the supplier sector, which lost hundreds of business to bankruptcy as OEMs clamped down on costs and the government refused to stop the bleeding with an effective bailout. Relationships have re-stabilized over recent months,as both the surviving suppliers and OEMs have swung back to the black, but profits aren’t enough to stop the oldest management profit-inflating move in the book: putting the screws on suppliers. Since the US market doesn’t appear on-track to regain its old 16m annual sales level, suppliers and OEMs can’t simply grow together.

Volkswagen Stops Passat Production

Last Friday, production of the Volkswagen Passat was stopped in Emden, Germany. Not because there aren’t enough customers for the car. There are too many.

Trade War Watch 16: Hot Wheels Just Got Hotter

It’s been some time since since we had a “ Trade War Watch” on mounting trade tensions in the auto industry, and thank goodness for that. In this economic climate of cuts, currency swings and bankruptcies, what we need are things which will make the situation worse, right? In May I reported about how the EU put a 20.6 percent tariff on aluminium wheels from China. The EU did this in response to complaints from domestic manufacturers. Naturally, this left a sour taste in China’s mouth. Well, over 5 months later, you’d think that the EU would have calmed down and this nasty business would be swept under the carpet, right? Erm, not quite….

Rumor Control: Mercedes (Not GM) Outsources Electric SUV Development. But What About Tesla?

Wild-Ass Rumor Of The Day: GM Outsourcing Development Of AMPed-Up Electric SUV

Relations Thaw Between Daimler And BMW. Or Not

A few weeks ago TTAC reported how BMW and Daimler revived a long-ago formed joint purchasing venture in order to help drive down costs for the 2 independent car makers who can’t achieve high volumes of scale. This was seen as quite a big step in a direction few expected. As our resident German put it, “If you think South Korea and North Korea have communication problems, then you should be in a meeting between Daimler and BMW engineers.” He does have a way with words, doesn’t he? But he wasn’t wrong. It’s been a bit of joke to in the industry how Daimler and BMW view each other. As the mustachioed one put it, “Daimler engineers view their colleagues as boorish Bavarian upstarts. BMW engineers think Daimler is a congregation of has-beens.” And you thought relations between GM and Toyota were frosty! At least they had a plant together. Well, it seems that relations maybe thawing between the boys in Munich and the lads in Stuttgart. Kind of…

JLR Looks East For Supplies

DNA India reports that Tata is making a concerted effort to source parts for Jaguar and Land Rover from low cost countries like China, India (duh!) and Poland. DNA’s source for this claim said: “Earlier, Ford used to procure 17 percent from low-cost countries like Poland, China and India, whereas Tata Motors is planning to increase it to 35 percent.” Tata has buys more than just cheap parts. They outsourced low-end design and development work to lower-wage countries. But before you start the “If you thought JLR reliability was bad now…” don’t get too carried away.

Report: Auto Industry Still Carrying 3.5m Units Of Overcapacity

Edmund’ Bill Visnic takes on the latest Harbour report, which finds North American auto plants running at an average of 58 percent capacity (even Europe, the global whipping boy for intractable auto overcapacity operates at an average 81 percent). Despite the recent downsizings across North America, the Harbour Report still estimates that 3.5m units of annual overcapacity remains in the US and Canadian auto manufacturing footprint, equivalent to 14 unneeded assembly plants. A rise in sales levels to the previous 15-16m mark could help the situation according to the report, but increased plant flexibility will be the factor that automakers can actually control. Even so, if 15-16m annual units don’t come soon, North America could be looking at more plant closures and job losses.

UAW Sells Out Members, Holds On To Black Lake Resort

Since taking office in June, UAW President Bob King has ramped up the rhetoric level at Solidarity Hall considerably, as he seeks to portray the union as a defender of the American middle class. But, as the old adage goes, actions speak louder than words… and King’s actions this week couldn’t paint a clearer picture of the UAW’s priorities.

Fiat/Chrysler EV Program Loses Battery Supplier A123

Volkswagen's Great Chinisefication

Good news for Chinese parts makers: Volkswagen, by far the biggest brand in China, wants to gradually achieve full localization in China. In regular English: Volkswagen’s Chinese joint ventures plan to locally source all auto parts and components needed to make cars in China, and will stop importing them.

Industry Opposes Mass "Right To Repair" Legislation Over Chinese Piracy Fears

Legislation aimed at improving the transparency of Technical Service Bulletins (TSBs) has passed the Massachusetts state House of Representatives, and awaits approval by the Senate. If approved, Bill 2517 [full text in PDF format here] would require that

The manufacturer of a motor vehicle sold in the commonwealth shall make available for purchase to independent motor vehicle repair facilities and motor vehicle owners in a nondiscriminatory basis and cost as compared to the terms and costs charged to an authorized dealer or authorized motor vehicle repair facility all diagnostic, service and repair information that the manufacturer makes available to its authorized dealers and authorized motor vehicle repair facilities in the same form and the same manner as it is made available to authorized dealers or an authorized motor vehicle repair facility of the motor vehicle.

The Alliance of Automobile Manufacturers is opposing the bill, according to the DetN, because it believes the bill is motivated by parts manufacturers who want access to parts in order to reverse engineer and sell them. Literally. And yes, it is China’s fault.

Culprit Of Chip Shortage Found, Automaker Hunting Down Chips

We finally know who’s responsible for shutting down Nissan assembly lines in Japan and the U.S.A. The shortage of a critical computer chip stopped Hitachi from making ECUs, which in turn stopped Nissan from making cars. For days, the identity of the lackadaisical chipmaker had been kept under wraps. Now, the culprit has been unmasked.

Car Chip Shortage Hits US Shores

The shortage of a critical computer chip that Hitachi desperately needs to supply Nissan with ECUs now threatens to affect U.S. production. Yesterday, Nissan warned that they will close down Japanese assembly lines. Today, Nissan COO Officer Toshiyuki Shiga said that production in the U.S. may be halted until the chip shortage is solved.

Chip Shortage Stops Nissan Assembly Lines

So far, it had been striking workers at Chinese parts suppliers that brought Japanese car makers to their knees, praying for parts needed to re-start the lines. Here is a new twist: Japan’s Hitachi ran out of chips for ECUs (commonly called “car computers”). And Japanese carmakers are shutting down the lines.

GM Continues Sell-Out To China

In a deal to prop up their books, GM is selling more assets to the Chinese. GM sold its Nexteer Automotive steering-parts unit to China’s Pacific Century Motors, a company formed by China’s Tempo Group and the Beijing government’s investment arm E-Town.

To Stay Competitive In The EV Transition, Suppliers Focus On Gas Engines

The simplification of the automobile that’s set to take place with the transition to electric drivetrains is a troubling trend for the industry. As Bertel Schmitt has already explored, switching to electric drive could see component counts cut by as much as 90 percent, meaning the suppliers who build most of the components in modern cars are staring down a steep drop in their business. As Automotive News [sub] reports, even electric motors, which were once thought of as a growth area for suppliers looking to get in on the EV shift, are being largely built by OEMs, freezing suppliers out of potential growth. Toyota, Nissan and GM supply their own electric motors, leaving suppliers like Remy International behind in the dust. So how can suppliers stay competitive as EVs become more popular? Counter-intuitively, the answer may be gas-powered range extenders.

Chinese Strikes: It Ain't Over Until It's Over – Toyota And Honda Down Again

You thought the strikes that affected Honda and Toyota in China are over, and both are happily churning out cars again? That makes two of us. But we are mistaken.

![Orion Labor Issues Resurface As Union Takes Strike Vote [UPDATE: Strike Authorized]](https://cdn-fastly.thetruthaboutcars.com/media/2022/07/17/9111970/orion-labor-issues-resurface-as-union-takes-strike-vote-update-strike-authorized.jpg?size=720x845&nocrop=1)

Recent Comments